1099-misc Qualified Business Income Deduction

If your client made 5m from consulting but no one paid more than 599 there would never be any 1099-Misc forms used for reporting. You are relating things that do not relate.

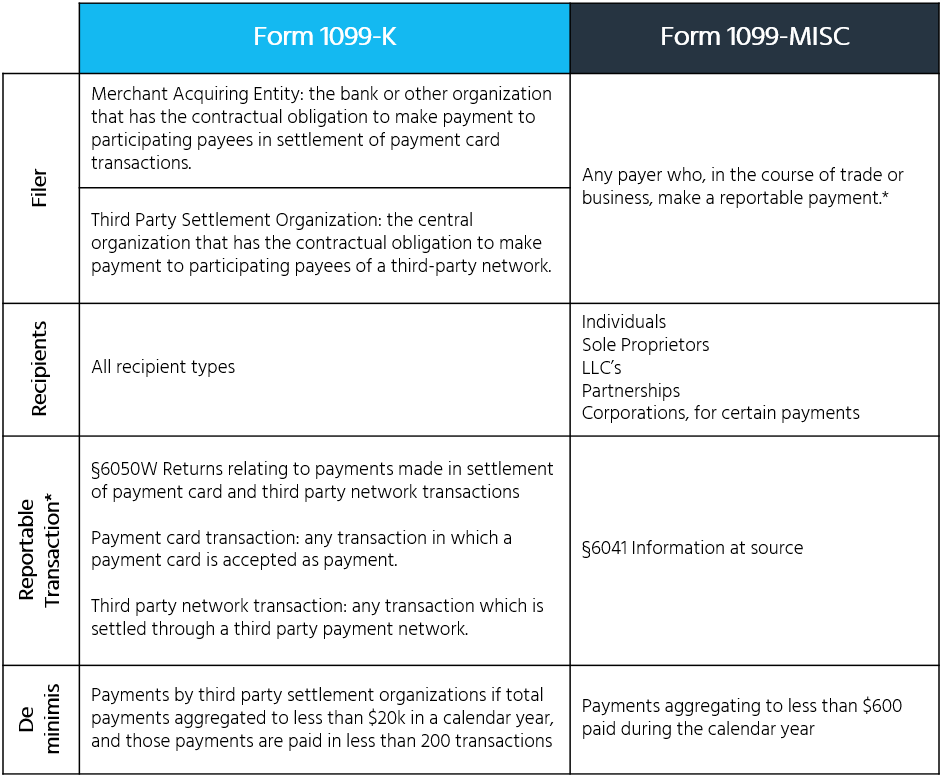

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos

The deduction allows them to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP income.

1099-misc qualified business income deduction. The 1099-Misc is a notational function which means it is used for reporting what happened when it meets the reporting threshold. Only items included in taxable income are counted. To get the 20 deduction you must have qualified business income.

Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20 of their net QBI from a trade or business including income from a pass-through entity but not from a C corporation plus 20 of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP income. The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified. Earned income and unearned income are taxed at different rates and impact eligibility for the refundable credit known as the Earned Income Tax Credit.

What is qualified business income QBI. Qualified Business Income Deduction. Only items included in taxable income are counted.

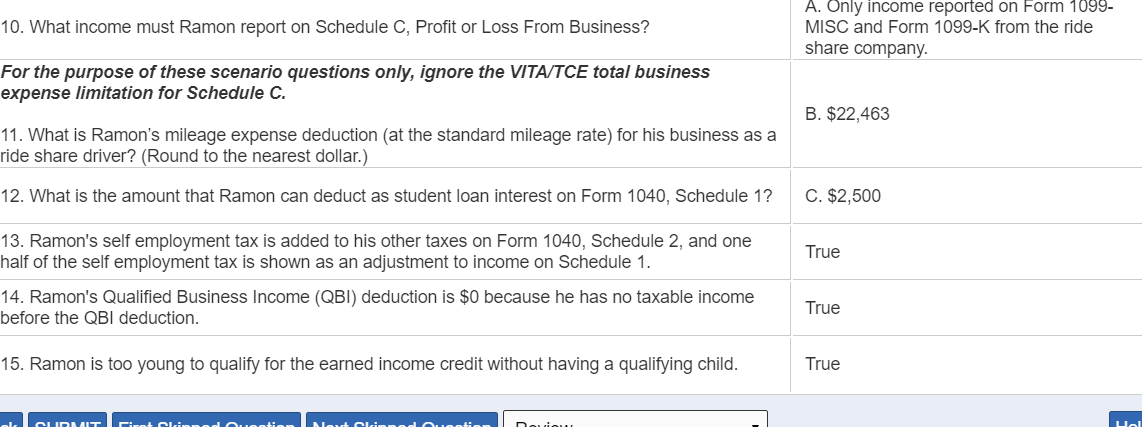

At least 10 in royalties or broker payments in lieu. Both Uber and Lyft will report your income on Form 1099-K if you earned at least 20000 over at least 200 rides. The deduction is available to eligible taxpayers whether they itemize their deductions on Schedule A or take the standard deduction.

Many owners of sole proprietorships partnerships S corporations and some trusts and estates may be eligible for a qualified business income QBI deduction also called Section 199A for tax years beginning after December 31 2017. The deduction only applies to that particular type of income. A 1099-MISC tax form is a type of IRS Form 1099 that reports certain types of miscellaneous income.

The term is defined in the Tax Cuts and Jobs Act but it is actually relatively straightforward at least at first blush. If you arent eligible to receive either form you can download an annual summary of earnings. Qualified business income is the net amount of qualified items of income gain deduction and loss connected to a qualified US.

This allows for the deduction of related business expenses on the IRS Schedule C form. 1099-MISC income Schedule C profit and K-1 income normally qualify. Income reported on Form 1099-MISC as an insurance agent would be subject to self-employment tax but possibly be eligible for the QBI deduction.

In addition the items must be effectively connected with a US. Earned income reported on a 1099-NEC or on box 7 of a prior year 1099-MISC is considered to be self-employment income. Income earned as a statutory employee would not be subject to self-employment tax but could qualify as QBI.

If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor. If your income is below the threshold level then almost any type of ordinary business income other than W-2 income or K-1 guaranteed payments will qualify for the 20 deduction ie. A qualified business income QBI deduction allows domestic small business owners and self-employed individuals to deduct up to 20 of their QBI plus 20 of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP income on their taxes or 20 of a taxpayers taxable income minus net capital gains.

It doesnt define anything regarding the QBI. For taxpayers who file Married filing separately the first 125000 of business income included in their federal adjusted gross income is 100 deductible. For tax years 2016 and forward the first 250000 of business income earned by taxpayers filing Single or Married filing jointly and included in their federal adjusted gross income is 100 deductible.

Income earned by a C corporation or by providing services as an employee isnt eligible for the deduction. You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. You may also receive Form 1099-MISC if you earned over 600 from non-driving payments like referrals and bonuses.

QBI is the net amount of qualified items of income gain deduction and loss from any qualified trade or business.

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

5 Simple Steps To 1099 Misc Forms Md Bookkeeping Tax Services

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Small Business Proving You Have Income Without A 1099 Misc Robergtaxsolutions Com

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

10 What Income Must Ramon Report On Schedule C P Chegg Com

10 What Income Must Ramon Report On Schedule C P Chegg Com

Paypal 1099 Taxes The Complete Guide

Paypal 1099 Taxes The Complete Guide

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

2018 Tax Act For Creative People