What Types Of Companies Get A 1099

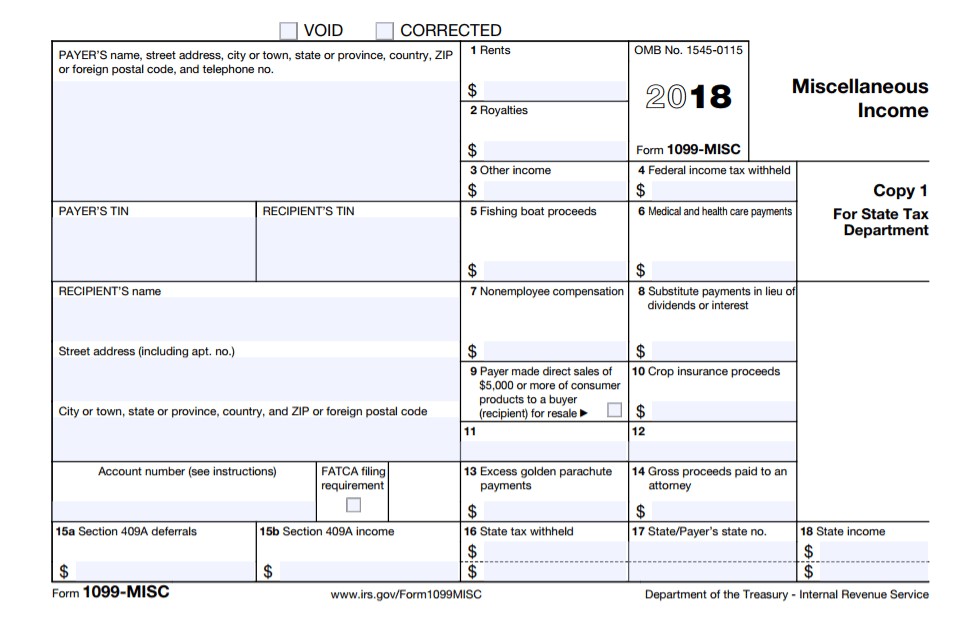

What Businesses Are Exempt From a 1099. Information about Form 1099-MISC Miscellaneous Income including recent updates related forms and instructions on how to file.

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd.

What types of companies get a 1099. Independent contractors use a 1099 form and employees use a W-2. If you had more than 600 worth of debt canceled the. 600 Threshold for 1099-MISC.

