The Three Types Of Business Ownership Include Partnerships Corporations And

Partnerships are uniquely the most flexible of all business forms of ownership as it is simple to negotiate changes to the agreement. There are different types of businesses to choose from when forming a company each with its own legal structure and rules.

Sba Business Plan Outline Edit Fill Sign Online Handypdf Regarding Sba Business Business Plan Template Word Business Plan Outline One Page Business Plan

Sba Business Plan Outline Edit Fill Sign Online Handypdf Regarding Sba Business Business Plan Template Word Business Plan Outline One Page Business Plan

Partnerships corporations and ___________.

The three types of business ownership include partnerships corporations and. However a single business cannot take a different form. Ownership can be acquired either through franchising or purchasing an existing business. 2 out of 200 points The three types of business ownership include.

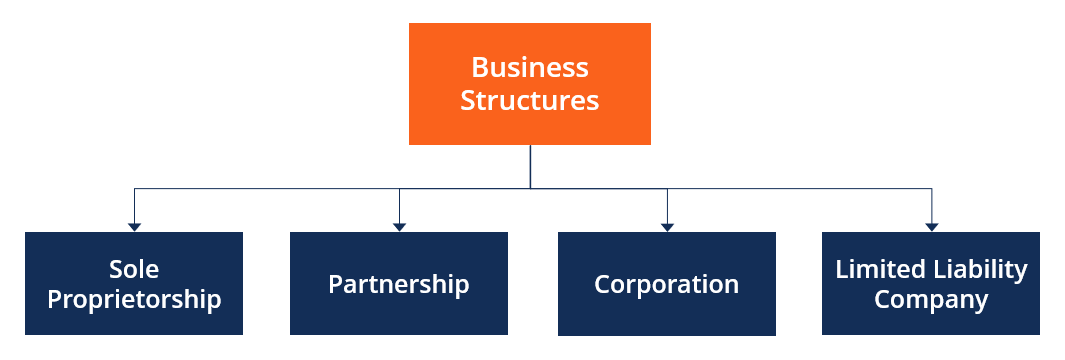

In addition to the three commonly adopted forms of business organizationsole proprietorship partnership and regular corporationssome business owners select other forms of organization to meet their particular needs. Terms in this set 26 3 Basic Types-Sole Proprietorship-Partnership-Corporation. In the US the three types of business organizations are sole proprietorships partnerships and corporations.

Hair Salon Local Drug Store Florist Shop Veterinary Clinics. One proprietor or owner. Typically there are four main types of businesses.

There are three basic forms of business ownership. In 2018 major Bold Penguin Exchange partnerships quadrupled. A business may be owned in one of three ways.

Sole proprietorship partnership and corporation. Sole Proprietorships Partnerships Limited Liability Companies LLC. 3 legal forms of business Form of business Self Proprietorship Partnership Corporation GTUforms of business ownershipbusiness ownership structuresty.

Other Types of Business Ownership In addition to the three commonly adopted forms of business organizationsole proprietorship partnership and regular corporationssome business owners select other forms of organization to meet their particular needs. The three types of business ownership are Sole Proprietorship Partnership and Corporation. Well look at several of these options.

In addition to the three commonly adopted forms of business organizationsole proprietorship partnership and regular corporationssome business owners select other forms of organization to meet their particular needs. The three types of business ownership. Todays lesson will use the chocolate candy industry to help them understand the costs and benefits of each type of organization.

There are many advantages and disadvantages of each type of ownership but one type is not the best for all. Once ownership is decided upon often the next step is trying to decide how to expand and grow. Sole proprietorship is an organization owned and operated by a single person.

There are three types of business ownership namely sole proprietorship corporation and partnership. Free markets capitalism sole proprietorships cooperatives limited liability corporations The three major types of business ownership are sole proprietorships partnerships and corporations. This money is often used to expandgrow and beat competitors.

Coverage types range from most common inquiries in general liability workers compensation professional liability commercial auto and. Seventy two percent of organizations in the United States are structured this way making it the most common form of business entity Hatten 2012. Examples of Sole Proprietorships.

Regardless of size or the number of candies made a business must have some type of structure. Sole proprietorship partnership or corporation. A single entrepreneur can own several businesses under different types of ownership.

As a separate entity for legal purposes a partnership business can buy and own a fixed annuity. 3 Someone who desires to startrun a business but is not comfortable with the idea of having a new product or service should consider a cooperative. The major advantage of the corporate form of ownership is the ability to raise money quickly by selling stock.

In addition a well drafted financial compensation and earnings allocation clause can minimize the overall tax burden borne by all partners. Well look at several of the following options.

Business Plan Tutorial Types Of Business Ownership Livecareer

Business Plan Tutorial Types Of Business Ownership Livecareer

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

Make Sure You Have A Data Governance Strategy To Identify Important Data Across Your Organi Master Data Management Information Security Governance Data Science

Make Sure You Have A Data Governance Strategy To Identify Important Data Across Your Organi Master Data Management Information Security Governance Data Science

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

4 Types Of Partnership In Business Limited General More

4 Types Of Partnership In Business Limited General More

Hunting Lease Lease Agreement Contract Template Lease

Hunting Lease Lease Agreement Contract Template Lease

Types Of Businesses Overview Of Different Business Classifications

Types Of Businesses Overview Of Different Business Classifications

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Types Of Business Structures Sole Proprietorship Llc More

Types Of Business Structures Sole Proprietorship Llc More

Partnership Agreement Templates Examples Pdf Doc Examples Inside Template For Business Partnership Agreement 10 Contract Template Agreement Business Template

Partnership Agreement Templates Examples Pdf Doc Examples Inside Template For Business Partnership Agreement 10 Contract Template Agreement Business Template

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 6 Forms Of Business Ownership Fundamentals Of Business

Chapter 6 Forms Of Business Ownership Fundamentals Of Business

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Business Structure Overview Forms How They Work

Business Structure Overview Forms How They Work

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business