Explain What Separate Legal Entity Means

It is a business that can enter into contracts either as a vendor or a supplier and can sue or be sued in a court of law. They can enter contracts.

Chapter 7 Corporations And Legal Personality

Chapter 7 Corporations And Legal Personality

In terms of day-to-day business a separate entity runs separately from the owner with a separate bank account and transactions buying and selling products or services or both and receiving and paying out its own money.

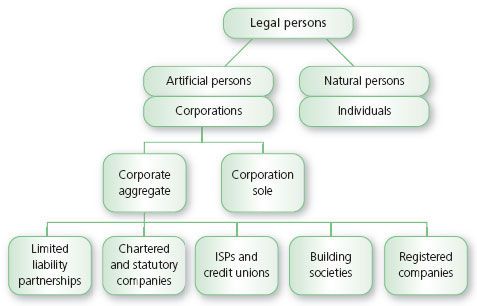

Explain what separate legal entity means. A corporation is a legal entity that is separate and distinct from its owners. Like a corporation a limited liability company or LLC is a separate and distinct legal entity. The entity has its own legal rights and obligations separate to those running andor owning the entity.

Or Operate under a joint venture agreement without creating a separate legal entity. Each entity in the joint venture which could be individuals groups of individuals companies or corporations keeps its separate legal status. Section 1241 of the Corporate Act 2001 says a company has the legal capacity and powers of an individual both in and outside this jurisdiction.

If a business is a separate legal entity it means it has some of the same rights in law as a person. This means that an LLC can obtain a tax identification number open a bank account and do business all under its own name. The separate entity concept states that we should always separately record the transactions of a business and its owners.

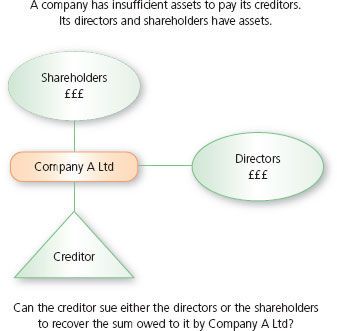

The primary advantage of an LLC is that its owners known as members have limited liability meaning that under most circumstances they are not personally liable for. What is a Separate Entity. Usually a corporation is treated as a separate legal person which is solely responsible for the debts it incurs and the sole beneficiary of the credit it is owed.

A separate entity is a business that is separate legally and financially from its owner or owners. This is usually done by forming a limited liability company or a corporation so that the companys actions may be legally declared as separate from those of an individual person the companys shareholders or another company. Common law countries usually uphold this principle of separate personhood but in exceptional situations may pierce or lift the corporate veil.

A separate legal entity is a person recognised by law - a legal person. In New Zealand a company is a separate legal entity from its owners. The Separate Legal Entity Concept Law Company Business Partnership Essay.

That person could be a company limited liability partnership or any other entity recognised by law as having its own separate legal existence. A legal entity is any company or organization that has legal rights and responsibilities including tax filings. Separate legal entity means any entity created by interlocal agreement the membership of which is limited to two or more special districts municipalities or counties of the state but which entity is legally separate and apart from any of its member governments.

According to this principle the company is treated as an entity separate from its members. This means that most of the legal entity in business is separate from another business or individual with value to accountability. Form a separate legal entity for the joint venture such as a corporation or limited liability company LLC with each party having an ownership stake in the new entity.

The Principle of Separate Legal Existence is a fundamental principle in the field of company law. A joint venture may be set up by a contract that outlines the resources such as money properties. It is for example able to enter contracts.

1 Corporations enjoy most of the rights and responsibilities that individuals possess. A company is a separate legal entity as distinct from its members therefore it is separate at law from its shareholders directors promoters etc and as such is conferred with rights and is subject to certain duties and obligations. A separate legal entity may be set up in the case of a corporation or a limited liability company to separate the actions of the entity from those of the individual or other company.

The concept is most critical in regard to a sole proprietorship since this is the situation in which the affairs of the owner and the business are most likely to be intermingled. One reason why businesses create. Functions of Separate Legal Existence In order to create a company the promoters of the company must produce certain documents to the registrar of companies.

Chapter 7 Corporations And Legal Personality

Chapter 7 Corporations And Legal Personality

The Company As A Distinct And Legal Person

The Company As A Distinct And Legal Person

Nature Of Financial Management Financial Management Finance Function Financial

Nature Of Financial Management Financial Management Finance Function Financial

Chapter 7 Corporations And Legal Personality

Chapter 7 Corporations And Legal Personality

Company Law Nature Of Legal Personality Youtube

Company Law Nature Of Legal Personality Youtube

The Company As A Distinct And Legal Person

The Company As A Distinct And Legal Person

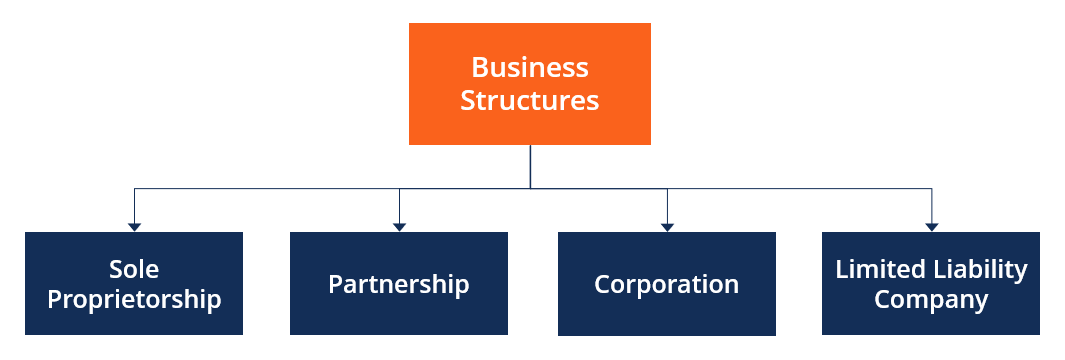

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

The Company As A Distinct And Legal Person

The Company As A Distinct And Legal Person

What Is A Company Under The Companies Act

What Is A Company Under The Companies Act

Chapter 7 Corporations And Legal Personality

Chapter 7 Corporations And Legal Personality

Separate Legal Existence The Most Important Feature Of A Company

Separate Legal Existence The Most Important Feature Of A Company

What Structure To Choose For My Singapore Company

What Structure To Choose For My Singapore Company

Business Structure Overview Forms How They Work

Business Structure Overview Forms How They Work

Separate Legal Entity Formation Of A Company Class 11 Business Studies Youtube

Separate Legal Entity Formation Of A Company Class 11 Business Studies Youtube

Chapter 7 Corporations And Legal Personality

Chapter 7 Corporations And Legal Personality

What Does It Mean To Be An Llc Legalzoom Com

What Does It Mean To Be An Llc Legalzoom Com

/dotdash_Final_Subsidiary_Jul_2020-01-5cb00a7e65ed43618112f2f94829fc03.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Trust_Aug_2020-01-6b0686cb892a40589605baeeef79a183.jpg)