Do I Need To Provide A 1099 To My Babysitter

As an individual you do not need to issue 1099-Misc to your babysitter However As an individual you need to issue W-2 only if you instruct the babysitter how the work is to be done and the total wages paid for the year are 2100 or more. Businesses send out a 1099-MISC when they pay a non-employee 600 or more over the course of a year.

Can I Pay My Nanny As A 1099 Tips For Household Employers

Can I Pay My Nanny As A 1099 Tips For Household Employers

If there are additional questions please reply to this answer so that I.

Do i need to provide a 1099 to my babysitter. In the eyes of the IRS this is tax evasion and can come with very heavy fines if youre caught via an audit or wage dispute filed by the sitter. Even if your babysitter could probably be seen as an independent contractor if you hit these payment thresholds you should be filing taxes and providing a W-2 regardless. 1099-Misc is only used to report certain payments made by a business.

Using 1099 Forms Send a 1099-MISC form in January if you pay 600 or more to any one child care provider during the calendar year using the nonemployee compensation box to report the amount you paid. Independent contractors are given a Form 1099 to handle their taxes. Since the snow shovelling and lawn mowing are services to you as an individual and not a business no 1099 is required.

A babysitter is considered a household workeremployee and if you paid 2100 or more in 201 9 you would have to withhold employment taxes since they would qualify as an employee unless they are under 18 then there are exceptions to this rule. The babysitters still must report their income to the IRS. Unless your babysitter takes care of your children in her own home and sets her own procedures she is not considered an independent contractor so you do not need to provide a W-9.

Thats only a requirement for businesses -- when you pay someone for services away from the office youre off the 1099 hook. The babysitters still must report their income to the IRS. She is self-employed as a caregiverbabysitternanny etc doing business as a sole proprietor.

Aside from tax forms managing a household employee is a year-round process because there are tax and payroll-related procedures to follow. If the babysitting was done in the babysitters home you should issue the 1099-MISC to the babysitter be sure to use the Form 1096 Transmittal and mail to the IRS address for your area. Instead you should give your babysitter a W-2 so they can file their personal income tax return.

Depending on how much you pay your housekeeper you may be required to pay and withhold Social Security taxes. This income is basically from self-employment so you dont have to issue Form 1099 if you pay a babysitter unless they earned 600 or more. This is because you arent paying the babysitter in the course of your trade or business.

If you have a household employee the babysitter worked in your home you may need. Only companies give out 1099 tax forms for services rendered in the course of trade or business. You do not need to send a 1099-MISC form if.

You will need a 1099-MISC for your babysitter and the IRS. However you dont need to issue a Form 1099-MISC or withhold taxes. No she is not a household employee.

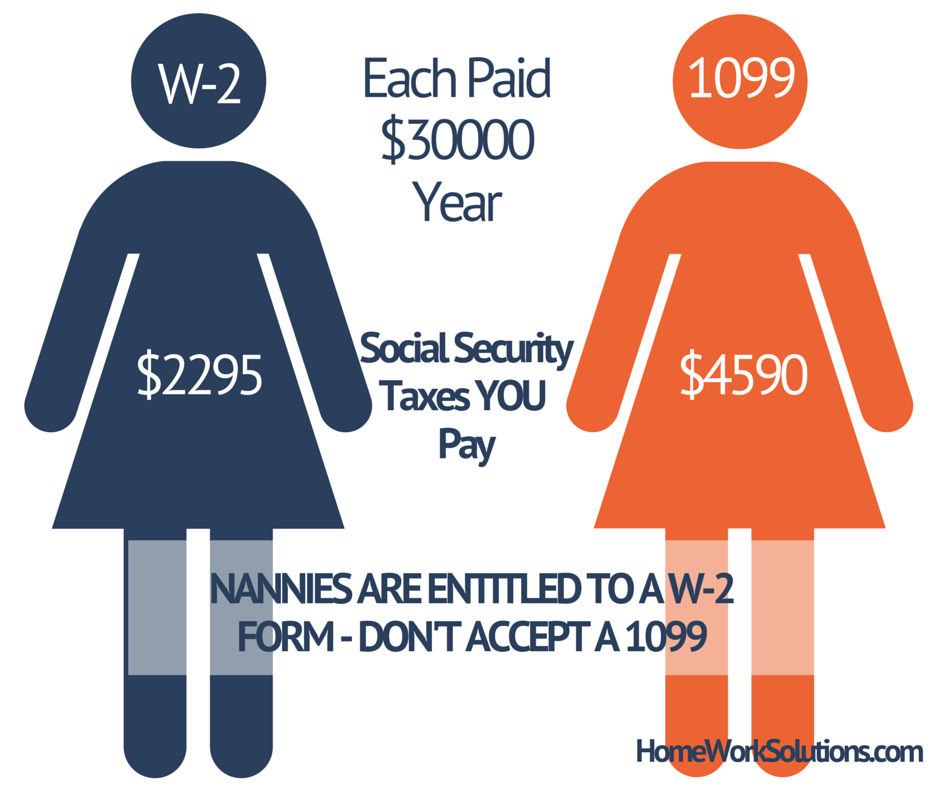

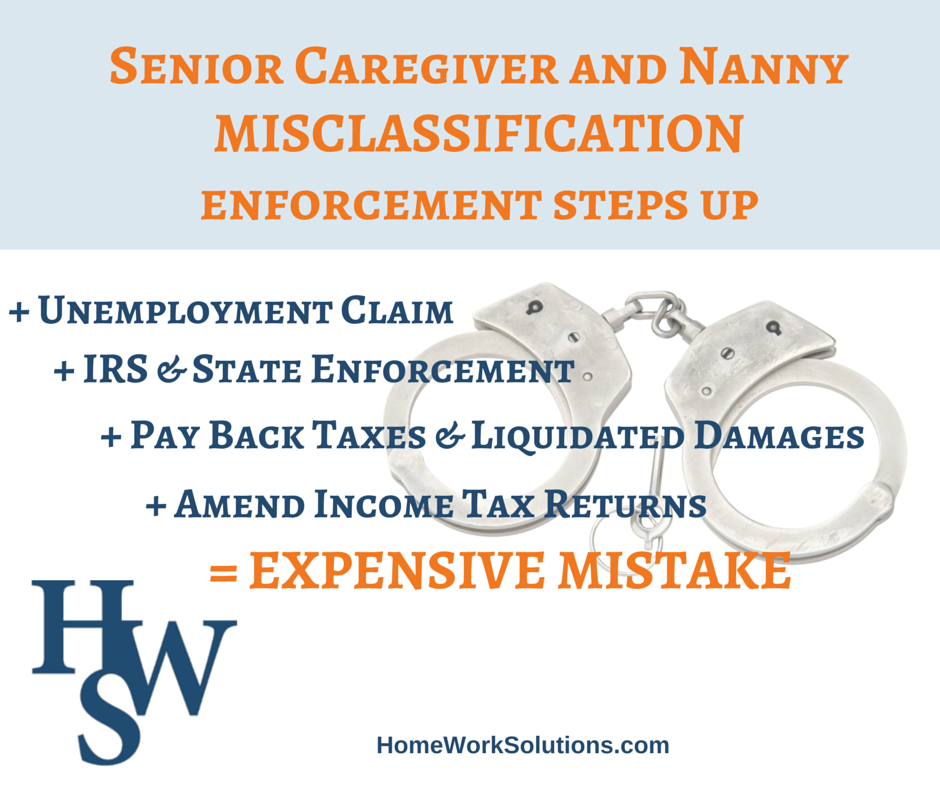

When you hire a nanny senior caregiver or other household employee you must give them a W-2 to file their personal income tax return. Remember the various Nannygate incidents some years ago. The IRS requires payers to submit 1099-MISC when they pay an independent contractor more than 600 in a calendar year.

It doesnt apply to personal payments. Instead she is a household employee and different tax laws and forms apply to the situation. No the taxpayer does not owe self-employment tax on amounts reported on the 1099-MISC she received from the insurance company if she is not engaged in a trade or business of providing care giving services as appears to be the case in this situation.

You do not need to issue a W-2 or a 1099-MISC Compensation form to her. No 1099s are only required for services provided in the course of business. There are exceptions of course.

