W8 Form For Canadian Companies

A W-8 form is an Internal Revenue Service IRS form that provides foreigners with an exemption from specified US. The ITO will provide these forms after review of the Business Visitor Questionnaire.

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

Identification of Beneficial Owner.

W8 form for canadian companies. Complete Part XXV See Definition of Active Passive NFFEs. Instructions for the Substitute Form W-8BEN-E for Canadian Entities RBC WMCO Rev. Instructions for Form W-8ECI Certificate of Foreign Persons Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States 0717 09162017 Form W-8EXP.

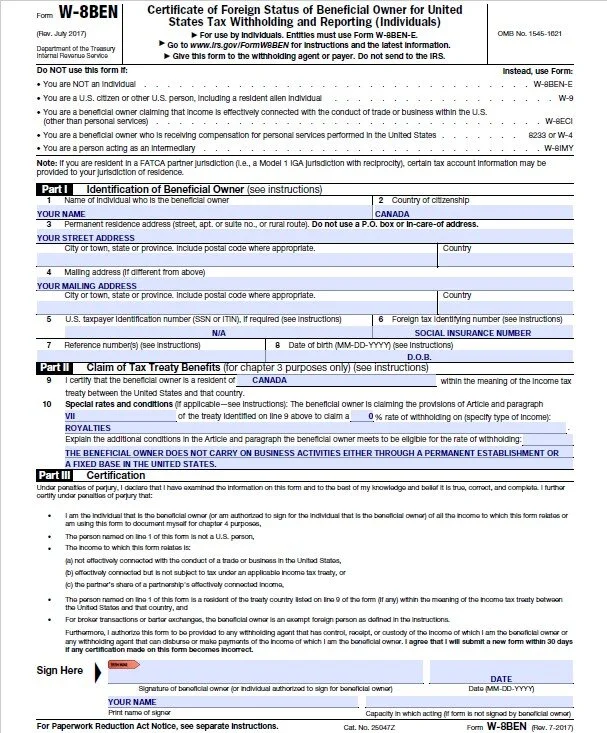

Nonresidents must fill out when they earn income from US. Clients can claim exemption from tax withholdings thanks to the Canada-US. In order to determine whether to withhold taxes for the payments they send the withholding agent must obtain a Form W-8BEN from the foreign payee.

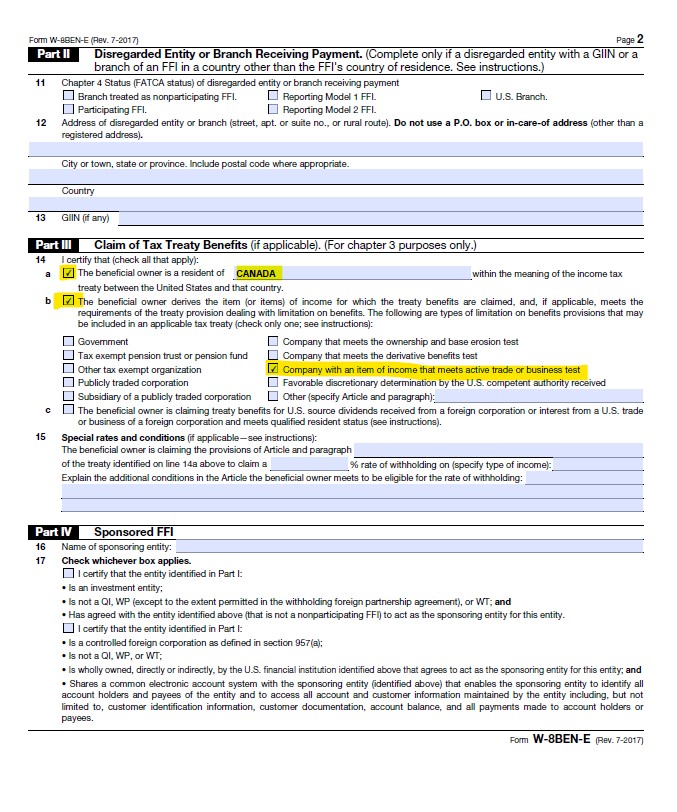

A completed W-8BEN form confirms that. In the past we used to charge 150 CAD for our work to prepare this form. Company that meets the ownership and base erosion test Company that meets the derivative benefits test.

How to complete W-8BEN-E Form for a Small Canadian Corporation. Sources must fill out the form but they can use it to claim exemption from withholdings due to income tax agreements between the US. This is an important piece of paper as it ensures you.

We frequently receive requests to assist with filling out the form W-8BEN-E from Canadian eCommerce sellers. Part I 1 Enter your corporations name Part I 2 Enter the country of incorporation Canada Part I 4 Check Corporation Part I 5 Check Active NFFE. Check the corporation box.

This is usually issued directly to your US. Income tax treaty by filling out whats commonly known as Form W-8BEN. Businesses working with customers across the border should now complete the proper paperwork and satisfy the enhanced FATCA provisions in order to avoid the 30 US tax withholding.

A new W-8BEN and Form 8233 must be provided each calendar year the tax treaty is claimed. It is required because of an intergovernmental agreement between Canada and the US. For most active Canadian companies the W8-BEN-E form will be used to determine that no withholding taxes should apply on the money paid to you due to the Canada US tax treaty.

This form contains information such as payee name address and tax identification number. Sources in order to determine their required tax withholdings. In some cases Form W-9 is provided however Form W-9 should only be completed by US.

Client so they can file it with their corporate taxes. Canadian sole proprietors with US. Private Canadian companies were among the first to face the new reporting requirements under FATCA and just like others were required to complete the new W-8BEN-E form in order to get paid by their US clients.

Part I 6 Enter. What you need to know about form w-8ben in Canada. These instructions supplement the instructions for Forms W-8 BEN W-8 BEN-E W-8 ECI W-8 EXP and W-8 IMY.

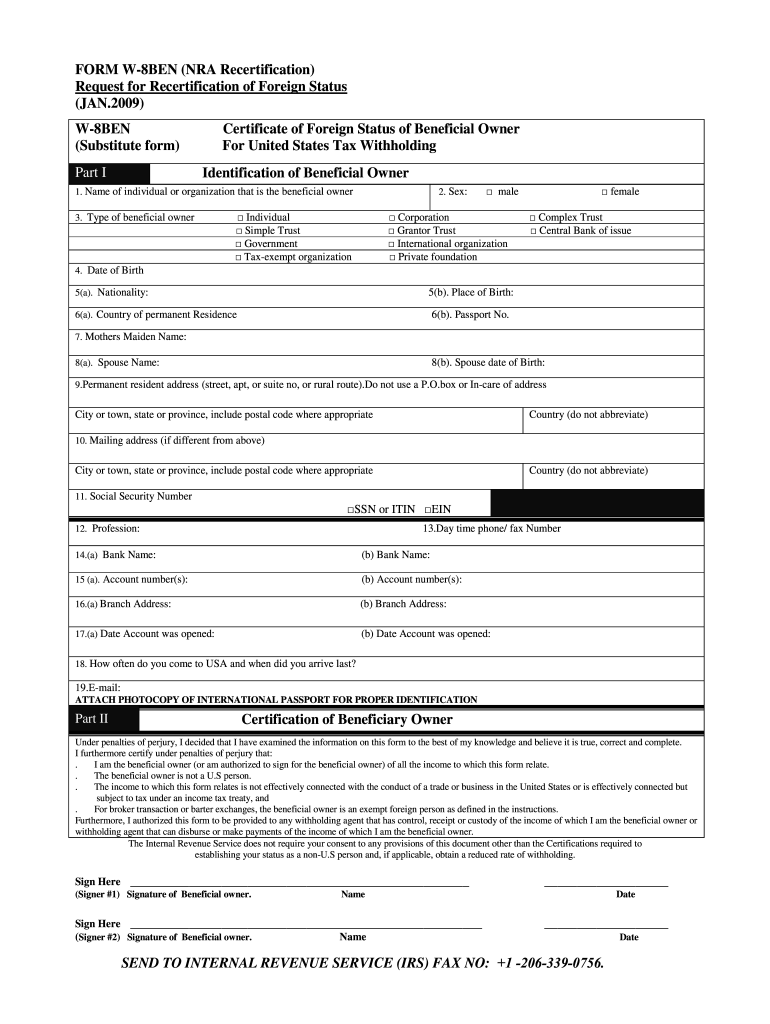

The W-8BEN-E is a new form that came about thanks to. A W-8BEN and Form 8233 are both usually required in the event that a treaty benefit is being claimed for services income. A W-8BEN form is a tax document used to certify that your country of residence for tax purposes is outside of the United States.

If youre a freelancer or sole proprietor and have started working with clients or customers in the US you might have been asked to complete a W8-BEN form. In order to determine its status the US. Which obligates Canadian Financial Institutions to provide this information.

11-2020 6 An entity will be a Canadian Financial Institution if it is included in the definition of listed financial institutions in Part XVIII subsection 2631 of the Income Tax Act Canada. For general information and the purpose of each of the forms described in these instructions see those forms and their accompanying instructions About Form W-8 BEN Certificate of Foreign. Information return reporting and backup withholding regulations.

Check the active NFFE box on the right column of the list NFFE standing for Non-Financial Foreign Entity. Clients may request the Canadian business to complete Form W-8BEN W-8ECI W-8IMY or W-8EXP depending on the situation. Page 1 Part I.

Fill in 1 companys name and 2 HQs country Fill in 3. How to complete W-8BEN Form for an individual in Canada. Certificate of Foreign Government or Other Foreign Organization.

The W-8BEN-E form is used to prove that the business providing the services is indeed a foreign entity. 99 of the companies we help fall into this category. Form W-8BEN is a tax form that US.

Sellers who sell on Amazon Shopify eBay WooCommerce and other eCommerce platforms are often required to present this form to identify themselves as a foreign company in the US. Company with an item of income that meets active trade or business test Favorable discretionary determination by the US. Your US customer is essentially placing the onus on you to let them know the tax treatment of the money they owe you.

Canadian independent contractors earning income from US.

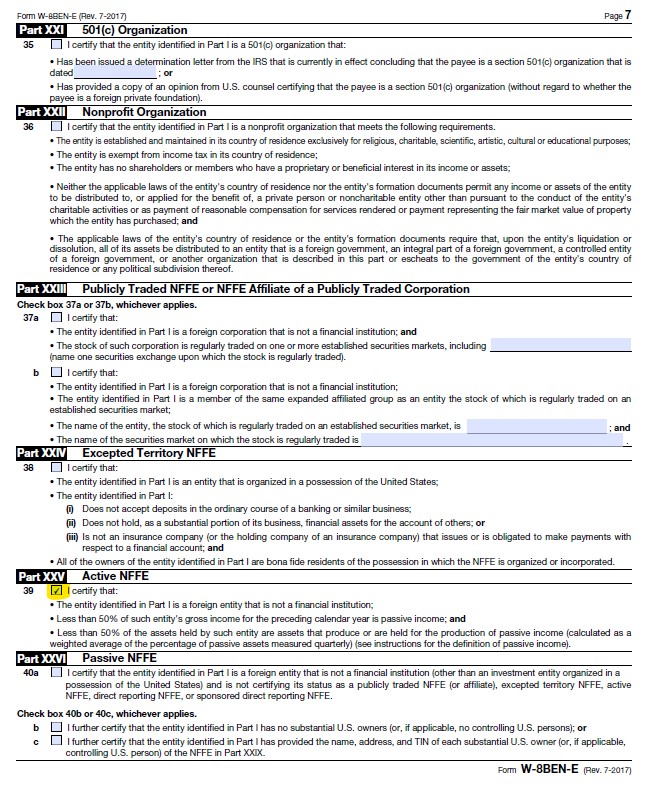

W 8ben E Form Instructions For Canadian Corporations Cansumer

W 8ben E Form Instructions For Canadian Corporations Cansumer

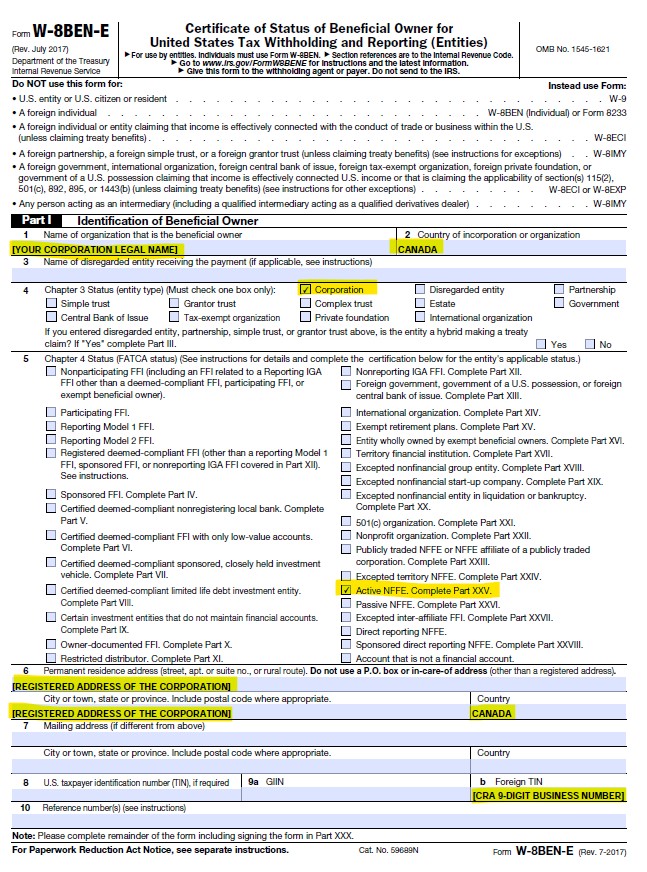

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W8 Form Fill Out And Sign Printable Pdf Template Signnow

W8 Form Fill Out And Sign Printable Pdf Template Signnow

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Filing Of W 8ben E By Canadian Service Provider With A Sample

Why Have I Been Asked To Fill Out A W 8 Ben E Form Virtual Heights Accounting

What Is A W 8 Form The Dough Roller

What Is A W 8 Form The Dough Roller

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Filing Of W 8ben E By Canadian Service Provider With A Sample

W 8ben E Form Instructions For Canadian Corporations Cansumer

W 8ben E Form Instructions For Canadian Corporations Cansumer

Canadians Stop Paying 30 To The Irs Diana Tibert

Canadians Stop Paying 30 To The Irs Diana Tibert

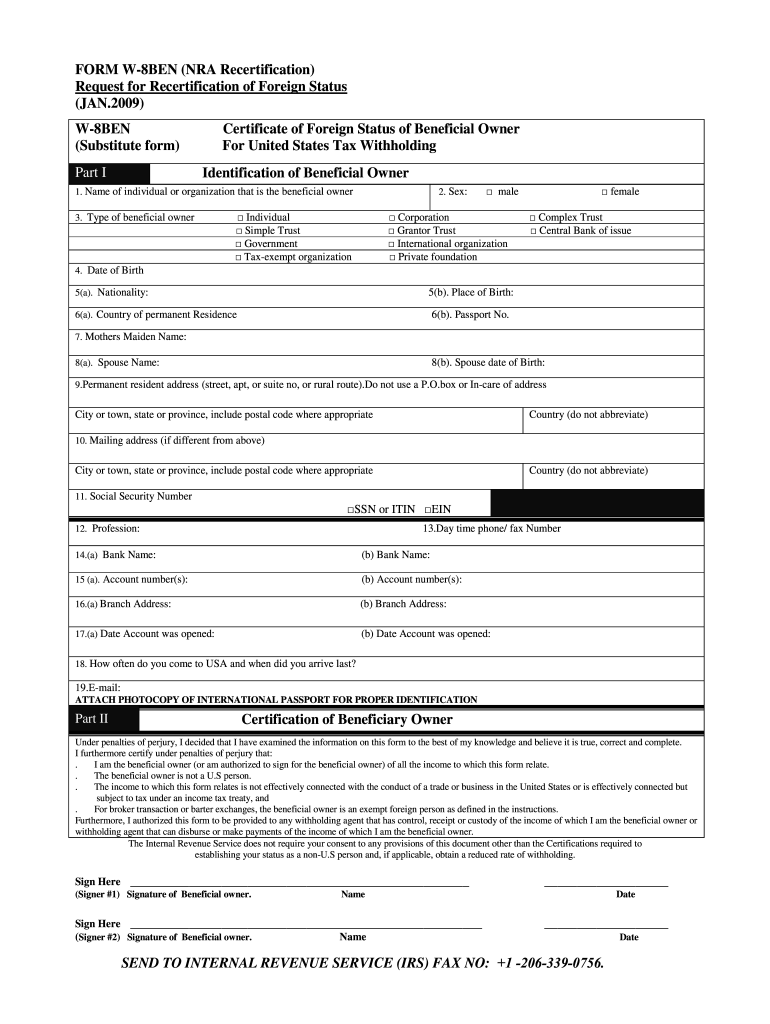

Irs W 8ben Substitute Form 2009 Fill Out Tax Template Online Us Legal Forms

Irs W 8ben Substitute Form 2009 Fill Out Tax Template Online Us Legal Forms

Filing Of W 8ben E By Canadian Service Provider With A Sample

Form W8 Instructions Information About Irs Tax Form W8

Form W8 Instructions Information About Irs Tax Form W8

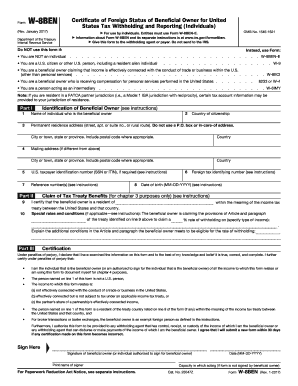

W 8ben Form Instructions For Canadians Cansumer

W 8ben Form Instructions For Canadians Cansumer

How To Complete W 8ben E Form For Business Entities Youtube

How To Complete W 8ben E Form For Business Entities Youtube

How To Fill Out W 8ben Form 2017 Updated Instructions Youtube

How To Fill Out W 8ben Form 2017 Updated Instructions Youtube