How To Track Small Business Stimulus Grants

Alternatively take a look at our other posts on the Skip Blog. While small business grants are normally taxable it appears that EIDL grants will not be taxed by the IRS.

Small Business Administration Funds To Public Companies Top 1 Billion The Washington Post

Small Business Administration Funds To Public Companies Top 1 Billion The Washington Post

Thats the relief being provided in this package as well Newsom said.

How to track small business stimulus grants. The stimulus package signed by Newsom also included 21 billion in grants for small businesses 400 million in federal funding for child care 24. Use your stimulus check to start an emergency fund or add to it if you already have one. Our daily posts include detailed updates on the stimulus package stimulus checks healthcare news infection news and much more.

SCORE mentors Womens Business Centers Small Business Development Centers and Veterans Business Outreach Centers. Ready to Track Stimulus Checks or EIDL Grant Eligibility. And thats in addition to these small business grants.

Goldman Sachs announced a slew of initiatives to support small businesses impacted by COVID-19 including a Small Business Stimulus Package allocating 250 million in emergency loans and 25 million in grants. Small business tax relief and your 2020 taxes. Start tracking on the free Skip app available on the App Store or Google Play or search Hello Skip.

Additionally if you spend that money on expenses that would normally be deductible you can still deduct them from your taxes. Small business stimulus relief available now Small business stimulus and loan guidance. Does a small business grant programmes stimulus to the economy.

286 billion for the Restaurant Revitalization Fund for industry-focused grants. Plenty of businesses have been forced to close their doors because they were unprepared he says. SBA has 68 District Offices around the country that provide guidance and assistance to small businesses in their area.

