Pennsylvania 1099 R Filing Requirements

Clude W-2s 1099-Rs 1099-MISCs and 1099-NECs based upon the method used to file the return paper or electronic filing. Beginning January 1 2018 anyone that makes the following payments is required to withhold from such payments an amount equal to the tax rate specified per 72 PS.

Irs What To Do If Form W 2 And Form 1099 R Is Not Received Or Is Incorrect Irs Taxes Irs Internal Revenue Service

Irs What To Do If Form W 2 And Form 1099 R Is Not Received Or Is Incorrect Irs Taxes Irs Internal Revenue Service

In addition to providing you a user-friendly and secure platform to eFile Pennsylvania 1099-MISC W-2 and 1099-NEC directly to the Pennsylvania State agency we can.

Pennsylvania 1099 r filing requirements. Brief Overview and Filing Requirements Who Must File. Every resident part-year resident or nonresident individual must file a Pennsylvania Income Tax Return PA-40 when he or she realizes income generating 1 or more in tax even if no tax is due eg when an employee receives compensation where tax is withheldRefer to the below section on TAXATION for additional information. Check the filing requirements of reconciliation Form REV 1667.

Are required to file Form 1099-R for Pennsylvania personal income tax purposes. Furthermore instruc-tions have been added to include W-2 Filing TipsQUALITY SERVICE and 1099-R Filing Tips. 1 We will no longer be filing via paper when using the 9 digit FEIN to the state of PA.

File a copy of the Federal Form 1099-MISC with the Department by January 31 of the next year. DOR recommends that 1099-MISC withholding returns and monies be remitted and filed electronically via the e-TIDES system. E-file Form 1099-NEC MISC R directly to the Pennsylvania State agency with TaxBandits.

The entity issuing the 1099 forms must have a PA employer withholding account to be able to file the forms electronically through e-TIDES. There is no special reporting for qualified charitable. The PA state return will exclude the taxable portion of the distribution due to death and you will receive a refund or credit for the amount of PA tax withheld on the.

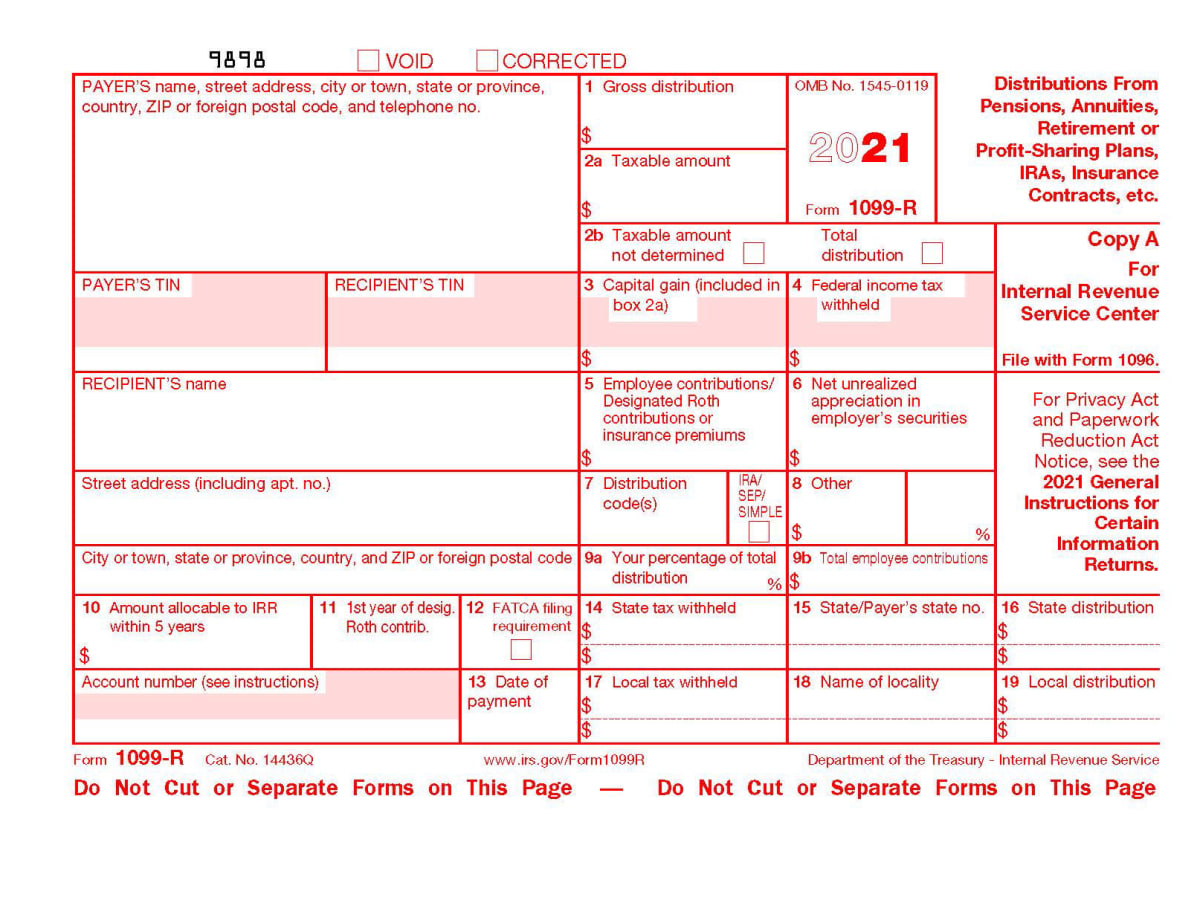

7302 currently 307. Reported on Form 1099-R. Reportable disability payments made from a retirement plan must be reported on Form 1099-R.

You may be required to submit Pennsylvania state reconciliation form REV-1667 R. The federal tax filing deadline for individuals has been extended to May 17 2021. See Pages 20 through 22.

Payments of Pennsylvania source. In 2012 Pennsylvania adopted 1099 reporting requirements for payers of certain non-employee compensation. Generally do not report payments subject to withholding of social security and Medicare taxes on this form.

Tax1099 offers this form for 499 through the platform. PA Employer Account ID must be a valid PA Employer Account ID registered with PA If any of the checks fail the edit checks the row is marked as an error If there is an error you will have the option to insert the rows that are valid or cancel the. You can still use the 9 digit FEIN and we will e-file to the state of PA.

1099-MISC PA Filing Requirements and Schedules The DOR stated in its February 5 announcement that it expects payors and lessors to file the related 1099-MISC forms with boxes 16 and 17 completed timely in January 2019. As part of the 2017-2018 budget process Pennsylvania expanded the 1099 reporting requirement to include withholding on payments made to non-resident individuals and disregarded entities that have non-resident members. I think the above answer by KellyG is marginally helpful as the OP asks do I have to copy the form 1099-R for the PA Tax and send it with my return.

You must report on Form 1099-R corrective distributions of excess deferrals excess contributions and excess aggregate contributions under section 401a plans section 401k cash or deferred arrangements section 403a annuity plans section 403b salary reduction agreements and salary reduction simplified employee pensions SARSEPs under section 408k6. 1099Rs with code 3 or 4 are not taxable in PA unless with code D. Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities.

If youre looking for additional assistance with your state tax filing this year our team here at Tax2efile is ready to assist. The given answer addresses federal IRS requirements not PA state. Detailed Explanation To assist you PSERS will include an explanation of the information appearing in each box on the 1099-Rs PDF.

It also expanded the requirements with respect to when a copy of Federal Form 1099-MISC is required to be filed with the Pennsylvania Department of Revenue. Beginning in 2018 anyone that pays Pennsylvania-source income to a resident or non-resident individual partnership or single member limited liability company and is required to file a Federal Form 1099-MISC is required to. Payers of distributions from profit sharing retirement arrangements insurance contracts etc.

Request KellyG clarify her response and focus on PA state requirements. You should receive a copy of Form 1099-R or some variation if you received a distribution of 10 or more from your retirement plan. Pennsylvanias 1099 Filing Requirements.

You would need to enter the 1099R in TurboTax as received. Report such payments on Form W-2 Wage and Tax Statement.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Irs Dependent Care Credit Guided Math Irs Taxes Irs

Irs Dependent Care Credit Guided Math Irs Taxes Irs

Understanding Your 1099 R 2020 Tax Year Youtube

Understanding Your 1099 R 2020 Tax Year Youtube

Pennsylvania Form 1099 Misc Filing Requirements Gyf

Pennsylvania Form 1099 Misc Filing Requirements Gyf

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Custom Website Redesign For Pembroke Pines Accounting Firm Acosta Tax Accounting Wordpress Portfolio Web Design Custom Web Design Freelance Web Design

Custom Website Redesign For Pembroke Pines Accounting Firm Acosta Tax Accounting Wordpress Portfolio Web Design Custom Web Design Freelance Web Design

Irs Miscellaneous Expenses Income Tax Return Irs Taxes Deduction

Irs Miscellaneous Expenses Income Tax Return Irs Taxes Deduction

Irs Appeals Irs Taxes Irs Appealing

Irs Appeals Irs Taxes Irs Appealing

Irs What To Do If Form W 2 And Form 1099 R Is Not Received Or Is Incorrect Irs Taxes Irs Internal Revenue Service

Irs What To Do If Form W 2 And Form 1099 R Is Not Received Or Is Incorrect Irs Taxes Irs Internal Revenue Service

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Irs How To File Tax Return In Us Owe Taxes Filing Taxes Tax Return

Irs How To File Tax Return In Us Owe Taxes Filing Taxes Tax Return

This Article Will Provide You The Instructions On How To Conveniently File Your 940 941 Or 944 Tax Forms Electronically Quickbooks Payroll Quickbooks Payroll

This Article Will Provide You The Instructions On How To Conveniently File Your 940 941 Or 944 Tax Forms Electronically Quickbooks Payroll Quickbooks Payroll

Irs Form 1099 R Box 7 Distribution Codes Ascensus

How To Read Your 1099 R Colorado Pera

How To Read Your 1099 R Colorado Pera

1099 R Form Copy D 1 Payer State Discount Tax Forms

1099 R Form Copy D 1 Payer State Discount Tax Forms

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More