Do Companies Get A 1099

By signing Form W-8BEN the foreign contractor is certifying that he or she is not a US. Additionally those whom you pay at least 10 in royalties or broker payments in lieu of.

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

This includes S-Corporations and C-Corporations.

Do companies get a 1099. Business owners have to file form 1099 as a record of payments they made to independent contractors over the course of the tax year. But not an LLC thats treated as an S-Corporation or C-Corporation. There is no need to send 1099-MISCs to corporations.

Most Forms 1099 arrive in late January or early February but a few companies issue the forms throughout the year when they issue checks. You do need to send 1099s to single-member limited liability company or LLCs or a one-person Ltd. Heres what you need to know about this important documentation for freelance workers.

While many business owners arent sure when to issue a 1099 form to an independent contractor doing so is an important part of tax compliance. They are amounts paid in other ways like in a lawsuit settlement agreement for example. This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs.

As long as the foreign contractor is not a US. You must file Form 1099-MISC for each person or business entity to whom you paid income made certain payments or. Do Construction Companies Get a 1099.

The exception to this rule is with paying attorneys. Use Form 1099-NEC to report payment of attorney fees for services. This payment would have been for services performed by a person or company who IS NOT the payors employee.

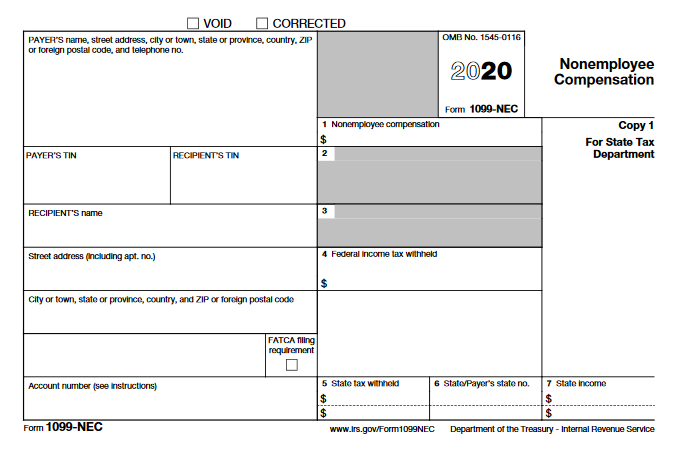

Generally if the organization pays at least 600 during the year to a non-employee for services including parts and materials performed in the course of the organizations business it must furnish a Form 1099-MISC Miscellaneous Income to that person by January 31 of the following year. A company must issue you a Form 1099-MISC to document the expenditure. If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business.

You made the payment to someone who is not your employee. You do not need to send 1099-MISCs to corporations. You will need to provide a 1099 to any vendor who is a.

Hence youre required to give your carries a 1099-MISC if you paid them more than 600 in a calendar year. If they fail to give you a 1099-MISC by the IRS deadline which is usually in mid to late February the company may face a 50. Businesses will now file Form 1099-NEC for each person in the course of the payors business to whom they paid at least 600 during the year.

Lets clarify everything so you can file your forms n1njah. Sole Proprietorships and Partnerships. If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099.

If a business buys or rents products or services that amount to more than 600 from one person or LLC during the year it has to file a 1099 for that contractor or vendor. Most corporations dont get 1099-MISCs Another important point to note. Due to the high level of administrative reporting for corporations the IRS exempts corporations from needing to receive a Form 1099-MISC.

Gross proceeds arent fees for an attorneys legal services. Internal Revenue Service IRS requires businesses to issue a Miscellaneous Income Form 1099-MISC return to the people and companiesincluding limited liability companies LLCsthey pay if the arrangement between the business and the service provider meets certain requirements Instructions for 1099-MISC. Construction companies operating as sole proprietorships and.

You may begin to receive these documents as a. A 1099 form is used to document wages paid to a freelance worker or independent contractor. Use Form 1099-MISC to report gross proceeds of 600 or more during the year including payments to corporations Box 10.

However a few exceptions exist that require a. Person and the services are wholly performed outside the US then no Form 1099 is required and no withholding is required. You should get a form W-8BEN signed by the foreign contractor.

The vendors or contractors will only receive the 1099-MISC once they reach the threshold amount in a calendar year. If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. 1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd.

Who Receives Form 1099-MISC Form 1099 goes out to independent contractors if you pay them 600 or more to do work for your company during the tax year. Instructions to Form 1099-NEC. If the following four conditions are met you must generally report a payment as nonemployee compensation.

Typically youll receive a 1099 because you earned some form of income from a non-employer source.

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose