Do I Have To Report 1099 R Rollover

Make sure you see the letter G on your 1099-R form in Box 7 which indicates that you did a rollover. The plan or account custodian completing the 1099-R must fill out three copies of every 1099-R they issue.

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

Reporting your rollover is relatively quick and easy all you need is.

Do i have to report 1099 r rollover. In an indirect rollover a retiree or investor withdraws money from an IRA transfers it to another retirement account and gets a 20 federal income tax withholding. IRA trustees required to report any events involving withdrawals of any type to the IRS. Youll generally receive one for distributions of 10 or more.

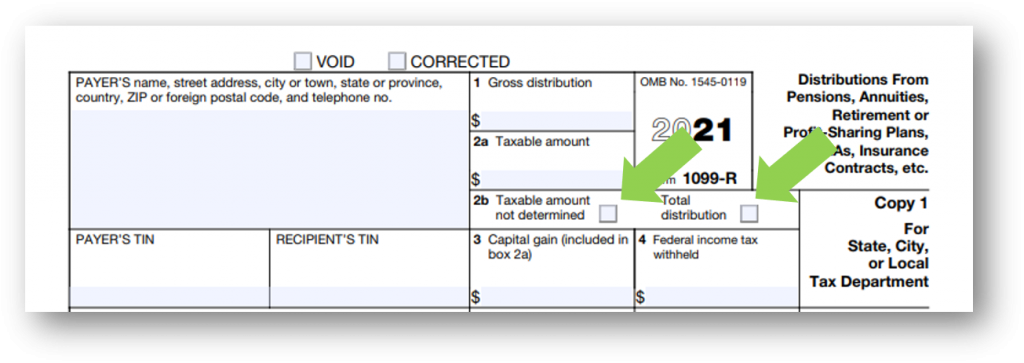

You should receive a copy of Form 1099-R or some variation if you received a distribution of 10 or more from your retirement plan. You can account for IRA rollovers using 1099 R tax form. Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities.

Whether federal income tax was withheld from the distribution Form 1099-R. Whether a previous tax-free rollover occurred with 12 months of the distribution. The tool is designed for taxpayers who were US.

Enter the amount from your 1099-R. A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts many of which are retirement savings accounts. If your form has code G in box 7 the rollover is automatically applied.

Regarding reporting 401K rollover into IRA how you report it to the IRS depends on the type of rollover. What is a 1099-R. If you have a Code 7 in Box 7 you can still indicate a Rollover screenshot and the income will not be taxable.

It can be unnerving for a taxpayer who timely rolled over his or her 2020 RMD to receive Form 1099-R reporting a taxable distribution after doing a. Even the event is a tax-free rollover the IRA trustees required to report them. B the exchange is solely a contract for contract exchange as defined above that does not result in a.

Ideally you will see the letter G in the box. However you still need to account correctly for this rollover on your income tax returns. Rollover With the Same Trustee If you are rolling over an IRA to a different account with the same trustee the distribution should be reported correctly on the Form 1099-R.

However if there is any other code you must show the rollover by answering some of the TurboTax follow up questions. Like all retirement plans or IRA distributions rollover distributions are reported to the taxpayer on the source document Form 1099-R - Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc Depending upon the manner in which the rollover occurs it can affect whether taxes are withheld from the distribution and how the taxable amount is. Box 1 will show the.

All rollovers whether they are direct or indirect should show up on your 1099-R. What Should I Expect to See on the Form. Even though you arent required to pay tax on this type of activity you still must report it to the Internal Revenue Service.

If you have a Code G in Box 7 of your 1099-R to indicate a Rollover you will get the screens asking about Roth IRA but the income is not taxable. These exchanges of contracts are generally reportable on Form 1099-R. Regarding rolling 401K into IRA you should receive a Form 1099-R reporting your 401K distribution.

However reporting on Form 1099-R is not required if a the exchange occurs within the same company. Do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the. If this was a direct rollover it should be coded G.

You may want to delete your 1099-R and re-enter it if you cant resolve your issue. The federal tax filing deadline for individuals has been extended to. If so they have correctly reported the transaction as a rollover.

Citizens or resident aliens for the entire tax year for which theyre inquiring. For example if you transmit a direct rollover and file a Form 1099-R with the IRS reporting that none of the direct rollover is taxable by entering 0 zero in box 2a and you then discover that part of the direct rollover consists of RMDs under section 401a9 you must file a corrected Form 1099-R reporting the eligible rollover distribution as the direct rollover and file a new Form 1099-R reporting the RMD as if it had. Even though the rollover is not taxable it should be reported as such on your income tax return.

Yes you do need to report the form 1099-R with the rollover. If you did a rollover look in box number seven of your 1099-R.

What S The Difference Between A Transfer And A Rollover Solo 401k

What S The Difference Between A Transfer And A Rollover Solo 401k

Tax Form Focus Irs Form 1099 R Strata Trust Company

Tax Form Focus Irs Form 1099 R Strata Trust Company

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Form 1096 Sample Templates Invoice Template Word Template

Form 1096 Sample Templates Invoice Template Word Template

How To Report Your 2020 Rmd Rollover On Your Tax Return Merriman

Reporting 401k Rollover Into Ira H R Block

Reporting 401k Rollover Into Ira H R Block

Tsp 2020 Form 1099 R Statements Should Be Examined Carefully

Tsp 2020 Form 1099 R Statements Should Be Examined Carefully

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Trustee To Trustee Transfer Retirement Dictionary Dictionary Retirement Finance

Trustee To Trustee Transfer Retirement Dictionary Dictionary Retirement Finance

Https Apps Irs Gov App Vita Content Globalmedia Teacher 11 Retincome Instructor Presentation Pdf

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

Welcome To General Assembly Retirement System

Welcome To General Assembly Retirement System

Tax Form Focus Irs Form 1099 R Strata Trust Company

Tax Form Focus Irs Form 1099 R Strata Trust Company

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

How To Report Backdoor Roth In Turbotax Turbotax Roth Disability Payments

How To Report Backdoor Roth In Turbotax Turbotax Roth Disability Payments