What Documents Does A Sole Proprietor Need For Ppp Loan

All PPP loan applicants will need to provide. Check Yes or No for all questions on the form.

Documents Required To Apply For A Ppp Loan Bench Accounting

Documents Required To Apply For A Ppp Loan Bench Accounting

Tax returns 2019 and 2020 whichever filed last.

What documents does a sole proprietor need for ppp loan. Vacation parental family medical or. We created a comprehensive comprehensible guide all about PPP loan forgiveness for the self-employed sole proprietors and independent contractors. In essence the PPP loan should be roughly ten weeks worth of 2019 net profit.

Business owners that fall into this category must submit their 2019 IRS Form 1099-MISC for any independent contractors paid. Payroll costs For the payroll portion of your PPP loan you will need to provide documents from your payroll provider and proof of paying employment taxes with IRS and state forms. There are now two calculations depending on if you have payroll.

It is not necessary to document any payroll. Must file a Form 1040 Schedule C for 2019. What do I need to apply.

In most cases this will be equal to the entirety of a sole proprietors PPPP loan subject to a 20833 cap. If you operate as a sole proprietor youll need to submit your 2019 IRS Form 1040-C. The tax documents you submit with your loan application are identical to those you submitted or will submit through the IRS.

There is one application form for first-time PPP loans and a different form for second draw PPP loans. The new rules also state Regardless of whether you have filed a 2019 tax return with the IRS you must provide the 2019 Form 1040 Schedule C with your PPP loan application to substantiate the applied-for PPP loan amount and a 2019 IRS Form 1099-MISC detailing nonemployee compensation received box 7 invoice bank statement or book of record that establishes you are self-employed. Include your contact name and email address.

If you are a freelance writer for example you are a sole proprietor. Must be in operation before February 15 2020. In order to apply for a PPP loan as a self-employed individual or independent contractor you have to meet the following criteria.

Regulations vary by industry state and locality. Eligible payroll costs include salaries and wages health benefits and paid leave ie. Indicate your Business Type Independent Contractors and Sole Proprietors have slightly different document requirements.

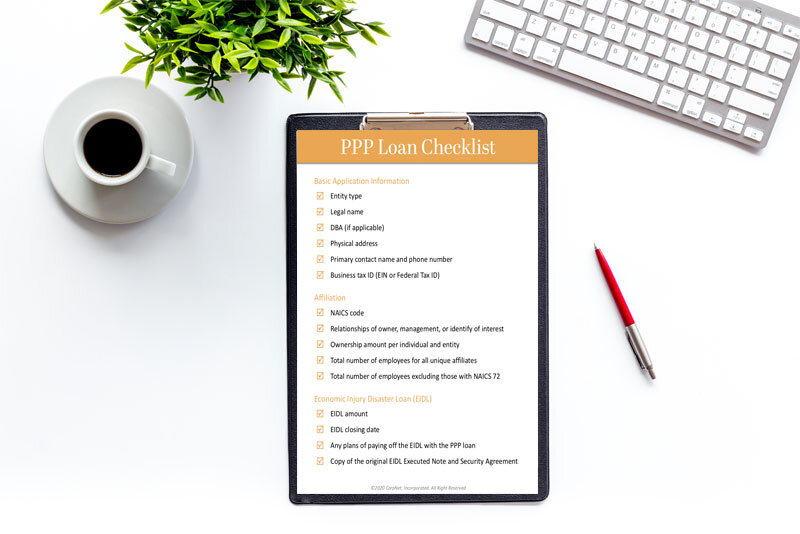

What other documents will I need to include in my application. How sole proprietor PPP loans are calculated. Once you complete the PPP loan application youll need to collect some documents for your loan officer.

This amount cant exceed 100000 for the year. Click HERE for the application. There is no requirement that this money be spent a particular way and it is not necessary to document any payroll.

This is everything we know based on information directly from the SBA the 19th Interim Final Rule IFR filed on June 19th 2020 and the last update for loans of 50000 or less released on. Must have income from self-employment sole proprietorship or as an independent contractor. Must live in the United States.

But changes were made on March 3 2021 that affected the PPP loan calculation process. Drivers license for all business owners. This article is a checklist of what your lender will mostly likely ask for.

But like all businesses you need to obtain the necessary licenses and permits. You will be required to agree that your lender will calculate your final loan amount based on the tax documents you submit with your PPP loan application. Borrowers who received loans prior to June 5 2020 may elect to use the 8-week forgiveness covered period and can claim eight weeks worth of OCR.

Using the OCR sole proprietors can claim forgiveness based upon 2019 net profit. You will need to complete the Paycheck Protection Program loan application and submit the application with the required documentation to an approved lender that is available to process your application by June 30 2020. Use the Licensing Permits tool to find a listing of federal state and local permits licenses and registrations youll need to run a business.

Previously sole proprietors were able to apply for a PPP loan using their 2019 or 2020 net income as reported on a Schedule C.

How To Apply For Your Second Ppp Loan Bench Accounting

How To Apply For Your Second Ppp Loan Bench Accounting

Schedule C For Sole Proprietor Independent Contractor Single Member Llc Ppp Loan Forgiveness Eidl Youtube

Schedule C For Sole Proprietor Independent Contractor Single Member Llc Ppp Loan Forgiveness Eidl Youtube

Sba Ppp Guidelines For Sole Proprietors And Independent Contractors

Sba Ppp Guidelines For Sole Proprietors And Independent Contractors

How To Apply For Ppp Loan As A Sole Proprietor Debt Free Hispanic

How To Apply For Ppp Loan As A Sole Proprietor Debt Free Hispanic

How To Track Ppp Loan Expenses For Sole Proprietors Independent Contractors Template Included Youtube

How To Track Ppp Loan Expenses For Sole Proprietors Independent Contractors Template Included Youtube

Paycheck Protection Program Loan Checklist From Corpnet

Paycheck Protection Program Loan Checklist From Corpnet

Ppp Round 2 Sole Proprietor Guide To Eligibility Application

Ppp Round 2 Sole Proprietor Guide To Eligibility Application

Sole Proprietor Vs S Corporation In 2019 Sole Proprietor S Corporation Corporate

Sole Proprietor Vs S Corporation In 2019 Sole Proprietor S Corporation Corporate

How To Calculate Gross Income For The Ppp Bench Accounting

How To Calculate Gross Income For The Ppp Bench Accounting