How To Obtain My 1099

The IRS computer might end up thinking you had twice the income you really did. We make the last 5 years available to you.

Irs Checks The Fillable 1099 Misc Form Irs Forms Irs 1099 Tax Form

Irs Checks The Fillable 1099 Misc Form Irs Forms Irs 1099 Tax Form

Your HSA plan administrator is required to send you a 1099-SA IF and only if you took any distributions from your HSA in 2016.

How to obtain my 1099. No other 1099Gs will be mailed. To access this form please follow these instructions. Posted by just now.

Form 1099-G for New Jersey Income Tax refunds is only accessible online. We do not mail these forms. Click 1099-R Tax Form in the menu to view your most recent tax form.

Step 2 Contact the payer or institution and ask a representative if your Form 1099 has been sent if you are expecting a Form 1099 and have not received it by January 31. How to access your 1099-R tax form Sign in to your online account. Contact the payer and ask the individual or company to send you a new copy if you have lost your Form 1099 by accident.

I am trying to help my niece do her taxes before the deadline. Need to obtain 1099-G information. For additional questions please review our 1099-G frequently asked questions here.

Download Form 4852 Substitute for Form W-2 Wage and tax Statement or Form 1099-R Distribution from Pensions Annuities Retirement or Profit-sharing Plans IRAs Obtain phone assistance through 800-829-1040. You can log into CONNECT and click on My 1099G49T to view and print the forms. Just ask the IRS for your wage and income transcript.

We tried logging onto her account to see if we could print it. Need to obtain 1099-G information. To 7 pm Monday-Friday your local time - except Alaska and Hawaii which are Pacific time.

1099-Gs for years from 2018 forward are available through your online account. To view and print your statement login below. If you do not have an online account with NYSDOL you may call.

If you were a phone filer it will be mailed to you. Your 1099-G will be electronically available in your BEACON portal. Click the save or print icon to download or.

You can instantly download a printable copy of the tax form by logging in to or creating a free my. The transcript should include all of the income that you had as long as it was reported to the IRS. Select a year from the dropdown menu to view tax forms from other years.

How to Get Your 1099-G online. You may download a copy of your current IRS Form 1099-G through your online account at desncgov at no charge. She had a few months of unemployment but does NOT have her 1099-G statement from UIA.

You will find the 1099G in Uplink on your Correspondence page. If you are looking for 1099s from earlier years you can contact the IRS and order a wage and income transcript. Need a replacement copy of your SSA-1099 or SSA-1042S also known as a Benefit Statement.

1099-G The 1099-G is the tax form the department issues in January for the purposes of filing your taxes. Theres a quick way to get all the information statements filed under your taxpayer identification number usually your Social Security Number for the past 10 years. Get a copy of your Social Security 1099 SSA-1099 tax form online.

Written requests for a hard copy of your 1099-G form from 2018 2019 2020 or 2021 may be. For Pandemic Unemployment Assistance PUA claimants the. That is did you use the debit card from the bank or financial institution that is your HSA plan administrator to.

Taxpayers and practitioners can access an electronic version of Forms 1099-G via the Personal Income Tax e-Services Center. To access a Form 1099-G electronically a taxpayer must first register for an e-signature account by establishing a User ID and Password. An alternative to asking an issuer for a Form 1099 is to get a transcript of your account from the IRS.

Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form. 1-888-209-8124 This is an automated phone line that allows you to request your 1099-G via US. If after 1099-Gs are issued in mid-January 2021 you wish to have a duplicate be mailed to your physical address you may obtain one by sending your request via to the Maryland Department of Labor - Benefit Payment Control BPC Unit at dlui1099-labormarylandgov.

Hours of operation are 7 am. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS. To determine if you are required to report this information on a federal income tax return see the federal income tax instructions contact the.

These forms will be mailed to the address that DES has on file for you. How do I find my 1099-SA. How Do I Receive a Copy of My 1099G Tax Statement.

What Is A W2 Employee What Is A 1099 Paying Taxes Employee

What Is A W2 Employee What Is A 1099 Paying Taxes Employee

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

Tax Time Is Here Which Means Many Of You Are Receiving Important Irs Forms To File Your Taxes Today We W Credit Repair Credit Repair Services Credit Education

Tax Time Is Here Which Means Many Of You Are Receiving Important Irs Forms To File Your Taxes Today We W Credit Repair Credit Repair Services Credit Education

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Regarding Irs W 9 2021 In 2021 Getting Things Done Tax Forms Irs

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Regarding Irs W 9 2021 In 2021 Getting Things Done Tax Forms Irs

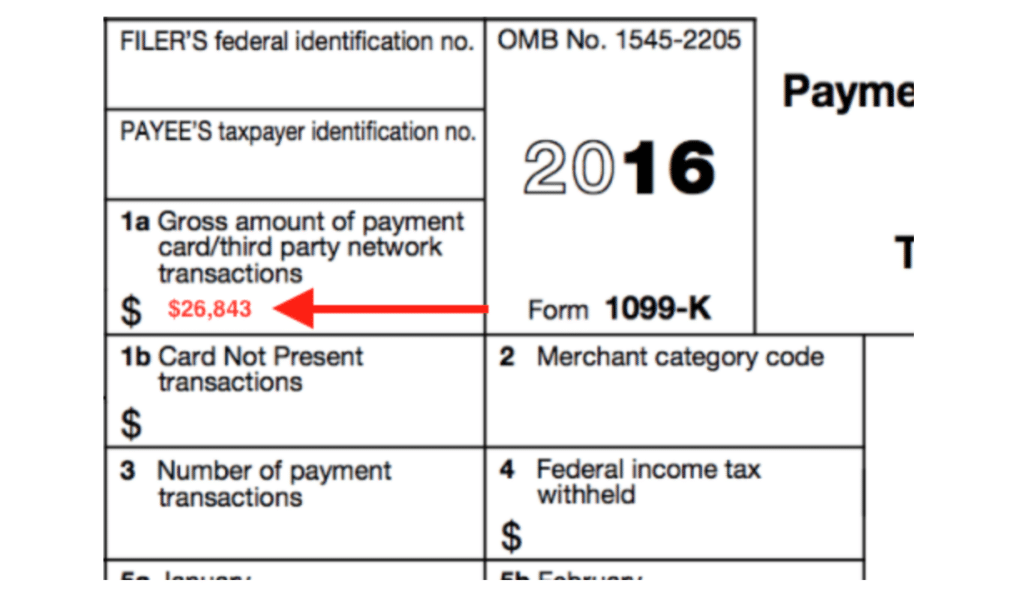

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

1099 Form Fillable Free Inspirational 1099 Misc Fillable Form 2017 At Models Form In 2020 Tax Forms Income Tax Doctors Note Template

1099 Form Fillable Free Inspirational 1099 Misc Fillable Form 2017 At Models Form In 2020 Tax Forms Income Tax Doctors Note Template

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

How To Read Your Brokerage 1099 Tax Form Youtube

How To Read Your Brokerage 1099 Tax Form Youtube

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition