Nj Form Reg-1e

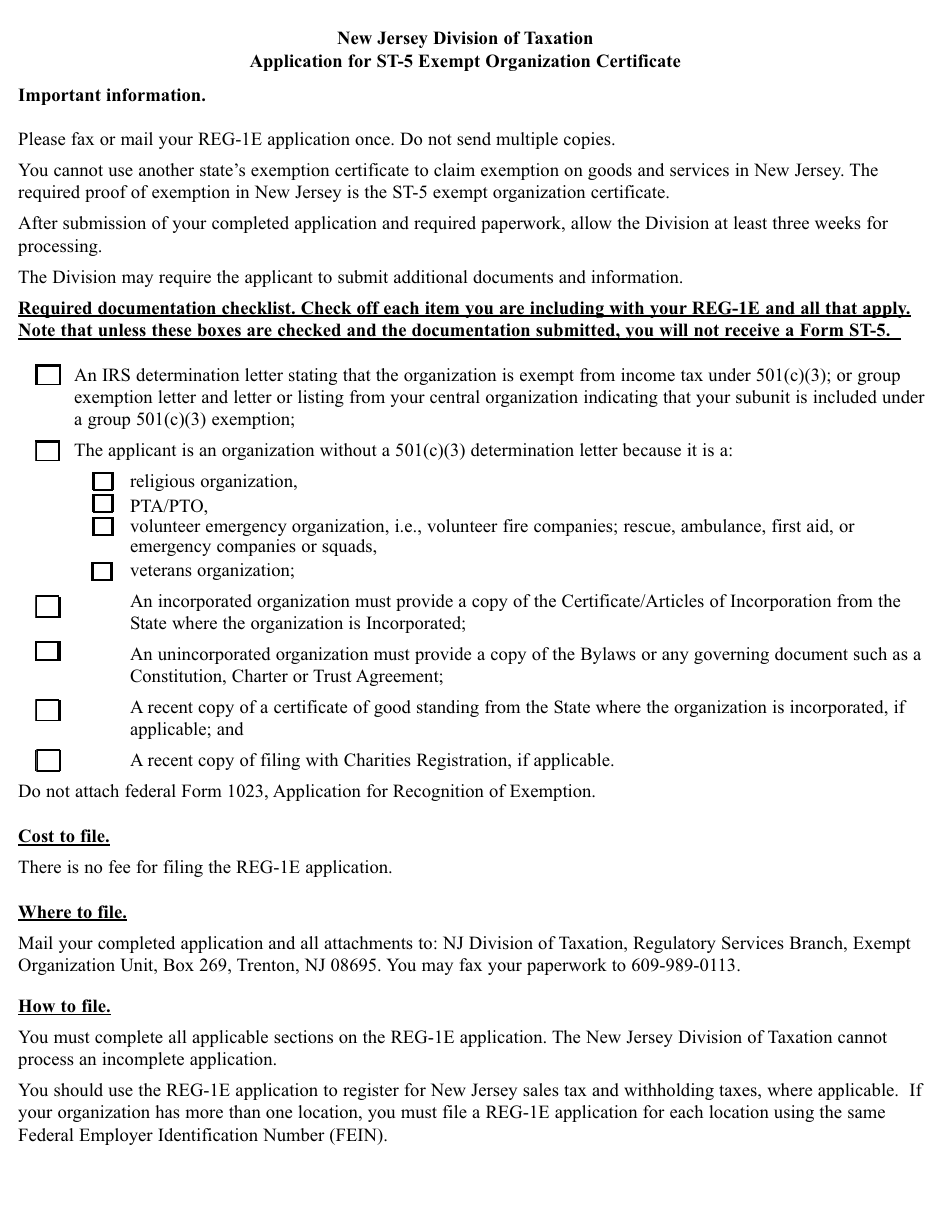

Sales Tax Exemption Application URS Charitable Registration if applicable New Jersey Charitable Registration Form CRI-200 or Form CRI-300R depending on gross contributions. He REG-1E within 6 months of formation in New Jersey.

Form Reg 1e Fillable Application For Exempt Organization Certificate

Once you finish each section it will be marked with a.

Nj form reg-1e. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Fill out securely sign print or email your reg 1e application 2006 form instantly with signNow. To Obtain New Jersey Sales and Use Tax Exemptions.

If however your organization has a business operation you should review the Taxes section of the NJ REG. If your organization has more than one location you must file a REG-1E application for each location using the same Federal Employer Identification Number FEIN. Submit Form REG-1E Application for ST-5 Exempt Organization Certificate along with Bylaws Certificate of Incorporation and IRS 501c3 determination letter to.

31 2017 Sales and Use Tax. The REG-1E form also serves as a tax registration form. File Application for ST-5 Exempt Organization Certificate Form REG-1E together with.

If we file an REG-1E application form do we also need to file the NJ-REG Business Registration form. New Jersey Division of Taxation Regulatory Services Branch PO Box 269 Trenton NJ 08695-0269. Who should file this form.

HOW TO OBTAIN NEW JERSEY STATES SALES AND USE TAX EXEMPTIONS. New Jersey Division of Taxation Regulatory Services Branch PO. Claim for Refund of Paid Audit Assessment.

Form 990 Form 990EZ Form 990-N Form 990PF and Form 990-T. You should use the REG-1E application to register for New Jersey sales tax and withholding taxes where applicable. 1 2017 Sales and Use Tax.

A Brief Outline of the IncorporationTax Exemption Process. A 501c3 organization will register using Form REG-1E. Articles of Incorporation Bylaws and 501c 3 Determination Letter.

Start a free trial now to save yourself time and money. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Use Tax Prior Year Form for purchases made on or after Jan.

See answer to 3 above. If you are registering a partnership or proprietorship you must provide either your SSN or EIN. Nj Reg 3 2011 Fillable Form.

Which one is required of any particular organization depends upon a number of factors the most significant of which is the amount of annual gross revenue received by the organization. Please note that a 501c3 organization should not use this online service to register. The REG-1E form also serves as a tax registration form.

You should use the Online Formations form instead if. Available for PC iOS and Android. If however your organization has a business operation you should review the Taxes section of the NJ REG.

Form REG-1E also serves as a tax registration form. Please use the navigation to the left to complete your Registration filing. Box 269 Trenton NJ 08695-0269.

Available for PC iOS and Android. There are 5 different versions of Form 990. There is no filing fee.

NEW JERSEY DIVISION OF TAXATION APPLICATION FOR ST-5 EXEMPT ORGANIZATION CERTIFICATE - FOR NONPROFIT EXEMPTION FROM SALES TAX - Read Instructions Before Completing This Form REG-1E 12-11 MAIL TO. The Division will keep your REG-1E on file for one year and then process it once you. You want to start a new business in the state of NJ LLC PA DP Non-Profit etc You need to authorize a legal entity in NJ for your business in another state.

If however your organization has a business operation you should review the Taxes section of the NJ-REG package to be apprised of the possible tax liabilities. 54A1-1 et seq Personal income tax is imposed on the New Jersey taxable income of. REG-3 11-06 NEW JERSEY GROSS INCOME TAXNJSA.

This form is for 501c3 organizations formed and operated for religious charitable scientific literary educational prevention of animal cruelty purposes and veterans volunteer. Imposed by the State of New Jersey and administered by the Division of Taxation and the Division of Revenue which a new business may be responsible for collecting and paying. Fill out securely sign print or email your nj reg 2011-2020 form instantly with SignNow.

609 989-0113 OFFICIAL USE ONLY DLN. Use Tax Prior Year Form for purchases made before Jan. This number will serve as your business tax ID in New Jersey.

NJ Division of Taxation Regulatory Services Branch PO Box 269 Trenton NJ 08695-0269 Fax. To incorporate your organization as a non-profit in New Jersey you must file a Certificate of Incorporation with the NJ Department of the Treasury Division of RevenueYou can expect to pay 115 for this which includes the filing fee expedited service to speed up the turnaround time for filing your Certificate and the return of. You may request a refund of NJ sales tax with form A-3730 on purchases delivered after the ST-5 effective date which usually is the date the Division received your REG-1E.

You can apply for New Jersey sales tax exemption before you receive an IRS 501c3 determination letter by submitting your REG-1E application upon formation of your organization. 1 2017 through Dec.

Nj Reg 1e 2006 Fill Out Tax Template Online Us Legal Forms

2016 2021 Form Nj Reg 1e Fill Online Printable Fillable Blank Pdffiller

2016 2021 Form Nj Reg 1e Fill Online Printable Fillable Blank Pdffiller

Form Reg 1e Multi Fillable Uniform Sales Use Tax Certificate Multijurisdiction

Caught Being Good Family History Caught Being Good Being Good

Clay Crabs Clay Art Projects Clay Projects Clay Art

Form Reg 1e Multi Fillable Uniform Sales Use Tax Certificate Multijurisdiction

Category Tattoo Tattoos For Women Flowers Dragon Tattoo Foot Foot Tattoos

Form Reg 1e Download Fillable Pdf Or Fill Online Application For St 5 Exempt Organization Certificate For Nonprofit Exemption From Sales Tax New Jersey Templateroller

Https Eformrs Com Forms09 States09 Nj Njreg1e Pdf

Form Reg 1e Download Fillable Pdf Or Fill Online Application For St 5 Exempt Organization Certificate For Nonprofit Exemption From Sales Tax New Jersey Templateroller

Unique Vintage Indiana Heirloom Red Carnival Hob Star Swing Etsy Colored Vases Unique Vintage Vase

3 11 12 Exempt Organization Returns Internal Revenue Service

2016 2021 Form Nj Reg 1e Fill Online Printable Fillable Blank Pdffiller

2016 2021 Form Nj Reg 1e Fill Online Printable Fillable Blank Pdffiller

Form Reg 1e Download Fillable Pdf Or Fill Online Application For St 5 Exempt Organization Certificate For Nonprofit Exemption From Sales Tax New Jersey Templateroller

Form Reg 1e Multi Fillable Uniform Sales Use Tax Certificate Multijurisdiction

Http Www Zillionforms Com 2013 F638403752 Pdf