Coronavirus Grant Relief Business Information Form

Territories consisting of the Commonwealth of Puerto Rico the United States. Coronavirus Preparedness and Response Supplemental Appropriations Act 2020 PL.

Small Business Resiliency Fund Coronavirus

Small Business Resiliency Fund Coronavirus

In response to the coronavirus pandemic HHS is awarding emergency grants and cooperative agreements funded under the Coronavirus Aid Relief and Economic Security CARES Act 2020 PL.

Coronavirus grant relief business information form. Aug 10 2020 The governments coronavirus economic support includes paid sick leave an employee retention tax credit a tax deadline extension and many other forms of aid for individuals and businesses. In general all economic relief payments to for-profit nonincorporated businesses eg sole proprietors individuals partnerships etc should be reportable as taxable grants. Michigans small businesses impacted by the COVID-19 virus can now apply for grants and loans through the Michigan Small Business Relief Program the Michigan Economic Development Corporation announced today.

Where an applicant has reached its limit under the Small Amounts of Financial Assistance Allowance and COVID-19 Business Grant Allowance it may be able to access a further allowance of funding under these scheme rules of up to 9000000 per single economic actor provided the following conditions. Coronavirus Funding and Awards Data. COVID-19 Business Grant Special Allowance.

The Montana Business Stabilization Grant program will provide working capital for small businesses to support payroll rent accounts payable debt service and expenses related to shifts in operations in order to retain existing businesses retain current employees or retain business viability for future re-employment. Employee Retention Credit Available for Many Businesses Financially Impacted by COVID-19 The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees. This grant provides emergency assistance for eligible venues affected by COVID-19.

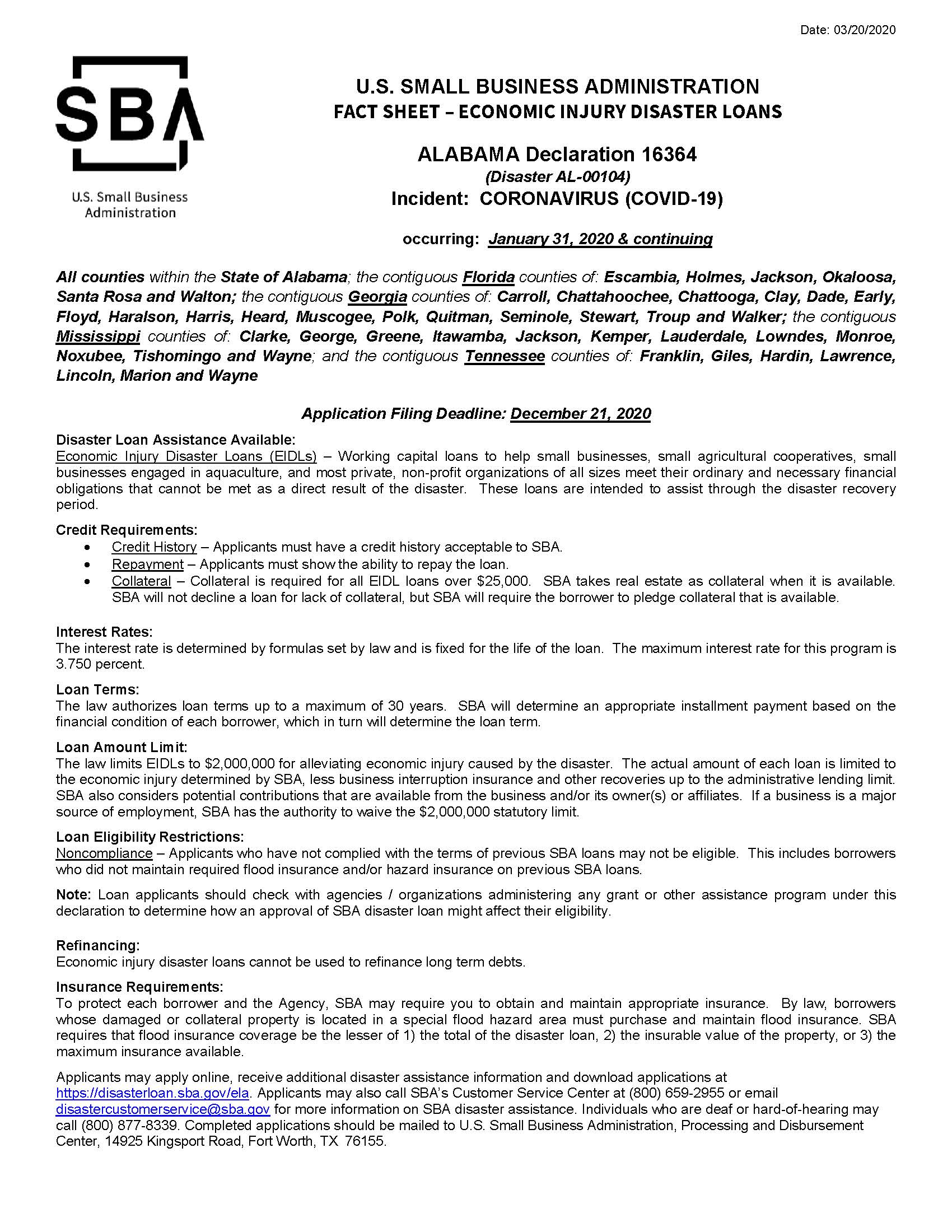

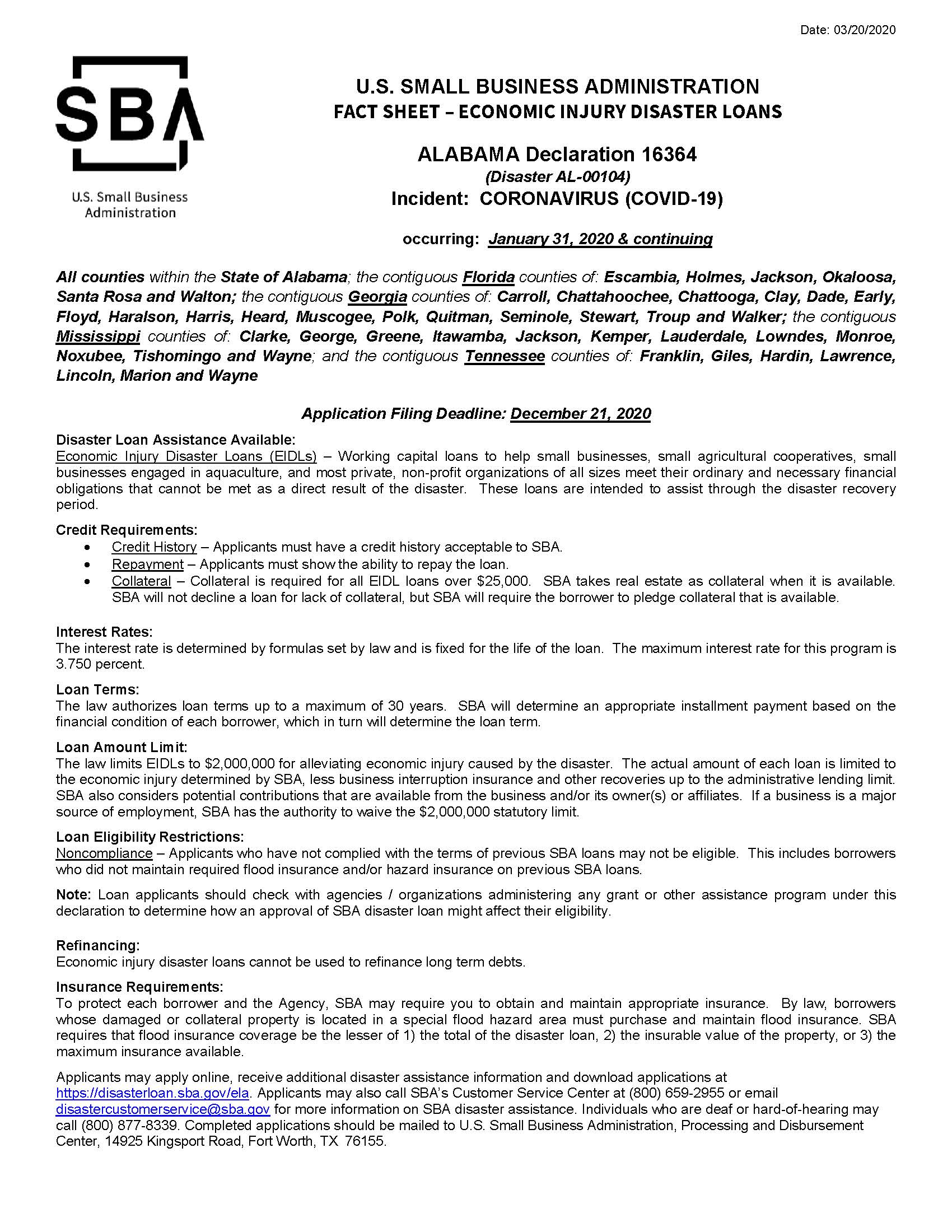

Wed like to set Google Analytics cookies to help us to improve our website by collecting and reporting information on how you use it. Commercial Landlord Hardship Fund. SBA Office of Disaster Assistance 1-800-659-2955 409 3rd St SW.

Specifically on February 24 2021 at 900 am. COVID-19 relief options. FEMA may provide funding to eligible applicants for costs related to emergency protective measures conducted as a result of the COVID-19 pandemicEmergency protective measures are activities conducted to address immediate threats to life public health and safety.

Australian Government coronavirus COVID-19 information and support for business. JobMaker Hiring Credit scheme The JobMaker Hiring Credit scheme is an incentive for businesses to employ additional young job seekers aged 1635 years. Find government coronavirus COVID-19 financial assistance and support for your business.

For more information on how these cookies work please see the List of cookies used on this website. Alabamas Coronavirus Relief Fund allocated 206996126 to the Revive Plus Program. Get information on coronavirus COVID-19 tax relief for businesses and tax-exempt entities.

Application Process Now Live for Michigan Small Business Relief Program Funding. Dec 18 2020 Remember Form 1099 reporting requirements vary based on the tax classification of the recipient so CRF recipients may need to issue Form 1099-G to some recipients but not to others. Apr 14 2020 Purpose.

Lost your job or income due to coronavirus COVID-19 No-interest loans scheme. 116-123 Families First Coronavirus Response Act. The cookies collect information in a way that does not directly identify anyone.

The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and appropriated 150 billion to the Fund. An SBA-backed loan that helps businesses keep their workforce employed during the COVID-19 crisis. On February 22 2021 President Biden announced the following changes to SBAs COVID-19 relief programs to ensure equity.

Eligible Applicants may submit funding requests to the Recipient and FEMA through the. Help with electricity gas and water bills. Under the law the Fund is to be used to make payments for specified uses to States and certain local governments.

This loan provides economic relief to small businesses and nonprofit organizations that are currently experiencing a temporary loss of revenue. The District of Columbia and US. As of February 22 2021 the Revive Plus Program has assisted 11216 small businesses and non-profit and faith based organizations with their Covid-19 related expenses.

COVID-19 Economic Injury Disaster Loan. The program will provide up to 20 million in grants and loans to provide economic assistance to Michigans small businesses that have been negatively impacted by the COVID-19. But as you manage your business dont forget about yourself and the possibility that youll receive a COVID-19 stimulus check.

ET SBA established a 14-day exclusive PPP loan application period for businesses and nonprofits with fewer than 20 employeesThis gave lenders and community partners more time to work with the smallest.

Beware Of Emerging Scams Cares Act Financial Scams And Fraud Targeting Small Businesses Snell Wilmer Jdsupra

Beware Of Emerging Scams Cares Act Financial Scams And Fraud Targeting Small Businesses Snell Wilmer Jdsupra

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Small Business Emergency Covid 19 Grants Lincoln County Oregon

Small Business Emergency Covid 19 Grants Lincoln County Oregon

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Https Coronavirus Nebraska Gov Assets Programfrequentlyaskedquestions Pdf

Chesapeake Small Business Covid 19 Recovery Grant Chesapeake Virginia Department Of Economic Development

Chesapeake Small Business Covid 19 Recovery Grant Chesapeake Virginia Department Of Economic Development

Emergency Funding For Small Business How To Qualify Funding Circle

Emergency Funding For Small Business How To Qualify Funding Circle

Washington County Resources Washington County Chamber Of Commerce Hagerstown Md

Washington County Resources Washington County Chamber Of Commerce Hagerstown Md

Small Business Financial Assistance The Chamber Of Commerce Of West Alabama

Small Business Financial Assistance The Chamber Of Commerce Of West Alabama

Small Business Administration Sba Loans Immediately Available To Child Care Providers First Five Years Fund

Small Business Administration Sba Loans Immediately Available To Child Care Providers First Five Years Fund

El Paso County Awards 13 858 527 In Grants To Local Small Businesses And Nonprofits El Paso County Colorado

El Paso County Awards 13 858 527 In Grants To Local Small Businesses And Nonprofits El Paso County Colorado

![]() Covid Relief Ppp And Eip Information Congressman Tim Walberg

Covid Relief Ppp And Eip Information Congressman Tim Walberg

List Of Arts Resources During The Covid 19 Outbreak Creative Capital

List Of Arts Resources During The Covid 19 Outbreak Creative Capital

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid 19 Relief Statewide Small Business Assistance Pa Department Of Community Economic Development

Covid 19 Relief Statewide Small Business Assistance Pa Department Of Community Economic Development

Coronavirus Business Resources

Businesses And Workers Impacted By Coronavirus The City Of Santa Ana

Businesses And Workers Impacted By Coronavirus The City Of Santa Ana

City Of Boca Raton Small Business Recovery Relief Grant Program Boca Raton Fl