Canada Business Mileage Reimbursement Rate

What is the 2019 business mileage rate in Canada. Although these rates represent the maximum amount that you can deduct as business expenses you can use them as a guideline to determine if the allowance paid to your employee is reasonable.

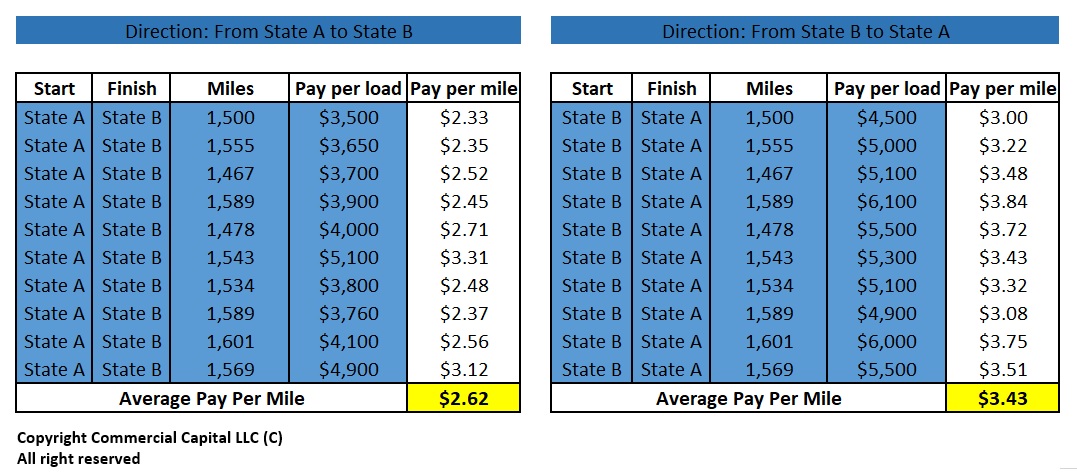

Trucking Company Revenue Rates Per Mile

Trucking Company Revenue Rates Per Mile

This approach is referred to as the standard mileage deduction.

Canada business mileage reimbursement rate. Reimbursements based on the federal mileage rate arent considered income making them nontaxable to your employees. The HST applies in the participating provinces at the following rates. The non-profit reimbursement rate for mileage and other travel expenses.

Tax law in Canada is complicated and ever-changing affected by frequent legislative changes court decisions and the administrative practices of the tax authorities. The 2020 CRA Mileage Rate has increased by one cent to 59 cents per kilometer for the first 5000 kilometers driven and to 53 cents per kilometer for each additional kilometer. Overview If you are self-employed Canada Revenue Agency only allows you to claim mileage driven for business purposes.

An electronic log to track business and personal driving. Car expenses and benefits Employee log annual summary 2021. The per-kilometre rates that we usually consider reasonable are the amounts prescribed in section 7306 of the Income Tax Regulations.

What is the 2019 CRA CAR Allowance Rate. 59 per kilometre for the first 5000 kilometres driven 53 per kilometre driven after that In the Northwest Territories Yukon and Nunavut there is an additional 4 per kilometre for travel. This solves the taxation problem and for many employees it could help with the loss of the unreimbursed expense deduction.

16 cents per mile was 17 cents in. Employees receiving a taxable allowance may be able to claim allowable expenses on their income tax and benefit return. You could also try reimbursing at the IRS business mileage rate which is non-taxable.

But it creates a new set of problems. In 2019 the IRS released a report that states non-profit business mileage can be reimbursed at 58 cents per mile. The rates above apply to all Canadian provinces except for the Northwest Territories Nunavut and Yukon.

For 2021 they are. When you do get reimbursements make sure its included in your employment contract and follows the CRA automobile allowance rates for 2019. For more information see Employees allowable employment expenses.

59 per kilometre for the first 5000 kilometres driven 53 per kilometre driven after that In the Northwest Territories Yukon and Nunavut there is an additional 4 per kilometre allowed for travel. For 2020 the federal mileage rate is 0575 cents per mile. The 2020 CRA Mileage Rate has increased by one cent to 59 cents per kilometer for the first 5000 kilometers driven and to 53 cents per kilometer for each additional kilometer.

For help For assistance with this complex subject. The CRA Mileage Rate has increased in 2019. The standard mileage rates for 2021 are as follows.

To support a deduction you are required to reasonably support and demonstrate the amount of miles you drove for business purposes. 58 cents per kilometer first 5000 kilometers 52 cents per kilometer after 5000 kilometers. Also for miles driven while helping a non-profit you can reimburse 14 cents per mile.

The mileage rates for 2019 are. You can also use this approach to deduct any expenses that you incur while driving for charity medical or moving purposes. An allowance is taxable unless it is based on a reasonable per-kilometre rate.

58 per kilometre for the first 5000 kilometres driven. Although CRA does not mandate a specific way of keeping mileage records it suggests maintaining a. New IRS tax rules.

The GST applies in the rest of Canada at the rate of 5. The reasonable per-kilometre rate for 2018 will increase by one cent to 55 cents per km for the first 5000 kilometres driven and to 49 cents per km for each additional kilometre. 162 for the business use of a vehicleUnder the law the taxpayer for each year is generally entitled to deduct either the actual expense amount or.

Reference in this publication is made to supplies that are subject to the GST or the HST. Company Reimbursement Using AAR Automobile Allowance Rate As a salaried individual you may be reimbursed by your employer for any expenses incurred regarding the use of your personal car for work. 575 cents per mile for business miles 58 cents in 2019 17 cents per mile driven for medical or moving purposes 20 cents in 2019 14 cents per mile driven in service of charitable organizations Reimbursement rates cover all the costs related to driving for business.

56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate for 2020 and. The business mileage reimbursement rate is an optional standard mileage rate used in the United States for purposes of computing the allowable business deduction for Federal income tax purposes under the Internal Revenue Code at 26 USC. 13 in Ontario New Brunswick and Newfoundland and Labrador 15 in Nova Scotia and 12 in British Columbia.

56 cents per mile was 575 cents in 2020 Medical Moving. The automobile allowance rates for 2021 are.

How To Record Mileage Help Center

How To Record Mileage Help Center

Top 10 Non Taxable Benefits For Employers In Canada Enkel

Top 10 Non Taxable Benefits For Employers In Canada Enkel

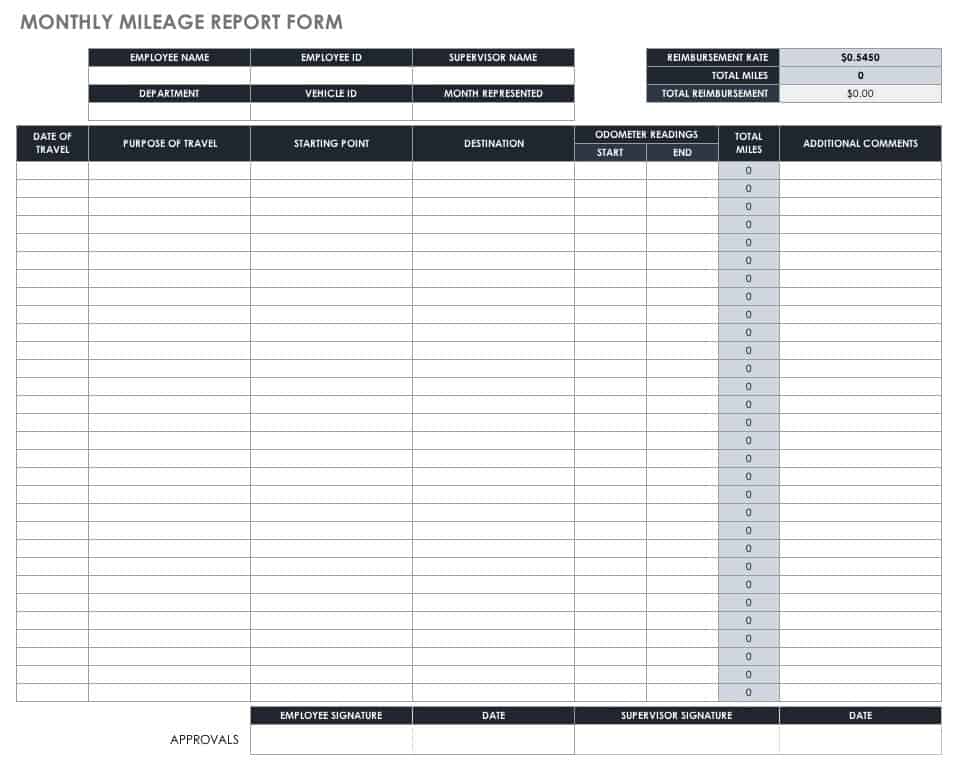

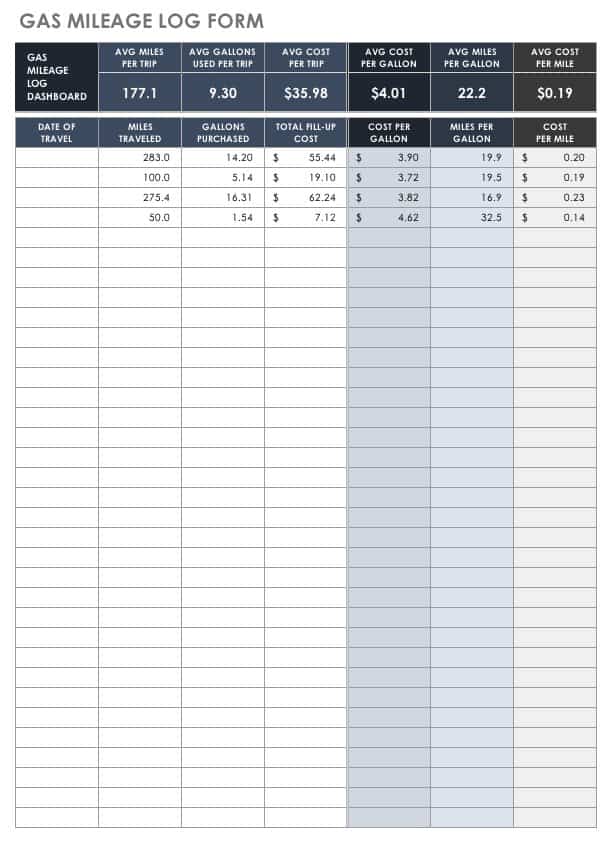

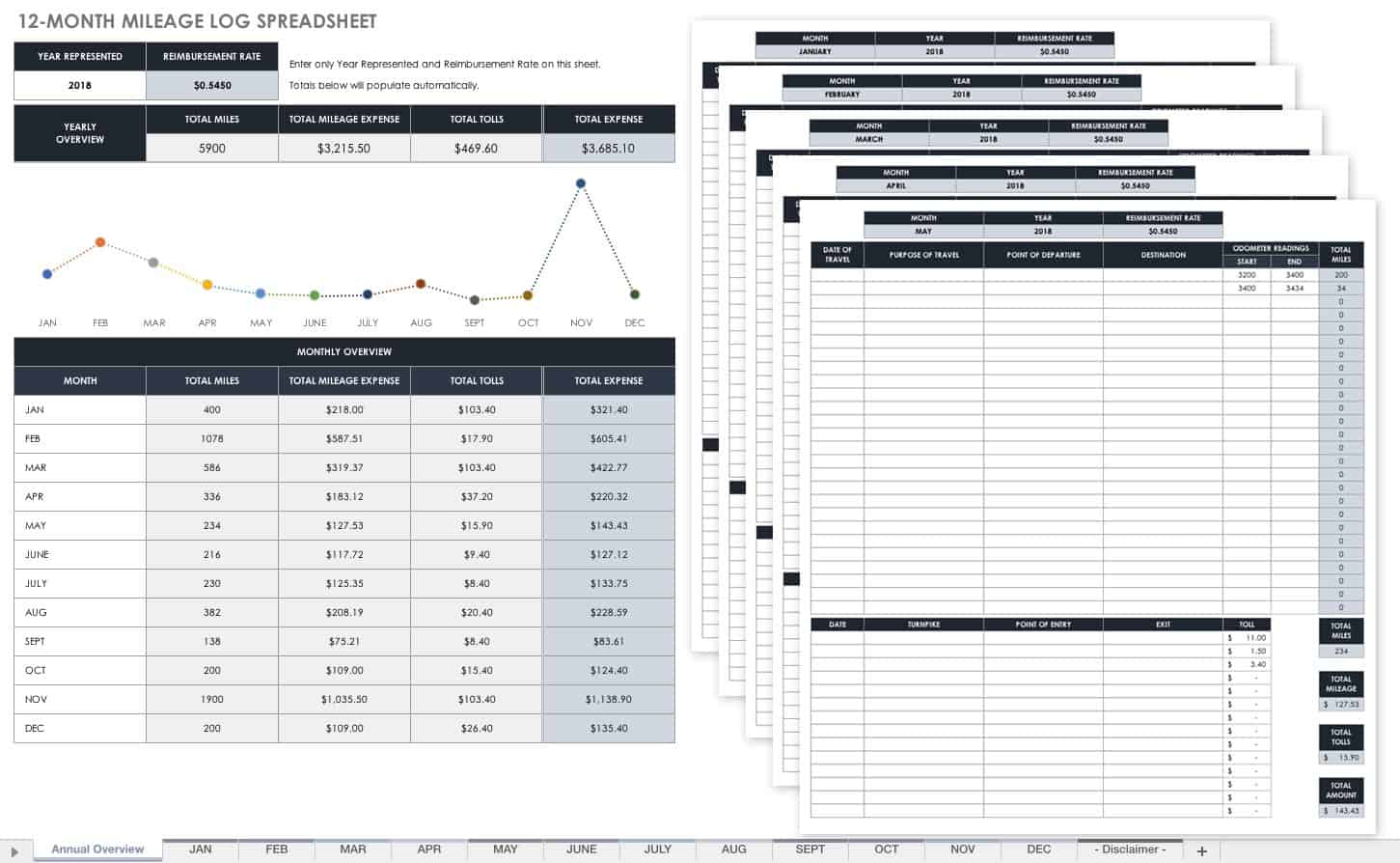

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

The Best Places To Live In Canada 2021 Best Cities In Canada 2021 Creditcardgenius

The Best Places To Live In Canada 2021 Best Cities In Canada 2021 Creditcardgenius

How Can I Reduce My Taxes In Canada

2020 Cra Mileage Rate Cra Car Allowance Rate Everlance

2020 Cra Mileage Rate Cra Car Allowance Rate Everlance

2020 Cra Mileage Rate Cra Car Allowance Rate Everlance

2020 Cra Mileage Rate Cra Car Allowance Rate Everlance

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

2020 Cra Mileage Rate Cra Car Allowance Rate Everlance

2020 Cra Mileage Rate Cra Car Allowance Rate Everlance

18 Best Ways To Earn Air Canada Aeroplan Points 2021

18 Best Ways To Earn Air Canada Aeroplan Points 2021

2020 Cra Mileage Rate Cra Car Allowance Rate Everlance

2020 Cra Mileage Rate Cra Car Allowance Rate Everlance

Air Canada Baggage Fees Policy 2021 Update

Air Canada Baggage Fees Policy 2021 Update

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

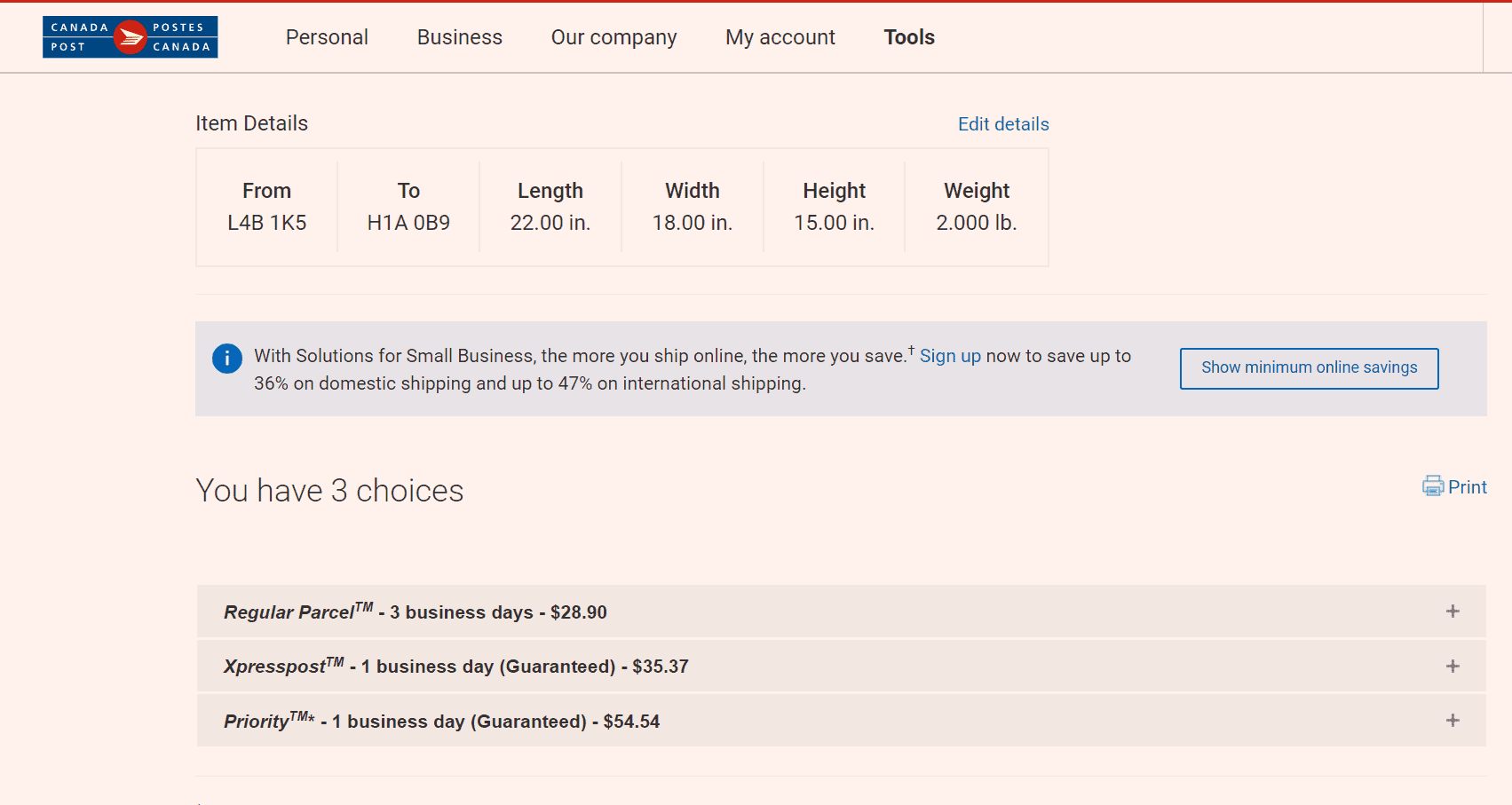

Ultimate E Commerce Shipping Guide In Canada Options Comparisons And Actionable Tips

Ultimate E Commerce Shipping Guide In Canada Options Comparisons And Actionable Tips

Car Allowance Vs Mileage Allowance What S The Difference

Car Allowance Vs Mileage Allowance What S The Difference

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

What Are The Tax Write Offs For A Small Business In Canada Madan Ca

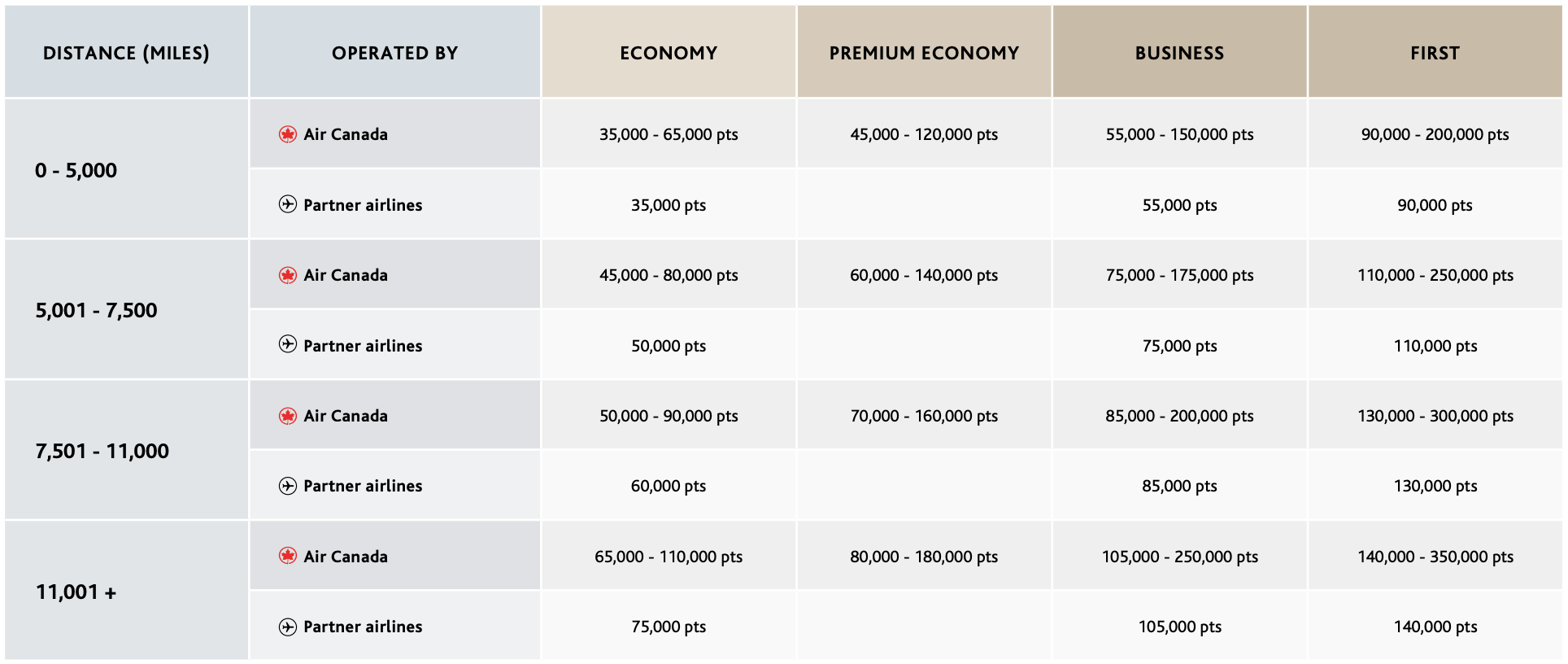

The Best Ways To Maximize Air Canada S Aeroplan Program The Points Guy

The Best Ways To Maximize Air Canada S Aeroplan Program The Points Guy