Can You Sell A Sole Proprietorship In Canada

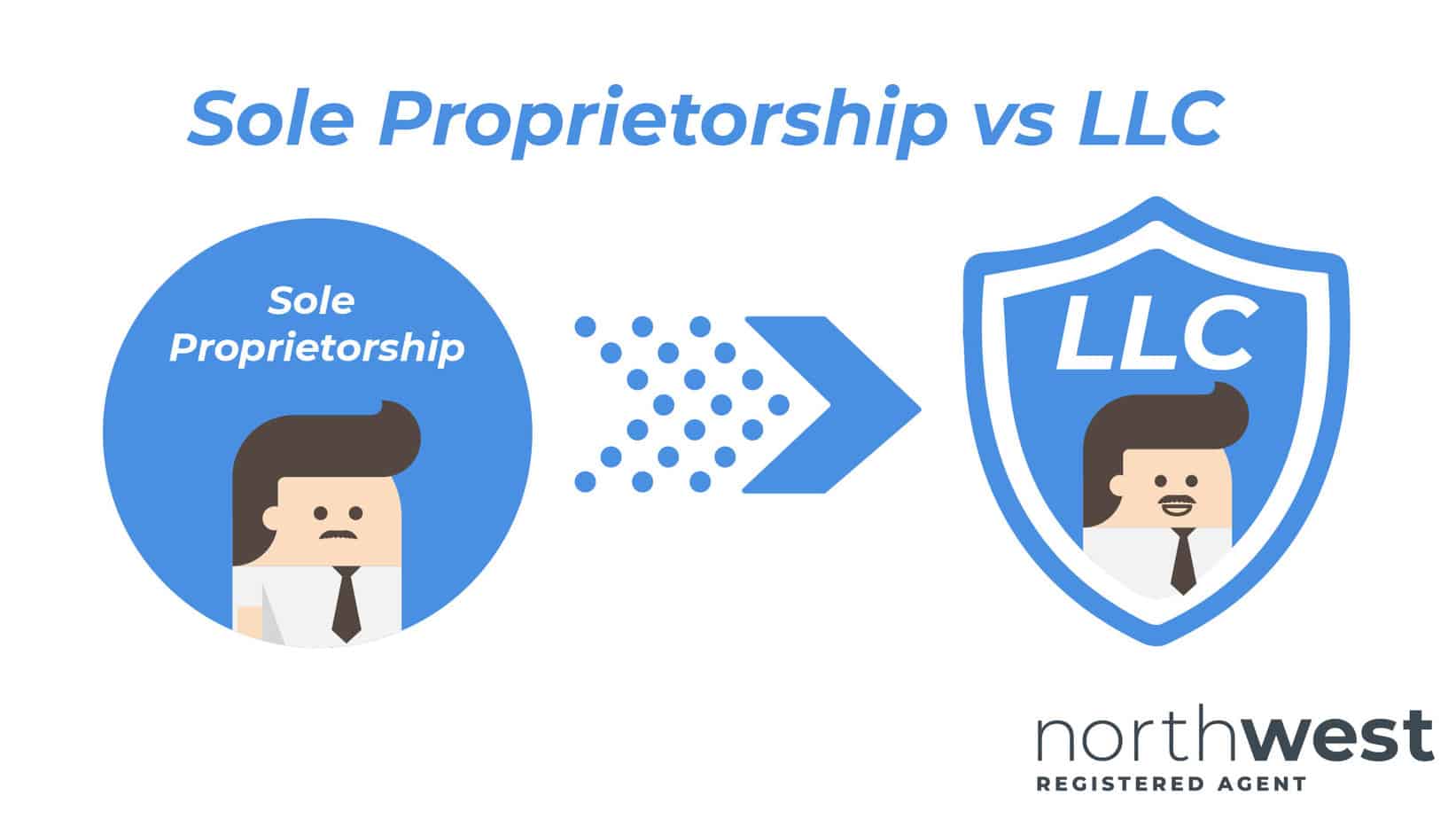

What Can a Sole Proprietorship Sell or Transfer. Because a sole proprietorship only consists of one person and does not have its own separate identity you cannot simply sell or transfer the business itself as you can when you dissolve a limited liability company LLC.

Sole Proprietor Resume Samples Qwikresume

Sole Proprietor Resume Samples Qwikresume

The owner of a sole proprietorship has sole responsibility for making decisions receives all the profits claims all losses and does not have separate legal status from the business.

Can you sell a sole proprietorship in canada. To learn more about sole proprietorships and corporations in Ontario and which ones right for you keep reading. As a sole proprietor you are not eligible for the lifetime capital gains exemption CGE. You do not have to take any formal action to form a sole proprietorship.

If you have to pay your sole proprietorship taxes through quarterly payments the quarterly due dates are March 15 June 15 September 15 and December 15. You must start charging GSTHST on your date of registration and unfortunately that includes collecting GSTHST on the sale that pushed you over the 30000 threshold. You are not a small supplier see below.

As the sole owner you can choose to use a less formal process if you are selling the business to someone you know such as a family member or an. The CGE is only available on the sale of the shares of a Canadian Controlled Private Corporation CCPC. As the sale of a sole proprietorship is a taxable event it would be advantageous to include your accountant in negotiations from the onset.

If your income is from a property go to rental income. Once the assets have been transferred the selling of the sole proprietorship is a relatively quick and easy process. If you are a freelance writer for example you are a sole proprietor.

If you are a small supplier. However because you personally own its assets you can sell these to another person or entity. If you are a sole proprietor you also assume all the risks of the business.

As a sole proprietor you should be required to register for the GSTHST if. Just like the filing deadline if the actual date falls on a weekend or holiday your payment is due the next business day. There is information for sole proprietorships or partnerships involved in unique types of business operations.

