Do I Need To Send A 1099 To A Nonprofit Corporation

Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation do not have to be reported on a 1099-Misc. This has the benefit of sidestepping the donors need to get a timely letter from the charity containing the magic words.

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

A non-profit is considered to be engaged in a business or trade.

Do i need to send a 1099 to a nonprofit corporation. You have to issue 1099s to corporations if you pay legal fees. If the business you paid is a C corporation or S Corporation then a 1099-NEC need not be issued unless you paid the business for medical or health care payments or attorney services. A 1099 form is used to report certain non-salary income to earners of that income and to the IRS for tax purposes.

They arent a sole proprietorship you dont send them a 1099. There are all kinds of different income categories and different form types under the 1099 umbrella. 1099-MISC only when payments are made in the course of your trade or business.

You are engaged in a trade or business if you operate for gain or profit. You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate. Do nonprofits need to do 1099s.

W9 is for business-to-business transactions where your organization may need to provide the vendor with a Form 1099 at the end of the year assuming total expenditures are greater than 600 for the year. Generally if the organization pays at least 600 during the year to a non-employee for services including parts and materials performed in the course of the organizations business it must furnish a Form 1099-MISC Miscellaneous Income to that person by January 31 of the following year. Exception to the general rule.

1099s are only sent to sole proprietorship. Additionally the IRS outlines some other specific circumstances where a 1099. Personal payments are not reportable.

If the charity does issue then it must also forward a copy of the 1099s to the IRS. Medical or Health care payments are reportable but non-employee compensation contractor payments are not reported. For most small nonprofit organizations its nonemployee compensation and the 1099-MISC form that we need to focus on.

You made the payment for services in the course of your nonprofit organization. You made the payment to someone who is not your employee. However nonprofit organizations are considered to be engaged in a trade or business and are subject to these reporting requirements.

Form W9 provides you with the vendors tax ID number which you would need to. 1099 Rules indicate that corporations are exempt from receiving 1099 statements EXCEPT for certain items which you must report on a 1099. 1099s need to be mailed by January 31 so dont wait.

You do not have to issue 1099s to corporations or to LLCs that have elected to be treated as a corporation with two major exceptions. Report on Form 1099-MISC only when payments are made in the course of your trade or business. Since nonprofit organizations are corporations a 1099-MISC will not be used.

See above and payments for medical or health care services see page 6 of the instructions. Under current law a non-profit is required to give a Form 1099-MISC to any independent contractor who provides services and is paid 600 or greater in a calendar year ie. Personalpayments are not reportable.

A professional corporation except for law firms. Charities can continue sending letters and disregard this proposal. Form 1099-MISC Your company must file Form 1099-MISC with the IRS for any non-corporate nonprofits to which your company paid 600 or more in.

Non profits are usually set up as corporations. You do not need to send a Form 1099-MISC to. A limited liability company that has elected to be taxed as a C corporation.

Youll know that youll need to issue a form 1099 when the following four conditions are met. Who are considered Vendors or Sub-Contractors. From IRSs 1099-Misc instructions.

You are engaged in a trade or business if you operate for gain or profit. The following payments made to corporations generally must be reported on Form 1099-MISC. Nonprofits must file 1099s just like any other organization.

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Who Are Independent Contractors And How Can I Get 1099s For Free

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Federal Form 1099 Misc Deadline Irs Forms Irs 1099 Tax Form

