Form 1041 Qualified Business Income Deduction

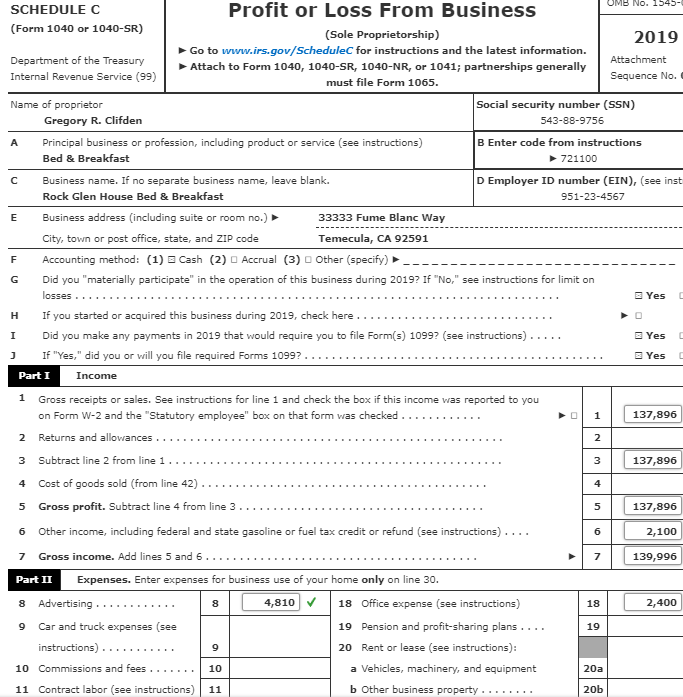

Fillable Form 1040 Schedule C 2019 In 2021 Sole Proprietor Tax Forms Benefit Program

Fillable Form 1040 Schedule C 2019 In 2021 Sole Proprietor Tax Forms Benefit Program

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

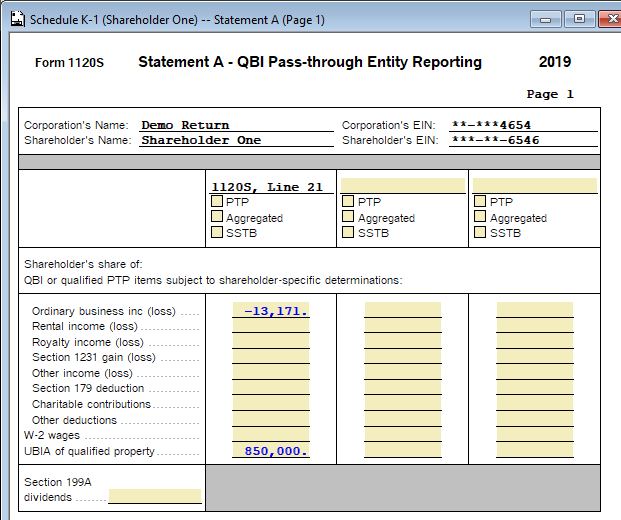

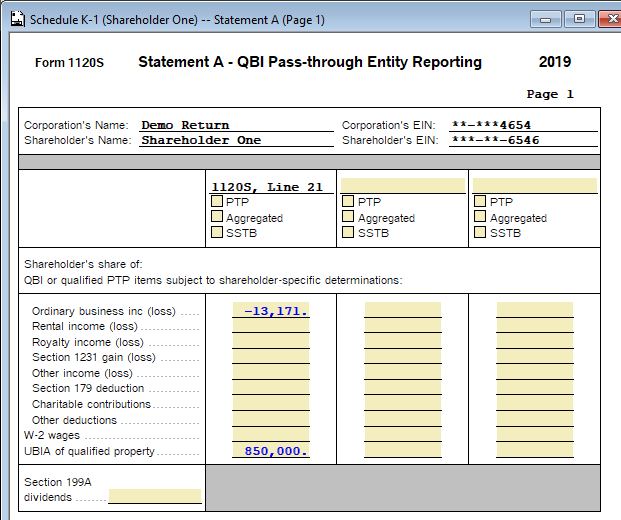

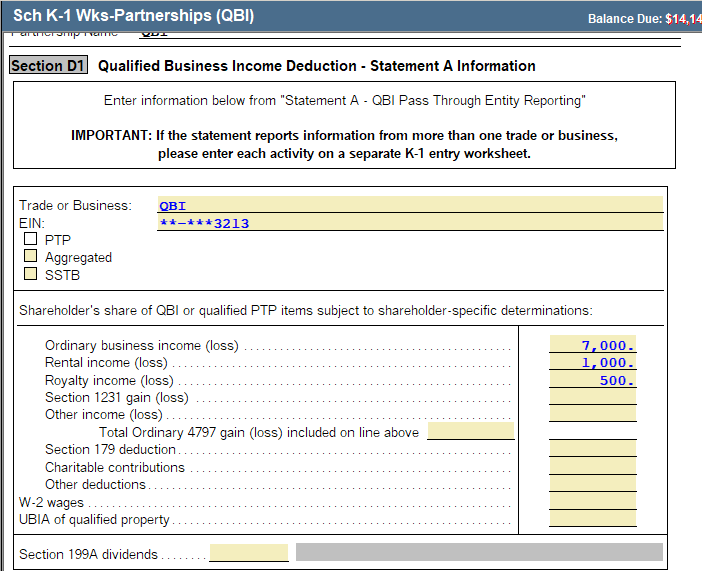

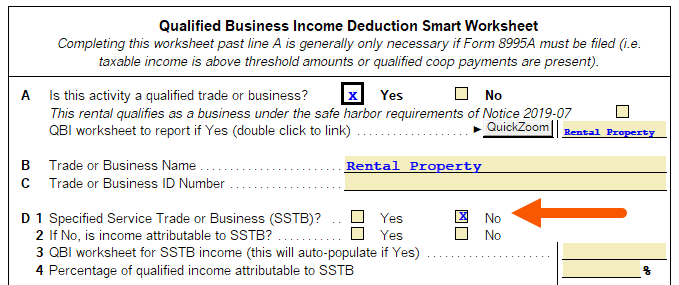

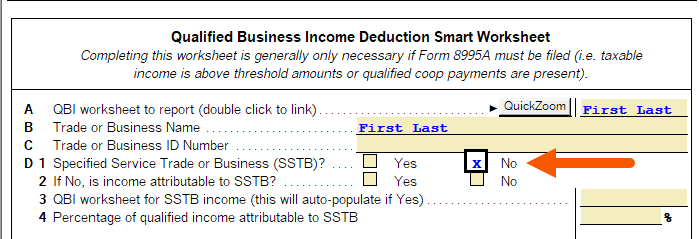

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Tax Credits And Tax Deductions Discover The Amazing Difference In 2020 Tax Credits Tax Deductions Tax Debt Relief

Tax Credits And Tax Deductions Discover The Amazing Difference In 2020 Tax Credits Tax Deductions Tax Debt Relief

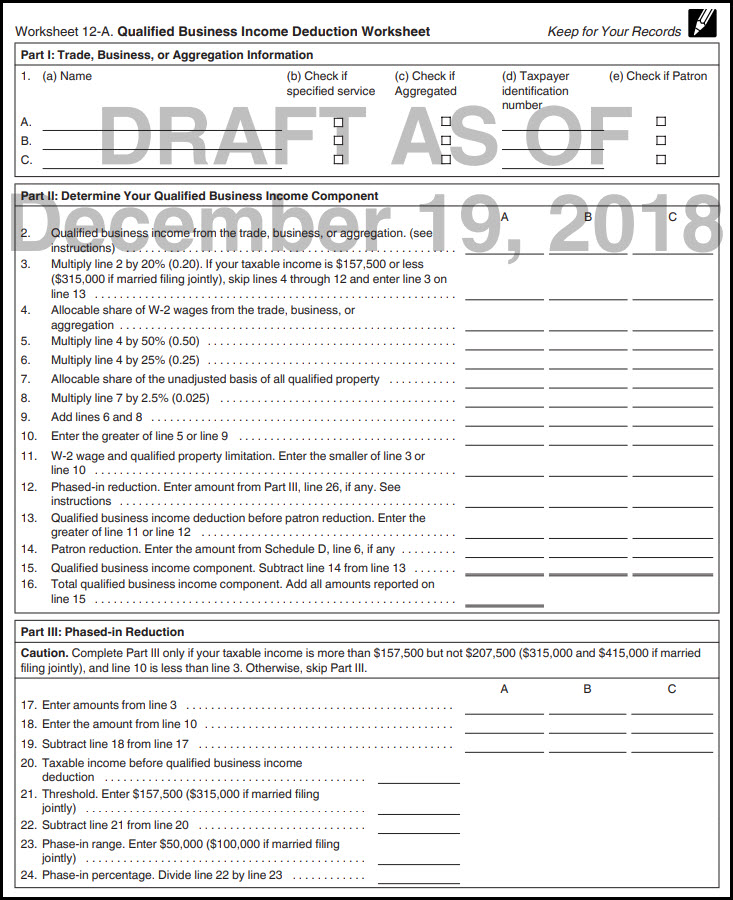

1040 Tax Planner Qualified Business Income Deduction Drake17 Can I Evaluate How The New Qualified Business Income Deduction Detailed In The Tax Cuts And Jobs Act Will Affect My Taxpayer S 2018 Return The Drake Tax Planner Can Be Used To

1040 Tax Planner Qualified Business Income Deduction Drake17 Can I Evaluate How The New Qualified Business Income Deduction Detailed In The Tax Cuts And Jobs Act Will Affect My Taxpayer S 2018 Return The Drake Tax Planner Can Be Used To

Https Exactax Com Documents Workshops 2018 20exactax 20workshop Pdf

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

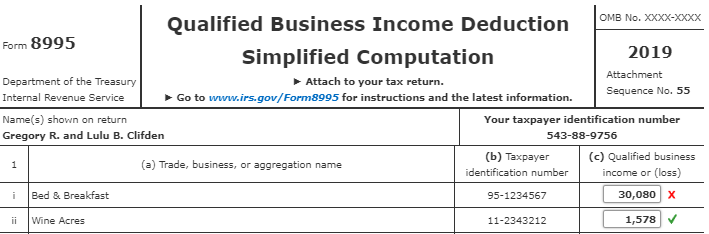

Solved I Am Having Trouble Calculating Qbi For The Bed An Chegg Com

Solved I Am Having Trouble Calculating Qbi For The Bed An Chegg Com

Solved I Am Having Trouble Calculating Qbi For The Bed An Chegg Com

Solved I Am Having Trouble Calculating Qbi For The Bed An Chegg Com

1040 Tax Planner Qualified Business Income Deduction Drake17 Can I Evaluate How The New Qualified Business Income Deduction Detailed In The Tax Cuts And Jobs Act Will Affect My Taxpayer S 2018 Return The Drake Tax Planner Can Be Used To

1040 Tax Planner Qualified Business Income Deduction Drake17 Can I Evaluate How The New Qualified Business Income Deduction Detailed In The Tax Cuts And Jobs Act Will Affect My Taxpayer S 2018 Return The Drake Tax Planner Can Be Used To

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2