If you managed to exceed that 30000 threshold in a single calendar quarter on the day you surpassed that threshold is your effective date of registration. As long as you are the only owner this status automatically comes from your business activities. Other requirements related to starting a sole proprietorship in Canada Foreign entrepreneurs can start sole proprietorships in Canada as long as they rely on their valid residence permits.

There is no set way to sell a sole proprietorship. For example you would need to collect GSTHST on your Canadian sales if your business revenue exceeded 30000 CAD in the last four consecutive quarters regardless if you operate a sole proprietorship corporation or a partnership. Go to farmers and fishers or daycare in your home if your business involves these activities.

A sole proprietorship cannot be transferred to another party. Since a sole proprietorship represents the owner of the business you cannot actually transfer a sole proprietorship to someone else. Sole proprietorships and corporations are the most popular forms of business organizations.

Sole Proprietorships in Ontario. The new business owner must have his own separate legal business structure in order to receive the assets. Also once the sole trader is registered it is also required to purchase liability insurance depending on the field in which the business operates.

In fact you may already own one without knowing it. For income tax purposes you have to transfer personal property to a sole proprietorship at its fair market value FMV. Starting a sole proprietorship in Ontario is the easiest business structure to organize.

A proper valuation of the assets that are being sold will help provide a basis for allocation within the sales price. However it may able to have its assets transferred to a new owner. All the legal obligations and debts that youve undertaken throughout the operation of the business will remain with you and cannot be transferred to someone else.

The CGE as the name suggests exempts up to 800000 of profit ie. The FMV of the assets is the opening undepreciated capital cost UCC. Capital gain on the sale of shares of a CCPC.

You are considered a small supplier if you do not exceed the 30000 in taxable supplies over four consecutive calendar quarters. You provide taxable sales leases or other supplies in Canada unless the only taxable supplies are of real property sold other than in the course of a business. As a sole proprietorship you may be required to register for the goods and services taxharmonized sales tax GSTHST if you provide taxable supplies in Canada.

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

Sole Proprietorship What Is A Proprietorship

Sole Proprietorship What Is A Proprietorship

Business Taxes Llc Vs Sole Proprietorship

Business Taxes Llc Vs Sole Proprietorship

Q A When Do I Start Selling In 2020 Canada Cosmetics Clay Soap Soapmaking

Q A When Do I Start Selling In 2020 Canada Cosmetics Clay Soap Soapmaking

A Sole Proprietorship Also Known As The Sole Trader Or Simply A Proprietorship Is A Type Of Business Entity That Is Sole Proprietorship Sole Trader Business

A Sole Proprietorship Also Known As The Sole Trader Or Simply A Proprietorship Is A Type Of Business Entity That Is Sole Proprietorship Sole Trader Business

Should I Incorporate Or Run As A Sole Proprietor As A Canadian Amazon Seller Youtube

Should I Incorporate Or Run As A Sole Proprietor As A Canadian Amazon Seller Youtube

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Business Startups Should I Do Business As A Sole Proprietor Or Form An Llc Toews Digital Sole Proprietor Making A Business Plan Business

Business Startups Should I Do Business As A Sole Proprietor Or Form An Llc Toews Digital Sole Proprietor Making A Business Plan Business

Sole Proprietorship What Is A Proprietorship Sole Proprietorship Sole Farm Business

Sole Proprietorship What Is A Proprietorship Sole Proprietorship Sole Farm Business

Can I Be A Single Person Corporation Ownr Unique Business Names Single Person Person

Can I Be A Single Person Corporation Ownr Unique Business Names Single Person Person

Laws For Selling Handmade Made Urban Sell Handmade Things To Sell Handmade Business

Laws For Selling Handmade Made Urban Sell Handmade Things To Sell Handmade Business

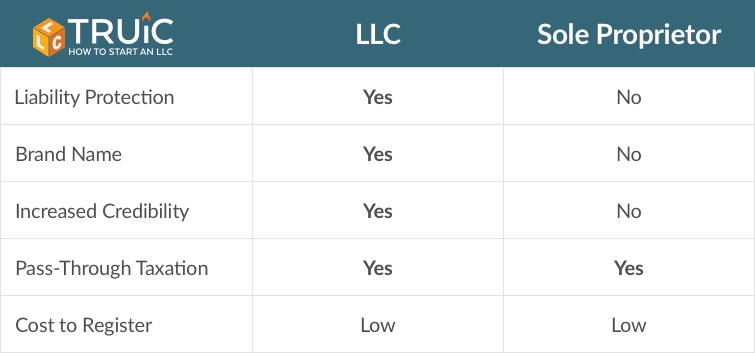

Forms Of Business Ownership Sole Proprietorships Partnerships

Forms Of Business Ownership Sole Proprietorships Partnerships

Isc Sole Proprietorship Sole Proprietorship Sole

Isc Sole Proprietorship Sole Proprietorship Sole

Exit Plan Guide To Selling Closing Or Leaving Your Business Quickbooks Canada Small Business Start Up How To Plan Exit Strategy

Exit Plan Guide To Selling Closing Or Leaving Your Business Quickbooks Canada Small Business Start Up How To Plan Exit Strategy

How To Protect Your Personal Assets A Business Lawsuit

How To Protect Your Personal Assets A Business Lawsuit

Sole Proprietorship Small Business Start Up Kit Sitarz Daniel 9781892949592 Amazon Com Books

Sole Proprietorship Small Business Start Up Kit Sitarz Daniel 9781892949592 Amazon Com Books

Why You Should Turn Your Sole Proprietorship Into An Llc

Why You Should Turn Your Sole Proprietorship Into An Llc

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business