How To Register Gst Company Singapore

Charging and Claiming GST. You have to submit your application for GST registration by the due date to avoid being penalised for late notification of your liability for GST registration.

What Company Type Suits Your Business Needs Get To Know Your Options With Paul Hype Page Co Company Types Getting To Know You Company

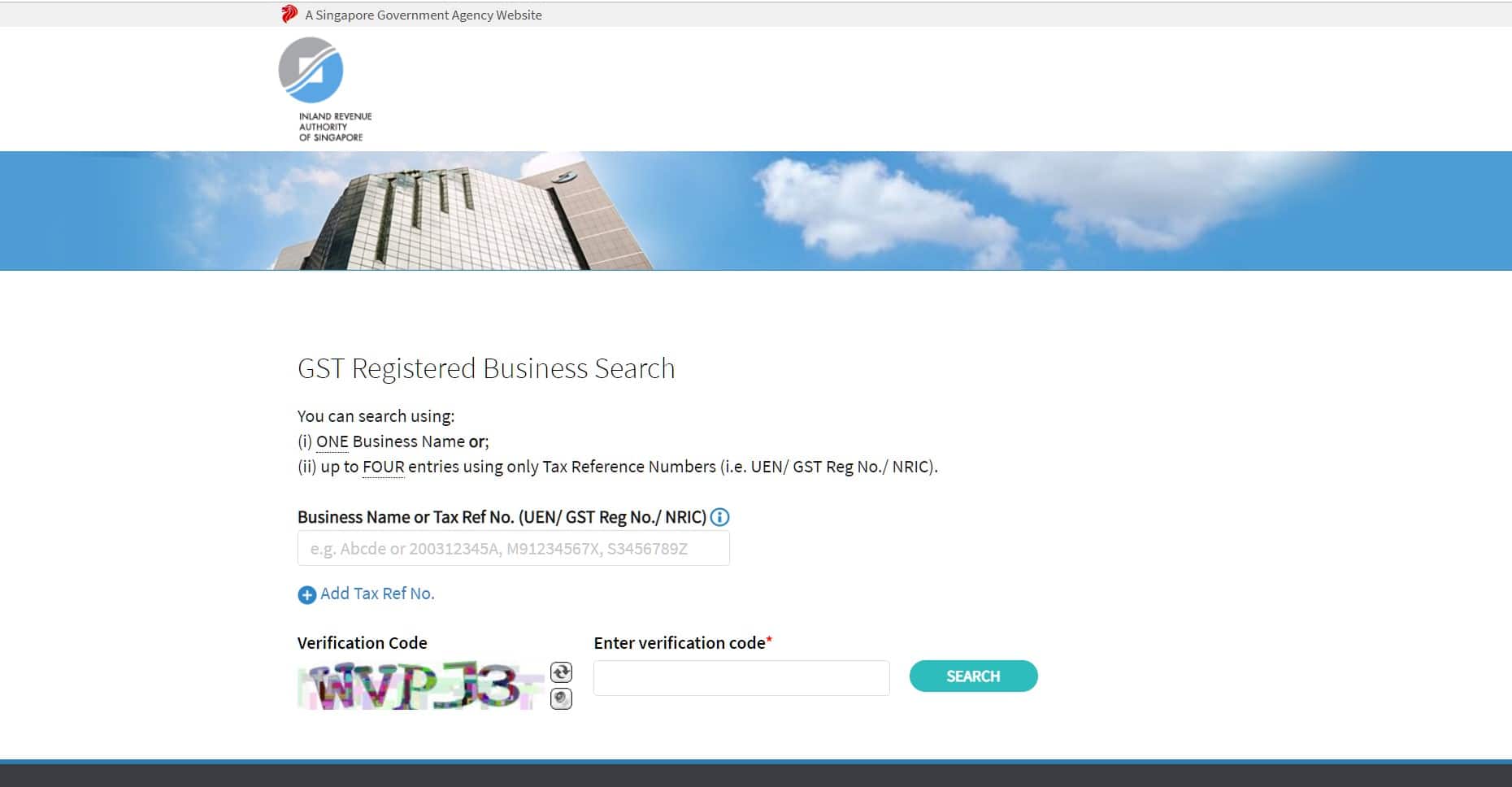

Search can be done using the name or tax reference number of the business.

How to register gst company singapore. First set up a CorpPass GST admin account under the registered GST Group or Divisional registration a sole proprietor or business for their respective GST registration number ie GSTN. Before 1 January 2019 within 30 days from the end of a calendar quarter. To register for GST you need to submit a form GST F1 together with all supporting documentation to IRAS.

Businesses in Singapore must register for GST if your taxable turnover is more than 1 million at the end of any calendar year from 2019 onwards. How to Apply for GST Registration in Singapore. If at any time you reasonably expect your taxable turnover in the next 12 months to be more than 1 million you will also have to register for GST.

An email will be received to the GST CorpPass admin after hisher account is created. Youll need to fill out an additional form GST F3 if you are operating a partnership business. Book an appointment or fill up the contact form for this and more incredible services for your business.

Our professional taxation specialists will attend to every step of your application thoroughly. In Singapore a company is still allowed to register for GST on a voluntary basis even if the turnover is below the expected 1 million. Employ local director Singaporean Permanent Resident or EntrePass holder Hire a registered filing agent accounting firm law firm or a corporate secretarial firm to complete the registration process for you.

Determine the Type of GST Registration. You must apply for GST registration within 30 days of. Go to Non-GST Registered Businesses Section.

You must determine if you are applying for compulsory or voluntary GST registration. Both GST returns and payment are due one month after the end of the accounting period covered by the return. Minimum of first five characters of the business name is required.

For companies who wish to do so on a voluntary basis it is advised that they first perform a cost-benefit analysis on the impact that GST registration will have on the business and reporting process. Firstly you need to fill a paper or online form on httpmytaxirasgovsg. 55 Newton Road Revenue House Singapore 307987.

Let CFO Accounts and Services help you in GST registration and filing of returns accurately and promptly. After 1 January 2019 within 30 days from the end of a calendar year. GST Registration Number GST Reg No Description.

Search can be done using the name or tax reference number of the business. Register for GST with Singapore Company Incorporation one of the leading tax agents in Singapore. Application for registration for GST must be made via myTax Portal within 30 days from the date the liability to register arises.

You may check online if a business is GST-registered via the Register of GST-registered Businesses. Responsibilities of a GST-registered Business. Business under GST group divisional registration Sole proprietorships Reference number for GST matters M91234567X MR2345678A MB2345678A MX2345678A.

To ensure that the business owners have a good understanding of the obligations and responsibilities of a GST-registered business before registering for GST the company director sole-proprietor partner trustee preparer of GST returns must complete two e-Learning courses- Registering for GST and Overview of GST - and pass the quiz before submitting the registration form. If you are filling an offline application you need to send it to the following address. Complete e-Learning Course Only for Voluntary Registration Step Three.

Complete And Submit An Application For GST Registration With IRAS. Applying for GST Registration. Do I Need to Register for GST.

Call 65 6636 9366 today to schedule your first appointment. How to file GST in Singapore GST-registered businesses are required to e-File their returns through myTax Portal and make payment to IRAS by the due date. Guide for foreigners to register a business in Singapore.

Applying for GST Registration. Applicants for GST registration will have to submit their applications online via myTax Portal using their CorpPass with supporting documents such as your Accounting and Corporate Regulatory Authority ACRA Business Profile or Certificate of Incorporation in English if your business is incorporated overseas. The end of the quarter where you are liable.

Goods And Services Tax Gst In Singapore Taxation Guide

Singapore Goods And Services Tax Gst Vat Guide Rikvin

Gst Registration Filing Services Singapore Goods And Service Tax Goods And Services Singapore

Company Registration Number In India Steps To Check Cin Online Online Learning Registration Learning Centers

Gst Singapore A Complete Guide For Business Owners

How Goods Services Tax Gst Works In Singapore Accounting Services Types Of Sales Goods And Services

Gst Singapore A Complete Guide For Business Owners

Understanding Gst In Singapore Understanding How To Find Out Singapore

Gst Singapore A Complete Guide For Business Owners

Find About Gst Registration Process Rules Forms Get Your Gst Registration At Rs 999 In Across India Simpl How To Apply Registration Goods And Service Tax

Gst Singapore A Complete Guide For Business Owners

Online Accounting Software Accounting Online Accounting Software Accounting Services

Company Registration Incorporation And Formation Services In Singapore Company Business Format Incorporate

Singapore Tax Guide Check A Company S Gst Registration Number Paul Wan Co

How Has Gst Revolutionised India S Economy Economy Indirect Tax Revenue Growth

5 Explanations On Why Gst Online Registration In India Is Important Online Registration Goods And Services Goods And Service Tax

Gst Singapore A Complete Guide For Business Owners

My Corporation Is India S Super Fast Company Registration Platform Which Offers Lowest Prices A Business Format Limited Liability Partnership Internet Business

Gst Is A Type Of Tax Regime Which Is Levied On The Import And Supply Of Goods In The Perimeters Of Singapore And Business Bank Account Types Of Taxes Bestar