If a babysitter or nanny is self-employed you dont have reporting or withholding requirements. If your mother babysits at her home then she is considered an independent contractor and you should issue her an IRS Form 1099-MISC at the end of the year totaling the amount she has received for babysitting. Even if a family writes into an employment contract that youre to handle taxes with a 1099 its still not legally correct unless you meet the guidelines of being an independent contractor says Breedlove.

There are different ways to report depending on if the work was done in your home or in the home of the babysitter. You will also need to fill out Form 1096 also available from this website as a coversheet for the 1099 that you will send to the IRS. If you provide Form 1099 to your babysitter during tax season youre misclassifying your employee.

If youre going to be paying your babysitter less than 1000 in any given quarter and less than 2100 in the year in 2019 you dont have to withhold taxes. Generally speaking because babysitting is a personal service rather than a business expense you do not have to give your babysitter a 1099 tax form. Hiring a babysitter for your kids doesnt require a 1099 form no matter much she charges.

W 2 Or 1099 For Babysitter A Simple Guide To Help You Decide The Usual Stuff

W 2 Or 1099 For Babysitter A Simple Guide To Help You Decide The Usual Stuff

Do I Need To Issue A 1099 To A Babysitter Or Nanny Amy Northard Cpa The Accountant For Creatives

Do I Need To Issue A 1099 To A Babysitter Or Nanny Amy Northard Cpa The Accountant For Creatives

Are Nannies Employees Or Business Owners Help For Nannies And Home Organizers Ohsosimply

Are Nannies Employees Or Business Owners Help For Nannies And Home Organizers Ohsosimply

Preparing For Taxes In Advance Makes Tax Season So Much Easier Notes Document Jackson School Tax Forms

Preparing For Taxes In Advance Makes Tax Season So Much Easier Notes Document Jackson School Tax Forms

What Every Family Needs In A Nanny Contract Care Com Homepay Nanny Contract Nanny Tax Daycare Costs

What Every Family Needs In A Nanny Contract Care Com Homepay Nanny Contract Nanny Tax Daycare Costs

How To File Nanny Taxes For Nannies Employers Benzinga

How To File Nanny Taxes For Nannies Employers Benzinga

Form 4852 Nannies Are Required To File Taxes Whether The Parents Provide Them With A W 2 Or Not If The Parents Do Parenting Plan How To Plan Parent Resources

Form 4852 Nannies Are Required To File Taxes Whether The Parents Provide Them With A W 2 Or Not If The Parents Do Parenting Plan How To Plan Parent Resources

Household Employment Blog Nanny Tax Information 1099 V W 2

Household Employment Blog Nanny Tax Information 1099 V W 2

8 Ways To Ensure Nanny Job Security Nanny Jobs Job Security Nanny

8 Ways To Ensure Nanny Job Security Nanny Jobs Job Security Nanny

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Household Employment Blog Nanny Tax Information 1099 V W 2

Household Employment Blog Nanny Tax Information 1099 V W 2

Do We Need To Give Our Babysitter A 1099 Tax Form 1099 Tax Form Tax Forms Babysitter

Do We Need To Give Our Babysitter A 1099 Tax Form 1099 Tax Form Tax Forms Babysitter

The Babysitter Checklist Schedule And Log Sheet Template Is Designed For Your Guidance Because You May Find It Diffi Babysitter Checklist Babysitter Checklist

The Babysitter Checklist Schedule And Log Sheet Template Is Designed For Your Guidance Because You May Find It Diffi Babysitter Checklist Babysitter Checklist

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg) Reporting 1099 Misc Box 3 Payments

Reporting 1099 Misc Box 3 Payments

How Does A Nanny File Taxes As An Independent Contractor

How Does A Nanny File Taxes As An Independent Contractor

Can I Deduct Nanny Expenses On My Tax Return Taxhub

Can I Deduct Nanny Expenses On My Tax Return Taxhub

Free Nanny Contract Free Nanny Daily Log Nanny Nanny Contract Nanny Agencies

Free Nanny Contract Free Nanny Daily Log Nanny Nanny Contract Nanny Agencies

Daycare Business Income And Expense Sheet To File Your Daycare Business Taxes Page 2 Daycare Business Plan Starting A Daycare Childcare Business

Daycare Business Income And Expense Sheet To File Your Daycare Business Taxes Page 2 Daycare Business Plan Starting A Daycare Childcare Business