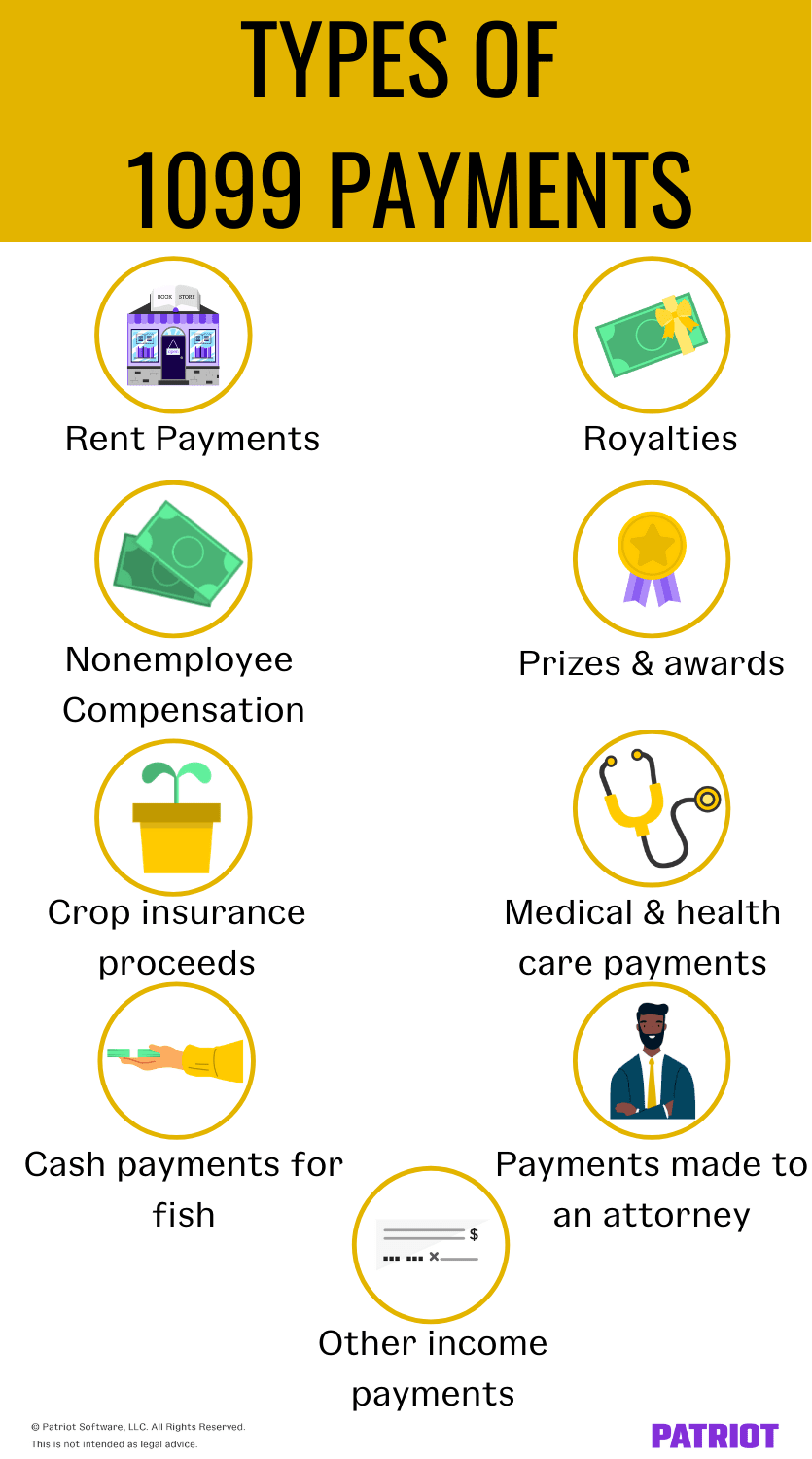

Who are considered Vendors or Sub-Contractors. The 1099-INT form is usually used by banks brokerage firms credit unions and sometimes even the companies handling your student loans. This form displays the amount and date of the sale and gives cost basis information.

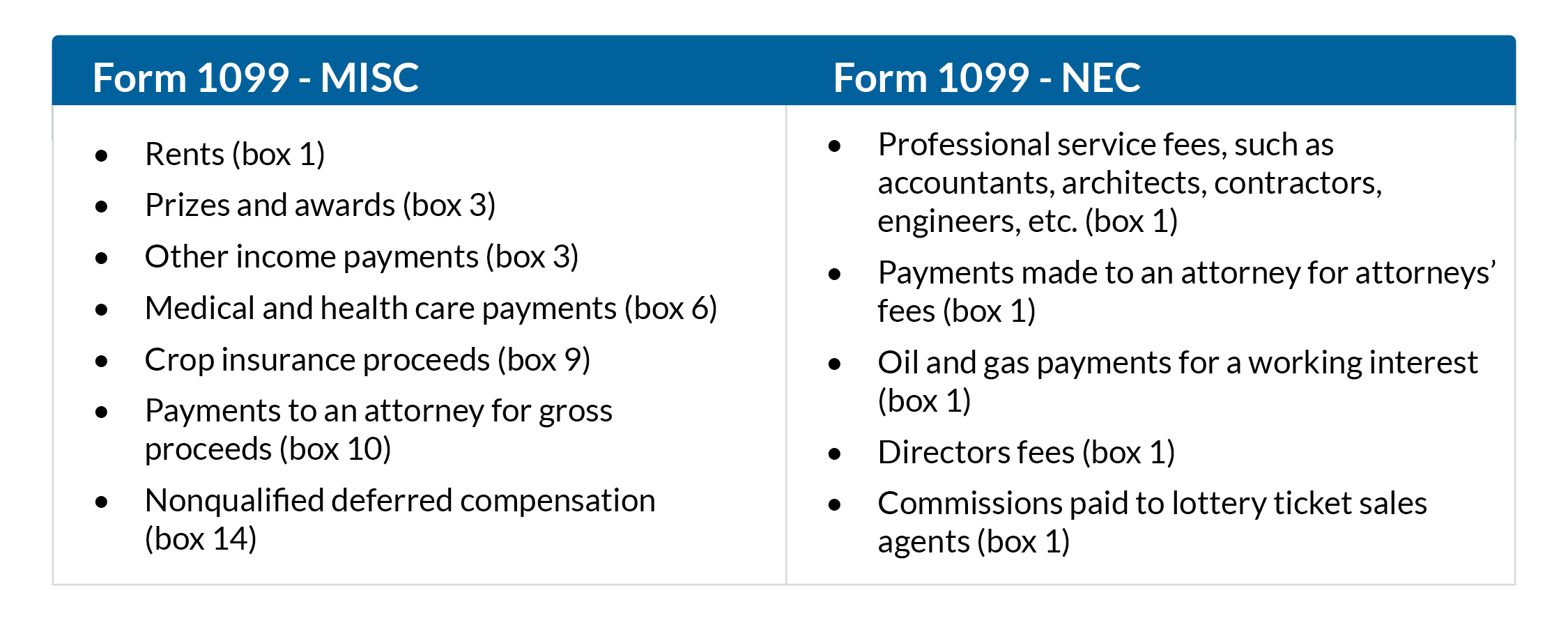

You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate. Form 1099-MISC is used to report rents royalties prizes and awards and other fixed determinable income. While most 1099 vendors for school business are IndividualSole Proprietors they could also be C Corporation S Corporation Partnership TrustEstate Limited Liability Company or Other.

A common exception to this rule are landlords and attorneys who must have a 1099 issued regardless of their business entity type. Who gets a 1099. Most corporations dont get 1099-MISCs Another important point to note.

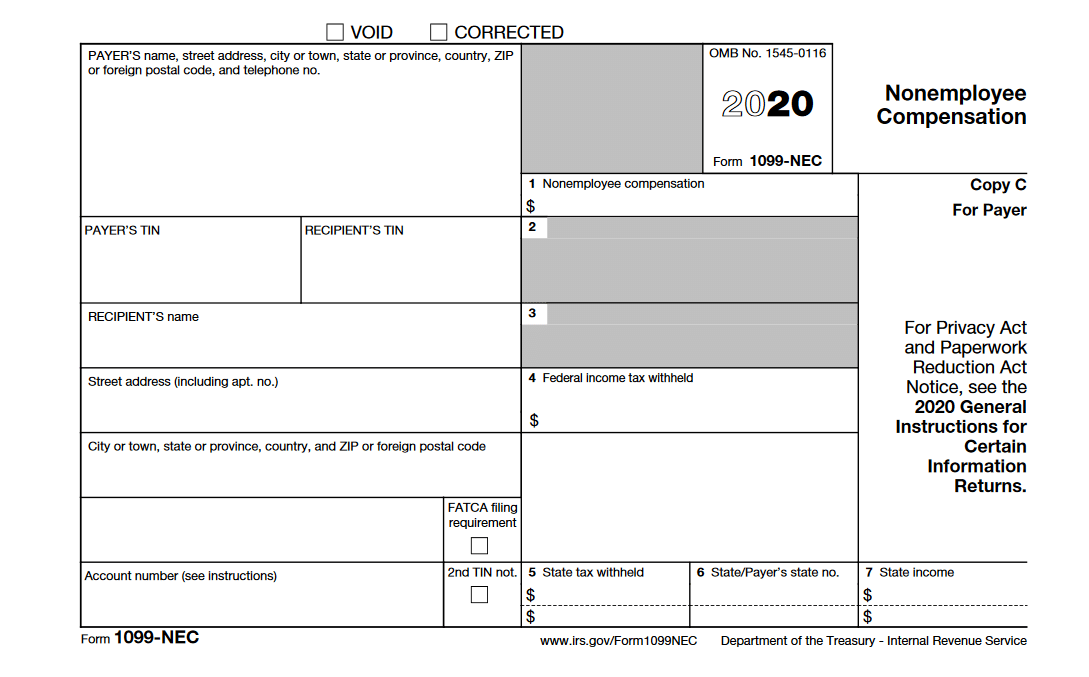

Beginning with the 2020 tax year the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC. You might have a few vendors who you know you need to provide a 1099-MISC to but there might be more that you dont think of. Particularly brokers or mutual fund companies must file this 1099-B when you sell a stock.

This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs. Theres a lot of income diversity among contractors. Business owners have to file form 1099 as a record of payments they made to independent contractors over the course of the tax year.

Form 1099-MISC provides information to the IRS that helps it track independent contractor income akin to the. In your accounting file look through your vendor list for. You may see this if you sold certain securities in the.

There is no need to send 1099-MISCs to corporations. It allows you to report this wage information to the IRS and also allows your associate to do his or her taxes. On the flip side if youre working with a contractor who is any other type of business individual sole proprietorship partnership LLC etc and youve paid them 60000 or more then you do need to prepare a 1099.

The form serves two purposes. Businesses will need to use this. Forms 1099 and W-2 are two separate tax forms for two types of workers.

If a business buys or rents products or services that amount to more than 600 from one person or LLC during the year it has to file a 1099 for that contractor or vendor. One common criticism of the 1099 workforce is how little contractors earn in comparison to W-2 workers -- but this claim doesnt hold true for the entire worker class. If you paid a vendor more than 10 in interest youve got to send out a 1099-INT.

This information return is used to report unemployment payments state and local income tax refunds agricultural payments and taxable grants. For W-2 employees all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer. What Are Common Types of 1099 Forms.

If You Paid Someone 10 Or More For Natural Resources Forestry or Conservation Grants. On the W9 they should be indicating what type of tax classification their business falls under. If you have paid any part-time workers or freelancers more than 600 during the year you will need to send them a 1099 form.

While grounds maintenance workers earn well below at 23970 and. Dentists accountants even farmers and ranchers earn well above the median American annual household income of 51939. Corporation Exemption for Form 1099-MISC.

CPAs Your Landlord. This form records income received from brokerage transactions and barter exchanges.

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Is Your Business Prepared For Form 1099 Changes Rkl Llp

Is Your Business Prepared For Form 1099 Changes Rkl Llp

1099 Payments How To Report Payments To 1099 Vendors

1099 Payments How To Report Payments To 1099 Vendors

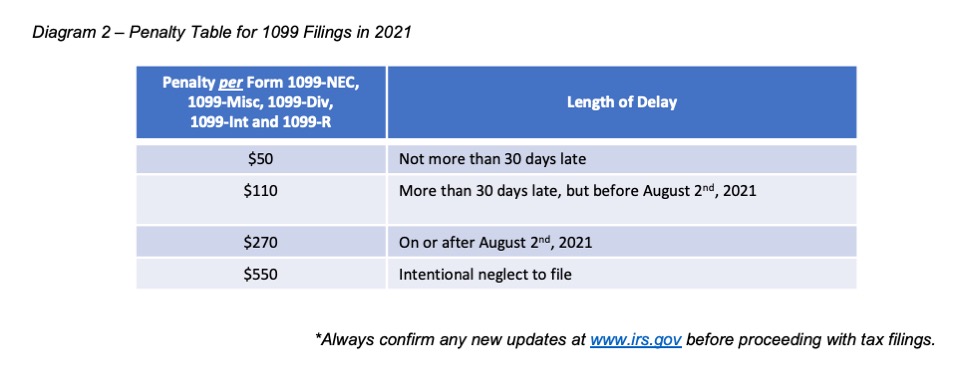

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements