What Is The Nonbusiness Energy Property Credit

25C in previous tax years is no longer eligible for this tax credit. Nov 04 2009 The Nonbusiness Energy Property Credit a tax credit for making energy efficient improvements to homes has been increased as part of the American Recovery and Reinvestment Act of 2009.

Filing For Residential Energy Tax Credits What You Need To Know

Filing For Residential Energy Tax Credits What You Need To Know

Oct 19 2020 The Non-Business Energy Property Credit The Non-Business Energy Property Credit initially expired at the end of 2017 but then it was reinstated through December 31 2020.

What is the nonbusiness energy property credit. Spring is here and that means tax season. Let Lindstrom install high-efficiency equipment so your home will be eligible for the Federal Energy Property Tax Credit now extended through 2021. Mar 02 2021 Nonbusiness energy property tax credits The nonbusiness energy tax credit is another way to lower your tax burden through eco-friendly home improvements.

25C - Nonbusiness energy property. The 2011 credit is 10 percent of the cost of qualified energy-efficient improvements up to 500. Here are seven things the IRS wants you to know about the Nonbusiness Energy Property Credit.

A homeowner who has already claimed the maximum applicable tax credits permitted under 26 USC. New homes cannot take advantage. 10 of cost up to 500 or a specific amount from 50-300.

1 building envelope components and 2 energy properties. Of that combined 500 limit. Must be an existing home.

The Non-business Energy Property Credit is generally intended for homeowners who install energy-efficient improvements. 10 of the amount paid or incurred for qualified energy efficiency improvements installed during 2020 and Any residential energy property costs paid or incurred in 2020. The credit is worth 30 for upgrades made before December 31 st 2019.

Nonbusiness energy property credit The nonbusiness energy property credit has a lifetime limitation as well as limitation based on tax liability similar to the residential energy credit. Tax credits for non-business properties are now retroactively available for purchases made through December 31 2017. Nonbusiness Energy Property Credit expired after 2017 - Taxpayers that made qualified energy-efficient improvements to their primary residence may have been eligible for the nonbusiness energy property credit.

This credit is currently scheduled to sunset in 2021. The Nonbusiness Energy Property Tax Credit on the other hand rewards homeowners for installing materials and equipment that meet energy efficiency standards set by the Department of Energy. Details of the Nonbusiness Energy Property Credit Extended through December 31 2021 You can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs.

A nonrefundable tax credit allows taxpayers to lower their tax liability to zero. The first part of this credit is worth 10 of the cost of qualified energy-saving equipment or items added to a taxpayers main home during the year. Prev next a Allowance of credit In the case of an individual there shall be allowed as a credit against the tax imposed by this chapter for the taxable year an amount equal to the sum of.

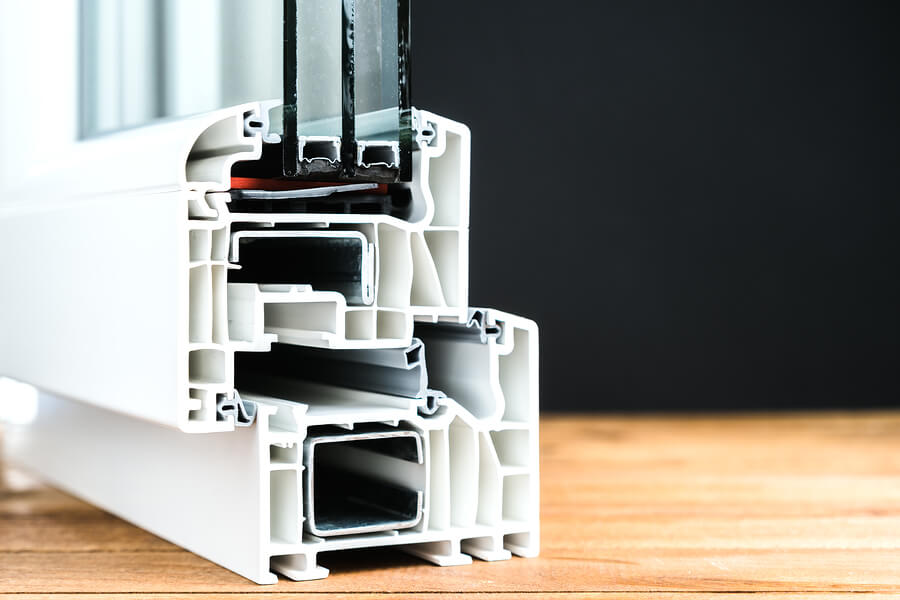

Jun 14 2017 In prior tax years the nonbusiness energy tax was available for energy efficient home improvements that fell into two categories. The Non-Business Energy Property Tax Credits have been retroactively extended from 12312017 through 12312021. The residential energy-efficient property credit can be used for upgrades made to both primary and secondary residences.

But taxes dont have to be as frustrating when you can save big with energy tax credits. These credits only apply to existing homes that serve as your main residence. This one rewards you for installing.

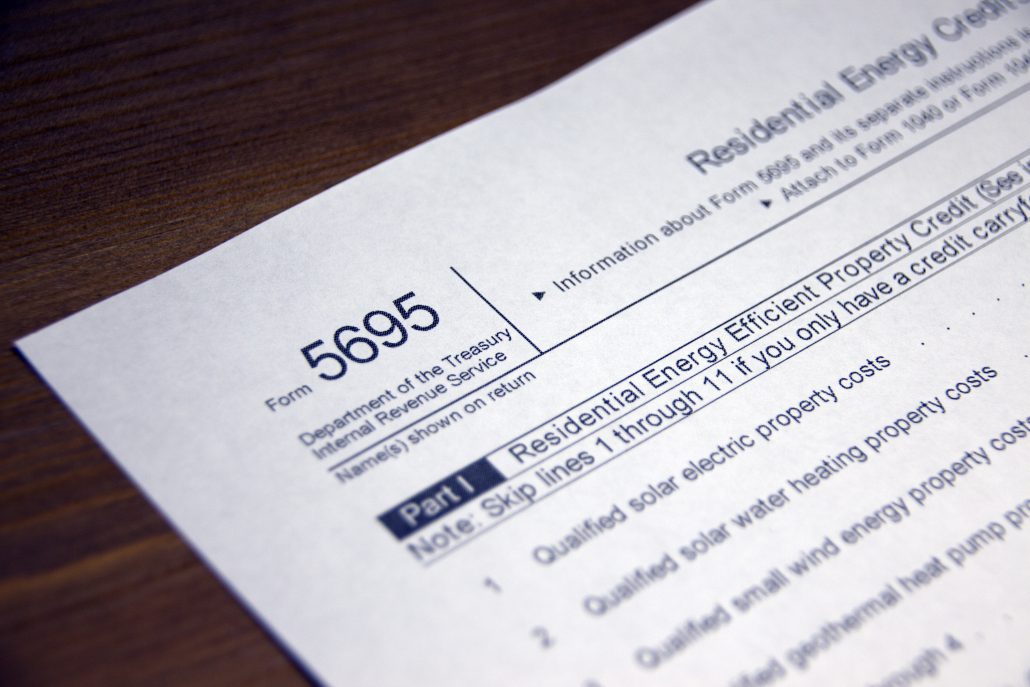

The cost of the installation should be included when you file Form 5695. All tax credits on these products are eligible until December 31 st 2021. The nonbusiness energy credit allowed you to make energy efficient home improvements that increased the heating and cooling efficiency of your main home and then.

This credit is worth a maximum of 500 for all years combined from 2006 to its expiration. Equipment Tax Credits for Primary Residences. Nonbusiness Energy Property Credit Part II You may be able to take a credit equal to the sum of.

25C tax credit which means all previous federal tax credits are a lifetime maximum credit. Qualifying improvements include adding insulation energy-efficient exterior windows and doors and certain roofs. The IRS offers two residential energy credits to tax payersthe non-business energy property credit and the residential energy-efficient creditwhich must be claimed using IRS Form 5695 or Residential Energy Credits.

The residential energy property credit is nonrefundable. The tax credit is an extension of the 26 USC. 300 for any item of energy-efficient building property.

Dec 09 2020 The Residential Energy Efficient Property Credit equals up to 30 of the costs of purchased equipment like solar water heaters and solar electric equipment while the Non-Business Energy Property Credit is 10 of the costs of qualified items which can include energy-efficient windows doors and roofs.

Home Energy Residential Tax Credits 2020 2021

Home Energy Residential Tax Credits 2020 2021

How To Draw Energy Diagram Http Energy Efficient Home Com How To Draw Energy Diagram Solar Energy Facts Solar Energy System Solar Kit

How To Draw Energy Diagram Http Energy Efficient Home Com How To Draw Energy Diagram Solar Energy Facts Solar Energy System Solar Kit

Federal Tax Credit Extended For Rinnai America Corporation Customers

Federal Tax Credit Extended For Rinnai America Corporation Customers

Energy Saving Air Conditioner Settings Http Home Energy Org Energy Saving Air Conditioner Settings Energy Efficient Homes Home Energy Audit

Energy Saving Air Conditioner Settings Http Home Energy Org Energy Saving Air Conditioner Settings Energy Efficient Homes Home Energy Audit

What Tax Credits Are Available Energy Star In 2020 Tax Credits Energy Star Energy

What Tax Credits Are Available Energy Star In 2020 Tax Credits Energy Star Energy

Home Energy Solutions Of The Triad Https Energy Efficient Home Com Home Energy Solutions Of The T Solar Energy Facts Energy Efficient Homes Solar Panel Cost

Home Energy Solutions Of The Triad Https Energy Efficient Home Com Home Energy Solutions Of The T Solar Energy Facts Energy Efficient Homes Solar Panel Cost

Https Www Irs Gov Pub Irs News Ir 10 110 Pdf

What Is An Energy Tax Credit Millionacres

What Is An Energy Tax Credit Millionacres

What Is An Energy Tax Credit Millionacres

What Is An Energy Tax Credit Millionacres

Philips Original Home Solaria Instrucciones De Uso Solarpanels Solarenergy Solarpower Solargener Solar Energy Facts Solar Energy Solutions Solar Energy Panels

Philips Original Home Solaria Instrucciones De Uso Solarpanels Solarenergy Solarpower Solargener Solar Energy Facts Solar Energy Solutions Solar Energy Panels

Steps To Complete Irs Form 5695 Lovetoknow

Steps To Complete Irs Form 5695 Lovetoknow

How To Qualify For Energy Efficiency Tax Credits In 2020 Energy

How To Qualify For Energy Efficiency Tax Credits In 2020 Energy

What Tax Credits Are Available For Making Your Home Energy Efficient Brubaker Inc

What Tax Credits Are Available For Making Your Home Energy Efficient Brubaker Inc

Business Creative Idea If You Find This Image Useful You Can Make A Donation To The Artist Vi Solar Energy Facts Solar Power House Solar Panel Efficiency

Business Creative Idea If You Find This Image Useful You Can Make A Donation To The Artist Vi Solar Energy Facts Solar Power House Solar Panel Efficiency

Form 5695 Claiming Residential Energy Credits

Form 5695 Claiming Residential Energy Credits

Off Grid Solar Power How Much Http Energy Efficient Home Com Off Grid Solar Power How Much Solar Energy System Solar Farm Solar Cost

Off Grid Solar Power How Much Http Energy Efficient Home Com Off Grid Solar Power How Much Solar Energy System Solar Farm Solar Cost

Nonbusiness Energy Property Credit Andretaxco Pllc

Nonbusiness Energy Property Credit Andretaxco Pllc

Irs Tax Forms Infographic Tax Relief Center Irs Taxes Irs Tax Forms Tax Forms

Irs Tax Forms Infographic Tax Relief Center Irs Taxes Irs Tax Forms Tax Forms