Are Unreimbursed Employee Business Expenses Deductible

An expense is ordinary if it is common and accepted in your trade business or profession. Unreimbursed business expenses are ordinary and necessary expenses incurred by a partner or shareholder which are not reimbursed.

Unreimbursed Business Expenses W2 Employees Does Your Employer Have An Accountable Plan

Unreimbursed Business Expenses W2 Employees Does Your Employer Have An Accountable Plan

Yes it doesnt seem fair that your.

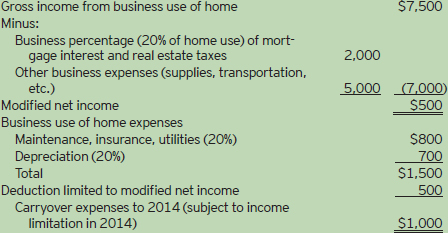

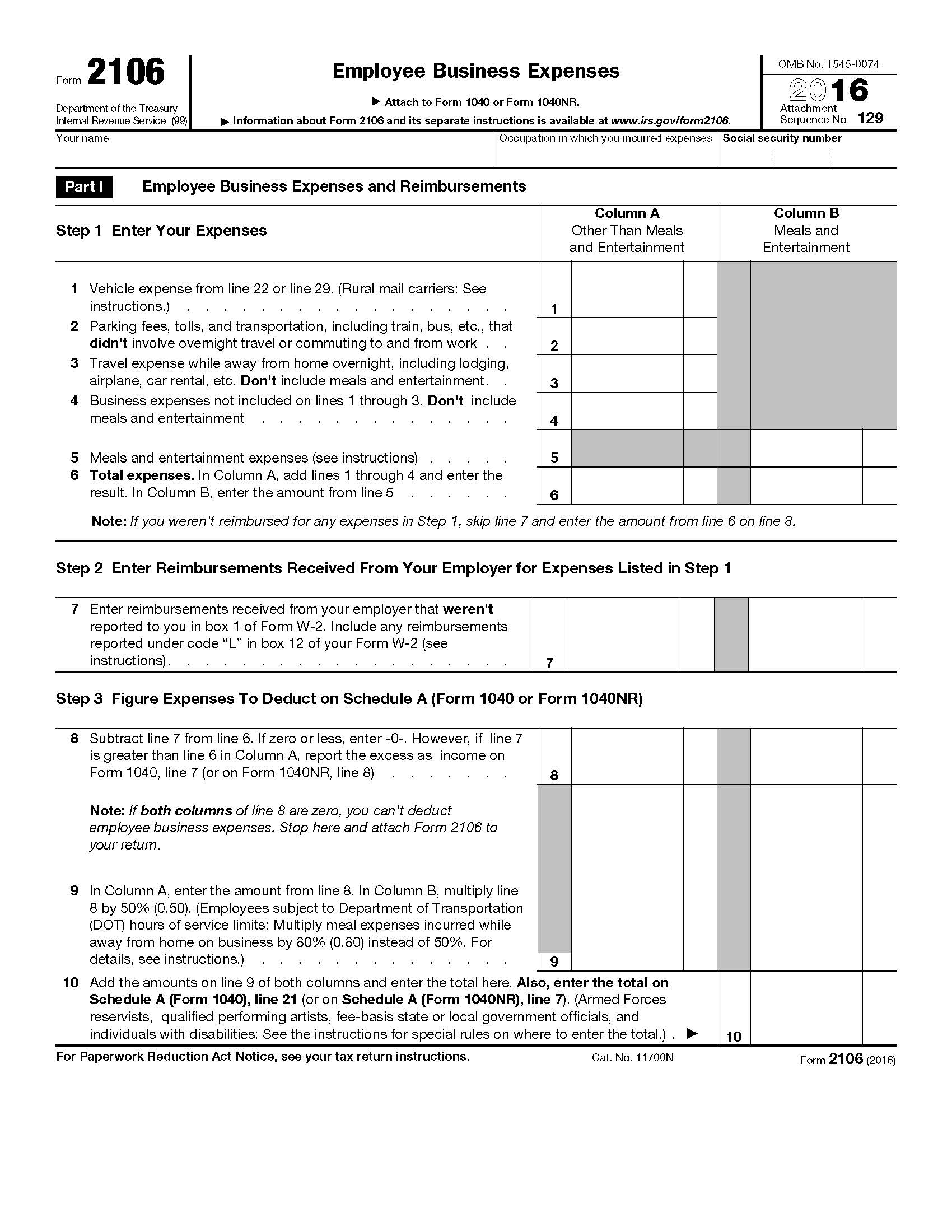

Are unreimbursed employee business expenses deductible. These expenses used to be summarized on Form 2106 Unreimbursed Employee Business Expenses and deducted on Schedule A Itemized Deductions to the extent that they and similar expenses exceeded 2 of the taxpayers adjusted gross income. But then Congress suspended the deduction for employee business expenses for tax years 2018 through 2025 as part of the Tax Cuts and Jobs Act of 2017. Unreimbursed Employee Business Expenses was a tax form issued by the Internal Revenue Service IRS for use by employees who wished to deduct ordinary and necessary expenses related.

Jul 17 2020 For a salesperson are federally deductible unreimbursed employee expenses if they are attributable to a trade or business in which the employee is a salesperson who solicits business for an employer away from the employers place of business 50 of qualified business meals and entertainment expenses may be claimed as a deduction. Beginning in 2018 unreimbursed employee expenses are no longer eligible for a tax deduction on your federal tax return however some states such as California continue to provide a deduction on your state tax return if you qualify. They must complete Form 2106 Employee Business Expenses to take the.

Tax reform not only eliminated this deduction for unreimbur. Oct 06 2020 The vast majority of W-2 workers cant deduct unreimbursed employee expenses in 2020. Employee business expenses can be deducted as an adjustment to income only for specific employment categories and eligible educators.

You can still claim this deduction if you havent yet filed your 2017 tax return however. Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions unless they are a qualified employee or an eligible educator. Jan 31 2020 In fact they were not deductible in 2018 and will not be deductible through 2025.

Expenses are deductible only if the reservists pay for meals and lodging at their official military post and only to the extent the expenses exceed Basic. Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions unless they are a qualified employee or an eligible educator. An ordinary expense is one that is common and accepted in your industry.

An employee cannot deduct expenses if he or she was reimbursed by the employer for any amount of the expenses - unless the employer included the reimbursement in PA taxable compensation in Block 16 of federal Form W-2. Dec 23 2019 For many employees this ability to deduct employment-related expenses that were not reimbursed by your boss was a godsend reducing your tax liability. In 2018 The Tax Cuts and Jobs Act eliminated the deduction for unreimbursed employee expenses.

If the employer did include reimbursements for the employees expenses in PA. Jan 03 2021 The deduction for unreimbursed employee business expenses was one of those that were affected. Before 2018 employees who incurred job-related expenses such as travel expenses and job-specific expenses were able to deduct itemized deductions on their federal tax returns.

Review the instructions beginning on Page 25 of the PA-40IN to determine if you can deduct expenses from your PA-taxable compensation. The Tax Cut and Jobs Act TCJA eliminated unreimbursed employee expense deductions for all but a handful of. The Tax Cuts and Jobs Act disallows this deduction for tax years 2018-2025.

You can only deduct unreimbursed expenses that are ordinary and necessary to your work as an employee. To claim unreimbursed travel expenses reservists must be stationed away from the general area of their job or business and return to their regular jobs once released. For returns filed before tax year 2018 employees can deduct any unreimbursed expenses that exceed 2 of their adjusted gross income.

Feb 22 2018 Under these older rules an employees tax deduction for their unreimbursed employee business expenses could only be claimed if they itemized their deductions as opposed to claiming the standard deduction and was only allowed to the extent the total of these expenses exceeded 2 of their adjusted gross income AGI. You can claim a deduction for an unreimbursed employee business expense by filing a PA Schedule UE Allowable Employee Business Expenses form along with your PA-40 Personal Income Tax Return. The TCJA eliminates it for tax years 2018 through 2025.

You can deduct only unreimbursed employee expenses that are paid or incurred during your tax year for carrying on your trade or business of being an employee and ordinary and necessary. Of the expenses claimed. Taxpayers classified as employees can also deduct some of their unreimbursed business expenses.

Jan 08 2021 Who can deduct these expenses. Some costs that you may be able to deduct include. A necessary expense is one that is appropriate and helpful to your business.

These deductions belong on Schedule A as miscellaneous itemized deductions. 2 days ago Employee business expenses can be deducted as an adjustment to income only for specific employment categories and eligible educators. Individual partners and shareholders may deduct unreimbursed employee expenses that are.

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Tax Prep Checklist Tracker Printable To Stay Organized By Howtofire Tax Prep Tax Prep Checklist Prepping

Tax Prep Checklist Tracker Printable To Stay Organized By Howtofire Tax Prep Tax Prep Checklist Prepping

Council Post When And Why Your Small Business Needs An Accountant Accounting Accounting Services Accounts Payable

Council Post When And Why Your Small Business Needs An Accountant Accounting Accounting Services Accounts Payable

Deducting Unreimbursed Employee Business Expenses Back Alley Taxes

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

Unreimbursed Employee Expenses

Unreimbursed Employee Expenses

Employee Business Expenses Commuting Doesn T Count Alloy Silverstein

Employee Business Expenses Commuting Doesn T Count Alloy Silverstein

Can I Deduct Unreimbursed Employee Business Expenses In 2019

Can I Deduct Unreimbursed Employee Business Expenses In 2019

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

How Pastors Church Employees Can Get A Tax Break For Their Unreimbursed Business Expenses The Pastor S Wallet

How Pastors Church Employees Can Get A Tax Break For Their Unreimbursed Business Expenses The Pastor S Wallet

Guest Post Unreimbursed Employee Business Expenses What Do You Mean I Have To Pay For That Nitram Financial Solutions

Guest Post Unreimbursed Employee Business Expenses What Do You Mean I Have To Pay For That Nitram Financial Solutions

List Of Tax Deductions For Hair Stylists Tax Deductions Stylist Marketing Hair Stylist

List Of Tax Deductions For Hair Stylists Tax Deductions Stylist Marketing Hair Stylist

Taxpayers Can Choose To Itemize Or Take Standard Deduction For Tax Year 2017 Standard Deduction Deduction Mortgage Interest

Taxpayers Can Choose To Itemize Or Take Standard Deduction For Tax Year 2017 Standard Deduction Deduction Mortgage Interest

Taxes From A To Z 2015 A Is For Actual Expense Method Tax Time Union Dues Tax

Taxes From A To Z 2015 A Is For Actual Expense Method Tax Time Union Dues Tax

What Law Firms Should Know About Employee Deductions Under The Trump Tax Bill Saville Dodgen Company

What Law Firms Should Know About Employee Deductions Under The Trump Tax Bill Saville Dodgen Company