Can A Sole Proprietor Get A Resale Certificate

Tax Jar blog post. You avoid that by obtaining a business license and resellers certificate in your home state and that only entitles you to not pay sales tax on items you buy specifically for resale.

Do You Understand The 1099 Misc Ageras Irs Taxes Irs Tax Forms Tax Tricks

Do You Understand The 1099 Misc Ageras Irs Taxes Irs Tax Forms Tax Tricks

The sellers permit includes a resale certificate that you will fill out sign and fax or email to the wholesaler so you can prove to the wholesaler that you have a sellers permit ID number.

Can a sole proprietor get a resale certificate. The best thing to do is turn to your local tax office or your lawyer. A copy of the certificate must be provided to the retailer. The permit is obtained from a government office at either the state or local level where the.

Items for your own use paper ink office equipment are still taxable. A certificate of incorporation applies only to a corporation. You need to collect sales tax for every state where you have a nexus.

A sole proprietor can be a self-employed individual or an independent contractor. For more information regarding valid Certificates of Resale. A sole proprietorship is a business run by an executive owner.

Yes for sole proprietorship if you sell merchandise crafts you need a sales tax ID also called a sellers permit. If the vendor doesnt accept the certificate the buyer will have to pay sales tax on the merchandise being purchased. Choose a business name.

If so should the SS-4 be filed under the individual or business name. The owner does business in their own name or with a trade name A business certificate is needed only if a trade name is used. As mentioned previously the laws vary from state to state.

If youre a US-based seller you dont need to pay sales tax out of your own pocket for the products youre reselling to others. Obtain an Employer Identification Number. Form ST-120 Resale Certificate is a sales tax exemption certificate.

This certificate is only for use by a purchaser who. Sole proprietorships would register their companys business name via a fictitious name or Doing Business As or dba filing with the State Corporation Commission. Certificates of Resale should be updated at least every three years.

A sole proprietorship is not a separate legal entity - it is merely an individual conducting business - thus there is no formation document. By rule you need a resale certificate for every case where you need to collect sales tax. Sellers are not required to accept resale certificates however most do.

In general a sole proprietor must obtain a permit to buy or sell product whether retail or wholesale. File an assumed name certificate with county clerks office. Can a sole proprietor obtain a resale license.

A is registered as a New York State sales tax vendor and has a valid Certificate of Authority issued by the Tax Department and is making purchases of tangible personal property other than motor fuel or. You can create an LLC partnership or corporation with the State Corporation Commission to use your business name is throughout the Commonwealth. The seller did not fraudulently fail to collect or remit the tax or both.

The owner is liable for all business operations. Sole Proprietor A sole proprietorship is a business that has only one owner and is not incorporated or registered with the state as a limited liability company LLC. The resale certificate presented to the seller by the purchaser contains all the information required by the Department and has been fully and properly completed.

Obtain licenses permits and zoning clearance. In the startup of a new online business Etsy for example with the intent to purchase goods many of which will be modified and resold. No a sole proprietorship does not need a certificate of incorporation.

The seller did not solicit a purchaser to participate in an unlawful claim that a sale was for resale. In most cases they will be able to get a credit for the sales taxes paid later on their sales tax filing. All information is kept secure and confidential.

There are four simple steps you should take. Im guessing your answer is a big fat Nope No one does which is why if youre going to get into the retail business you need a resellers permit also called a resale license resellers license resale certificate or resellers certificate sales tax permit or sales tax ID. STSP is here to get you the necessary certificates.

Of course as a salon business you need a DBA LLC or corporation as well as a. Purchasers may either document their tax-exempt purchases by completing Form CRT-61 Certificate of Resale or by making their own certificate. In Michigan you can establish a sole proprietorship without filing any legal documents with the Michigan state government.

We can process your application for any state and our expert team members will help you get the exact resale certificates and sellers permits you need. Sole proprietors self-employed individuals report all business income and expenses on their.

One Of The Most Common Questions I Get From Entrepreneurs Is How They Should Initially Set Up Their Bu Business Tax Deductions Sole Proprietorship Llc Business

One Of The Most Common Questions I Get From Entrepreneurs Is How They Should Initially Set Up Their Bu Business Tax Deductions Sole Proprietorship Llc Business

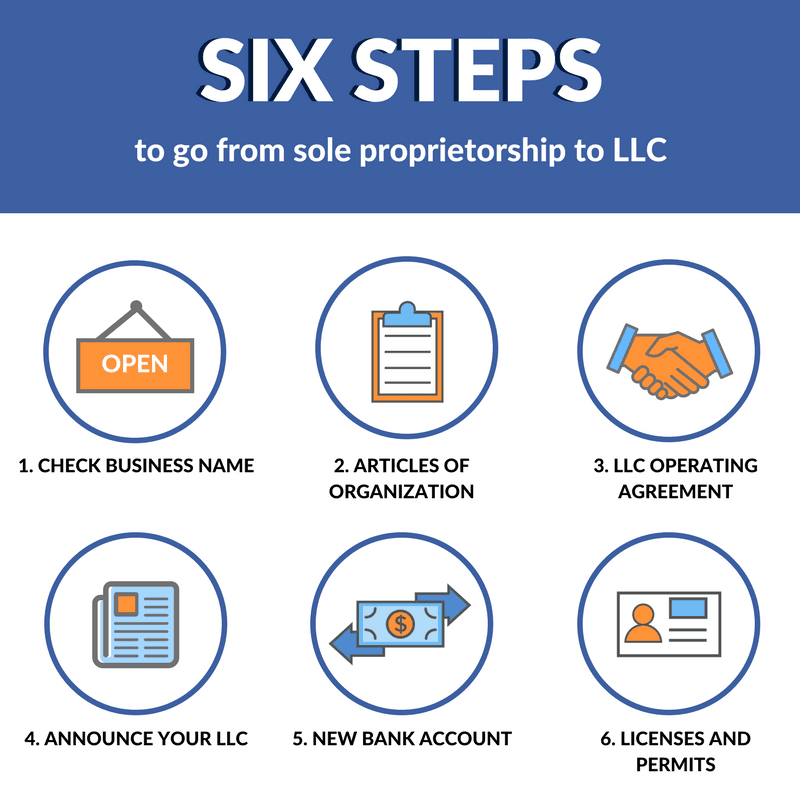

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

Get A Resellers Permit In Utah Utah Resell Permit

Get A Resellers Permit In Utah Utah Resell Permit

Https Business Oksbdc Org Documentmaster Aspx Doc 1866

Business Entity Comparison Chart S Corporation Sole Proprietorship General Partnership

Business Entity Comparison Chart S Corporation Sole Proprietorship General Partnership

Register Nevada Sales Tax Nv Reseller Pertmit Nevada Permit Sales Tax

Register Nevada Sales Tax Nv Reseller Pertmit Nevada Permit Sales Tax

Apply For Sellers Permit Or Resale Tax License 89 Permit Seller How To Apply

Apply For Sellers Permit Or Resale Tax License 89 Permit Seller How To Apply

Ventura County Seller S Permits Ca Business License Filing Quick And Easy

Ventura County Seller S Permits Ca Business License Filing Quick And Easy

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

Partners Certificate Template Fictitious Or Assumed Name Free Fillable Pdf Forms Certificate Templates Names Templates

Partners Certificate Template Fictitious Or Assumed Name Free Fillable Pdf Forms Certificate Templates Names Templates

What Is A Sole Proprietorship Steps To Starting A Business

What Is A Sole Proprietorship Steps To Starting A Business

How To Get A Resale Number 8 Steps With Pictures Wikihow

How To Get A Resale Number 8 Steps With Pictures Wikihow

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

Get Our Example Of Sole Proprietor Profit And Loss Statement Template For Free Profit And Loss Statement Statement Template Sole Proprietor

Get Our Example Of Sole Proprietor Profit And Loss Statement Template For Free Profit And Loss Statement Statement Template Sole Proprietor

How To Get A Sales Tax Certificate Of Exemption In Virginia Startingyourbusiness Com

How To Get A Sales Tax Certificate Of Exemption In Virginia Startingyourbusiness Com

Look Into Our Dealer Program From Strongpoles Toll Free 844 669 3537 Or Strongpoles Com Company Names Zip Code Sheet Music

Look Into Our Dealer Program From Strongpoles Toll Free 844 669 3537 Or Strongpoles Com Company Names Zip Code Sheet Music

What Is A Certificate Of Good Standing How Do I Get One Ask Gusto

What Is A Certificate Of Good Standing How Do I Get One Ask Gusto

How To Change From A Sole Proprietor To An Llc

How To Change From A Sole Proprietor To An Llc

A Seller S Permit Allows A State To Identify A Business As A Collector Of Sales Tax Some States May Call Thi Creative Education Black Girl Art Sole Proprietor

A Seller S Permit Allows A State To Identify A Business As A Collector Of Sales Tax Some States May Call Thi Creative Education Black Girl Art Sole Proprietor