Federal Form 1099 Misc Deadline Irs Forms Irs 1099 Tax Form

Do Brokers Need To Issue A 1099 For Commission Paid To A Llc Berkshirerealtors

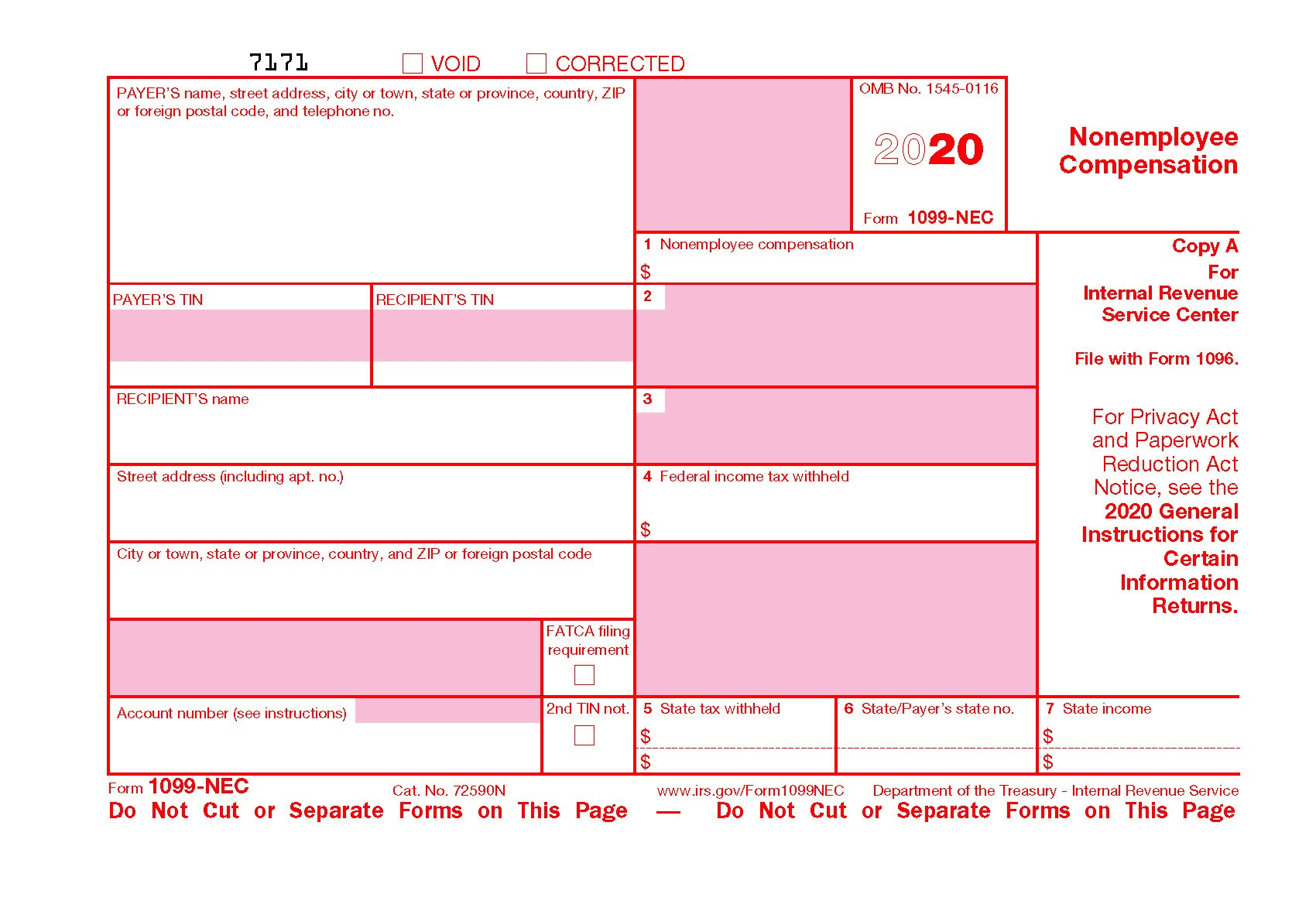

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Make Sure You Have A W 9 For Each Recipient In 2020 Irs Forms 1099 Tax Form Tax Forms

Make Sure You Have A W 9 For Each Recipient In 2020 Irs Forms 1099 Tax Form Tax Forms

1099 Reporting Requirements For Small Business Clients Mrcpa Net

1099 Reporting Requirements For Small Business Clients Mrcpa Net

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Do You Need To Send 1099s From Your Nonprofit Tiny Opera House

Do You Need To Send 1099s From Your Nonprofit Tiny Opera House

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager