Are Nsw Small Business Grants Taxable

You do not include NANE income in your income tax return. Small business grants designed to help businesses recover from the coronavirus economic crisis will not be subject to income tax under new legislation before the federal parliament.

Law Enforcement Grants The Four Main Types Of Grant Funding

Law Enforcement Grants The Four Main Types Of Grant Funding

Between 1-19 employees and turnover of more than 75000.

Are nsw small business grants taxable. Small and medium exporters in NSW will benefit from the 12 million Going Global support program aimed at creating jobs and supporting the regions. Grants to households ie individuals are taxed differently than grants to small businesses. 31 2021 small businesses with fewer than 500 employees that experienced a quarterly revenue decline of 20 previously 50 year-over-year can claim a payroll tax credit for 70 of qualified wages up to 10000 per employee per quarter.

The grant will help to cover unavoidable expenses for which no other government support is available and may include utilities rent or financial or legal advice. New South Wales Government Small Business COVID-19 Support Grant. Emergency financial support such as the Self-Employment Income Support Scheme SEISS and Small Business Grant Fund SBGF are subject to Income Tax and Self-Employed National Insurance.

Unfortunately this doesnt hold true for most business grants. Northern Beaches small business hardship grant Small businesses on the Northern Beaches that experienced hardship due to the COVID-19 restrictions from December 2020 may be eligible for a grant of 3000 or 5000. An Australian Business Number as at 1 March 2020 be based in NSW and employ staff as at 1 March 2020.

You are a small business entity for the 202021 financial year or would be if the aggregated turnover threshold was 50 million. This page will be updated accordingly. Small Business COVID-19 Support Grant Guidelines The NSW Government is providing financial support of up to 10000 for small businesses experiencing a significant decline in revenue as a.

Small business recovery grants up to 50000 direct damage These grants are designed to provide short-term targeted assistance for recovery and reinstatement activities including safety inspections repairs to premises and internal fittings and replacement of stock. For more information contact the Disaster Customer Care Service on 13 77 88 or visit the Service NSW website. Payroll below the NSW Government 2019-20 payroll tax threshold of 900000.

In most instances grant funds are counted as taxable. SBGF and RHLGF grants are classed as business income and should be recorded in your accounts as such. If the grantee thinks it is not a taxable sale and an RCTI is issued showing that it is a taxable sale.

So we know that the direct grants of up to 2500 per month for three months to the self employed are taxable - but has anybody found any utterances regarding the COVID-19 Small Business Grant Scheme assistance by grant to Business Rates payers taxable. Nearly half of self-employed workers are not aware that COVID-19 grants should be declared in future tax returns. For eligibility criteria visit Service NSW.

Whether you record them as sales or other income in your accounts the grants are taxable income the tax treatment of such payments is well established so the Government isnt being unfair in any way by classing such payments as taxable. New South Wales Government Small Business COVID-19 Support Grant South Australian Government 10000 Emergency Cash Grants for Small Businesses. The list of eligible grants programs may be extended to specific grants in other states and territories.

To qualify for the 10000 grant the business must satisfy the following key conditions and have. We can now confirm that if you receive one of the following state or territory grants or payments before 30 June 2020 it is assessable income and you will need to declare it in your 2020 tax return. For example college grants for individuals are not taxable provided funds are spent on tuition expenses for the students chosen degree program.

To make sure that the grant arrangement is treated consistently for GST purposes if the RCTI shows that the grantee is making a taxable sale the grantee must pay the GST. Grants of up to 50000 for eligible small business owners and not-for-profit organisations are available through Service NSW. The package includes assistance grants for exporters tailored workshops and opportunities to explore new markets.

South Australian Government 10000 Emergency Cash Grants for Small Businesses. Find more information and register your interest. As explained below need-based grants to households likely fall under the general welfare exclusion and are therefore not taxable whereas grants to small businesses are likely not covered by this exclusion and would be taxable.

We can confirm that if you receive one of the following state or territory grants or payments before 30 June 2020 it is assessable income and you will need to declare it in your 2020 tax return. 1 2021 and through Dec.

Build Own Video Streaming Service Launch A Netflix Or Hulu Business Accounting Business Advisor Marketing Jobs

Build Own Video Streaming Service Launch A Netflix Or Hulu Business Accounting Business Advisor Marketing Jobs

Professional Australian Tax Invoice Templates Demplates Invoice Template Invoice Sample Microsoft Word Invoice Template

Professional Australian Tax Invoice Templates Demplates Invoice Template Invoice Sample Microsoft Word Invoice Template

Taxgain Is One Of The Leading Chartered Accounting First Nested In Sydney Specialized In Providing Professional Ac Tax Return Tax Accountant Income Tax Return

Taxgain Is One Of The Leading Chartered Accounting First Nested In Sydney Specialized In Providing Professional Ac Tax Return Tax Accountant Income Tax Return

The New Tax Law Puts A New Limit On Certain Losses Don T Let It Trip You Up Inc Com

The New Tax Law Puts A New Limit On Certain Losses Don T Let It Trip You Up Inc Com

Small Business Tax Incentive 150 000 Instant Car Tax Reduction

Small Business Tax Incentive 150 000 Instant Car Tax Reduction

How Do I Apply For The 10 000 Nsw Small Business Grant Accounting

How Do I Apply For The 10 000 Nsw Small Business Grant Accounting

New Jersey Economic Development Authority Grant Packages Njbia New Jersey Business Industry Association

New Jersey Economic Development Authority Grant Packages Njbia New Jersey Business Industry Association

Ontario Small Business Support Grant Mentor Works

Ontario Small Business Support Grant Mentor Works

Velocity Accounting Covid 19 Help For Business

Velocity Accounting Covid 19 Help For Business

Did You Apply For The Nsw 3 000 Small Business Recovery Grant

Did You Apply For The Nsw 3 000 Small Business Recovery Grant

What Is A Small Business Grant Understanding The Pros And Cons Kabbage Resource Center

What Is A Small Business Grant Understanding The Pros And Cons Kabbage Resource Center

Small Business Covid Grants Given Tax Free Treatment Mybusiness

Small Business Covid Grants Given Tax Free Treatment Mybusiness

Los Apartamentos Mas Bellos De Manhattan Apartamentos Disenos De Dormitorios Diseno Dormitorio Principal

Los Apartamentos Mas Bellos De Manhattan Apartamentos Disenos De Dormitorios Diseno Dormitorio Principal

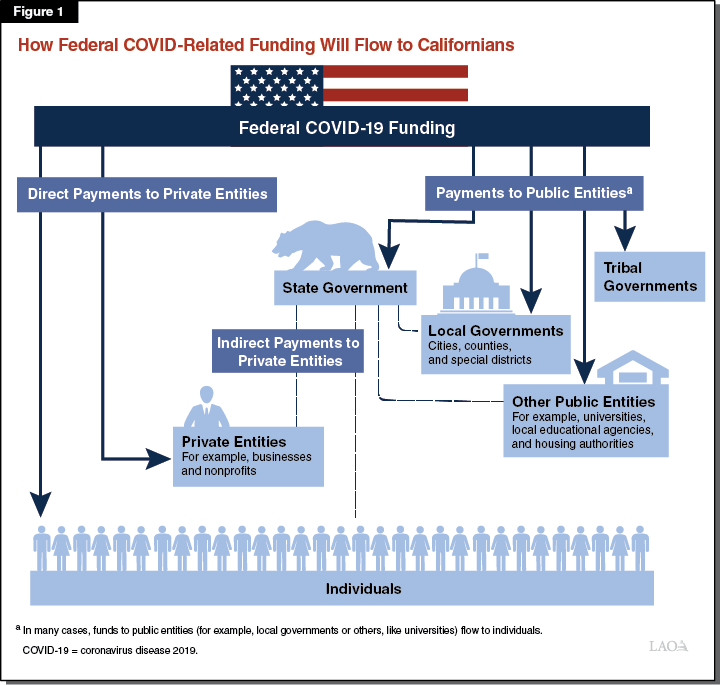

Federal Covid 19 Related Funding To California

Federal Covid 19 Related Funding To California