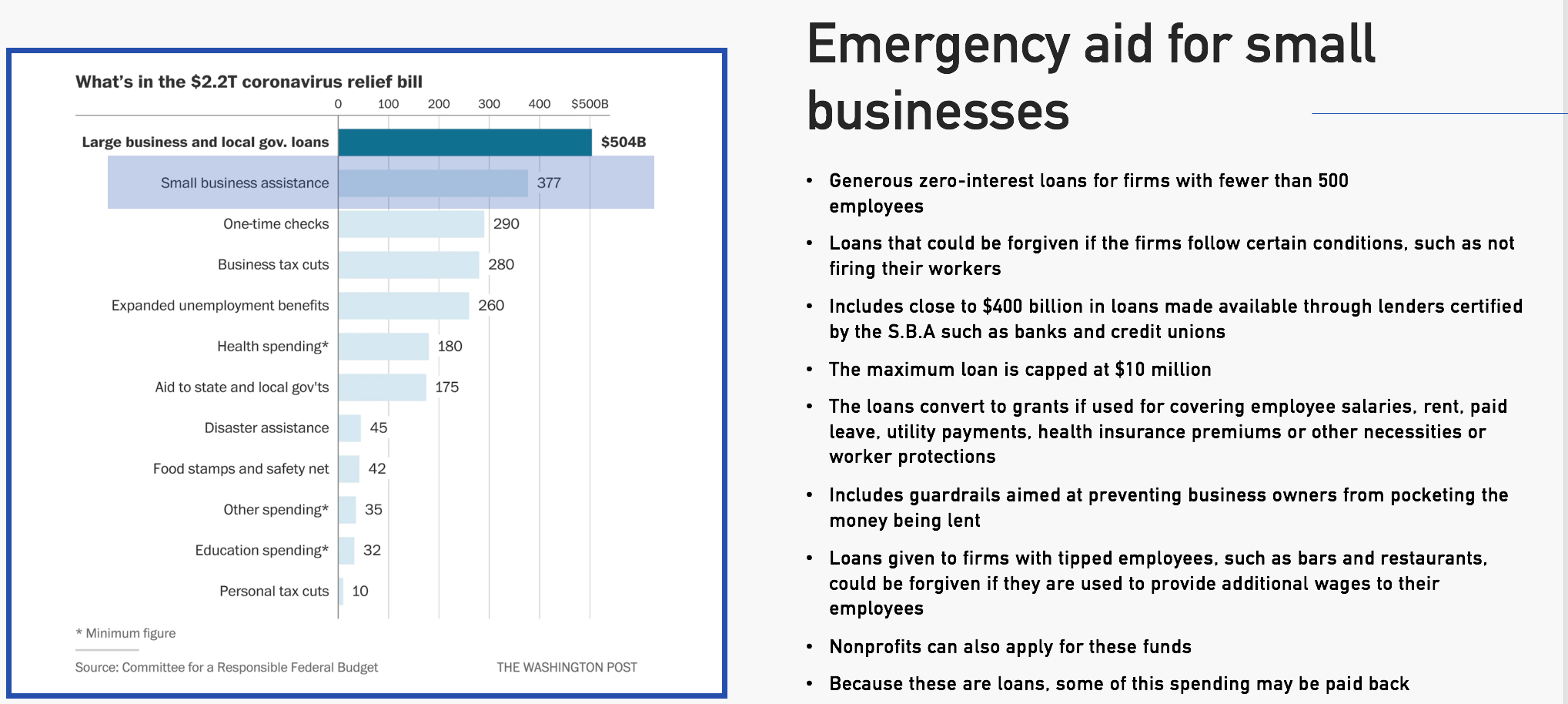

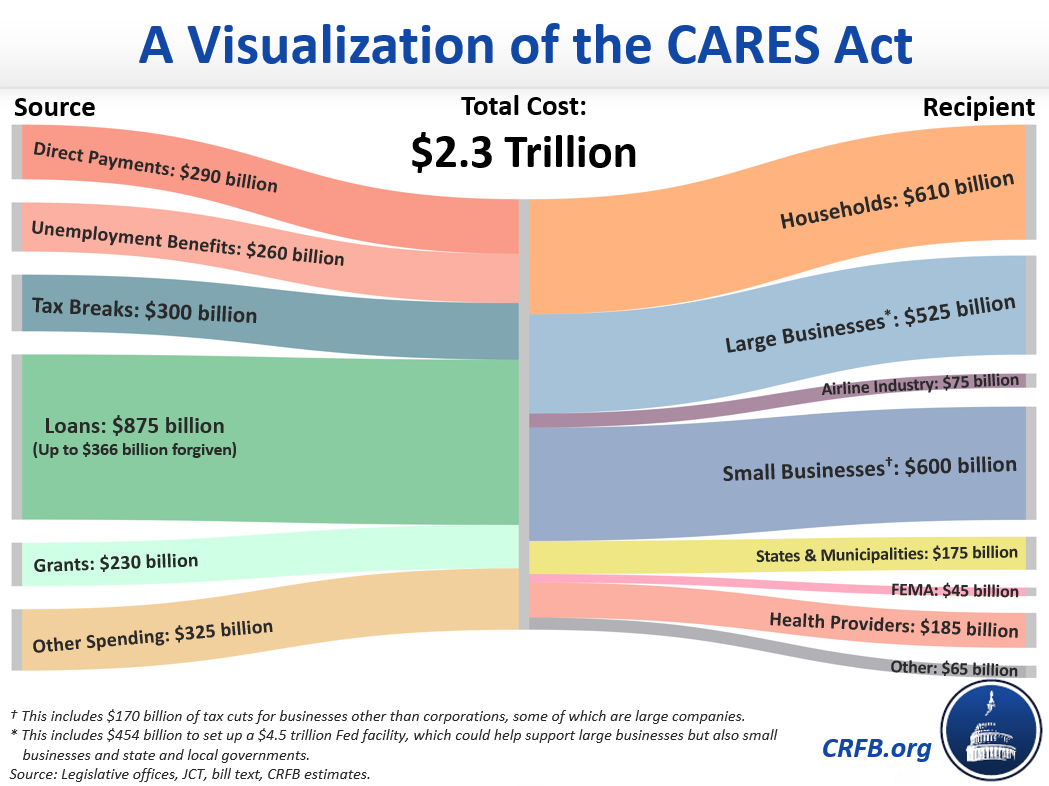

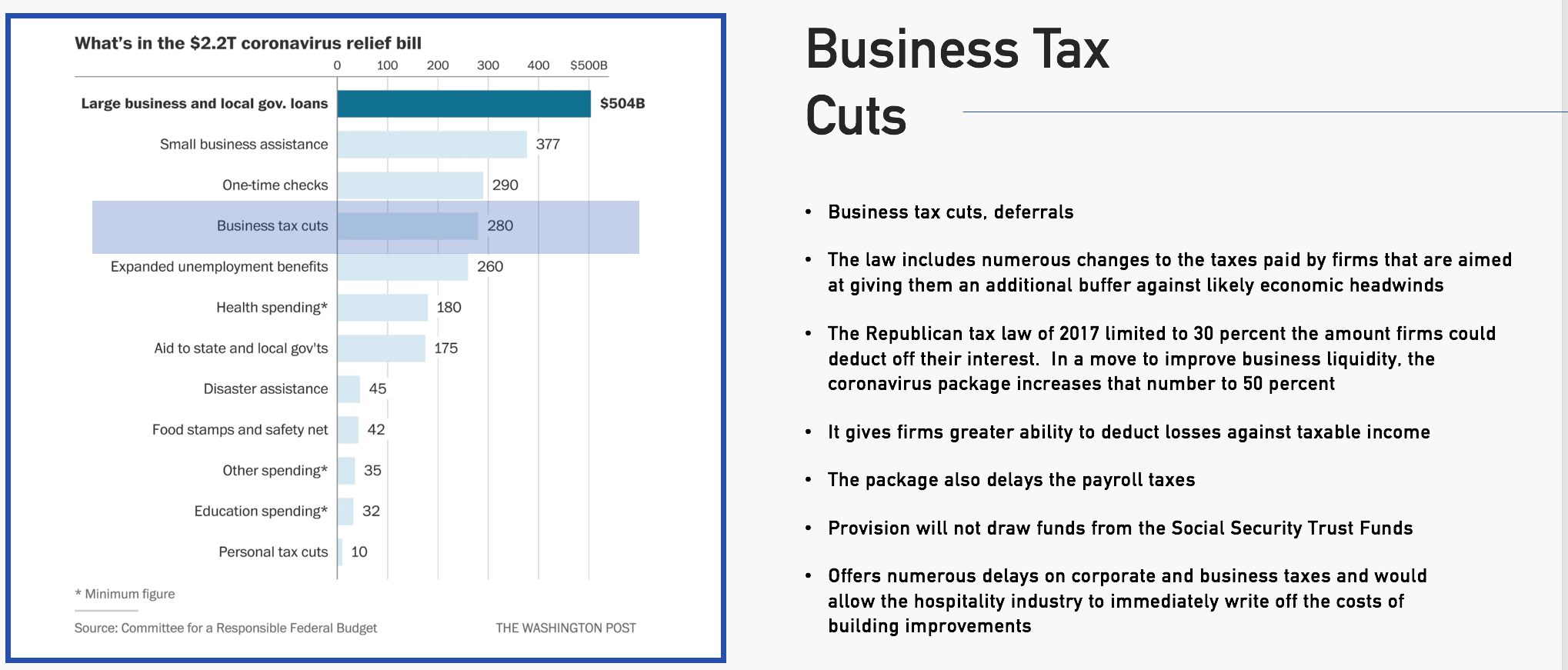

Email us at supportgrantsgov or visit our Support page. Billions for small businesses included in new stimulus relief package. Employers will be eligible for the payroll tax credit as long as they keep workers employed amid coronavirus-related shutdowns.

Included in the stimulus package that Congress passed this week is funding for more EIDL grants for small businesses. To Track Grantsgov submissions enter up to five Grantsgov tracking numbers one per line and click the Track button. The bill earmarked 20 billion for EIDL grants which are grants of up to 10000 for small businesses alongside the 284 billion earmarked for forgivable PPP loansThe qualification rules for EIDL grants have changed in this round from the first round of EIDL grants also.

The stimulus plan grants small business owners tax credits and defers payroll taxes through 2020 so they can continue paying employees. You can now track. Grants are a win win situation and there are types available to meet nearly all needs.

With the funds you can easily get back on track. Small Business Administration SBA was created in 1953 as an independent agency of the federal government to aid counsel assist and protect the interests of small business concerns to preserve free competitive enterprise and to maintain and strengthen the overall economy of our nation. The company has committed a total of 300 million.

Updated as of 3102021. Lets say your payroll costs were 120000 or 10000 per month. Multiply that 10000 by 25 the number of months this loan will cover and you end up with a loan of 25000 from this program.

Employers who apply for small business loans do not qualify for payroll tax credits. What The Stimulus Package Says About 2021 EIDL Loans Grants. We also work with a number of local organizations to counsel mentor and train small businesses through our official Resource Partners.

Another 50 million in grants was also set aside for cultural. Please note this only confirms that an application was successfully retrieved by the awarding agency. Small business stimulus relief options such as the Paycheck Protection Program PPP and Economic Injury Disaster Loans EIDL have become household names during the COVID-19 pandemic.

Certain businesses particularly those in high-tech fields may qualify for small business funding in the form of federal grant money. Beware of third-party websites sometimes masquerading as government sites which promise to reveal valuable government grant information or apply for grants on your behalf in exchange for money andor personal information. To determine how much youre eligible to receive take your payroll costs from the last 12 months divide by 12 and then multiply by 25.

![]() Track Eidl Grants And Stimulus Checks

Track Eidl Grants And Stimulus Checks

How To Apply For An Sba Disaster Loan

How To Apply For An Sba Disaster Loan

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus Covid 19 Hub Miamitimesonline Com

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus Covid 19 Hub Miamitimesonline Com

![]() Track Eidl Grants And Stimulus Checks

Track Eidl Grants And Stimulus Checks

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Stimulus Checks And Other Coronavirus Relief Threatened By Old Technology And A Rocky Government Rollout The Washington Post

Stimulus Checks And Other Coronavirus Relief Threatened By Old Technology And A Rocky Government Rollout The Washington Post

Covid 19 Relief Statewide Small Business Assistance Pa Department Of Community Economic Development

Covid 19 Relief Statewide Small Business Assistance Pa Department Of Community Economic Development

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

![]() Track Eidl Grants And Stimulus Checks

Track Eidl Grants And Stimulus Checks

Federal Government S 350b Small Business Relief Fund Runs Out Of Money In Less Than 2 Weeks Geekwire

Federal Government S 350b Small Business Relief Fund Runs Out Of Money In Less Than 2 Weeks Geekwire

Covid 19 Aid To Small Business Owners Trickles Out As Sba Clarifies Cares Act Rules For Sole Proprietors

Covid 19 Aid To Small Business Owners Trickles Out As Sba Clarifies Cares Act Rules For Sole Proprietors

Coronavirus Small Business Relief How To Get Grants And Loans Smartasset

Coronavirus Small Business Relief How To Get Grants And Loans Smartasset

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

How To Fill Out The Sba Disaster Loan Application Youtube

How To Fill Out The Sba Disaster Loan Application Youtube

Coronavirus Small Business Relief How To Get Grants And Loans Smartasset

Coronavirus Small Business Relief How To Get Grants And Loans Smartasset

Dane County Announces 15 Million Boost To Small Business Grant Program Local Government Madison Com

Dane County Announces 15 Million Boost To Small Business Grant Program Local Government Madison Com

6 Ways To Rebuild Your Small Business After Covid 19

6 Ways To Rebuild Your Small Business After Covid 19

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus