1099 Form Box 7 Codes

30 rows Within the program if your loan is treated as a deemed distribution please enter in box 7. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

For more information on these distributions see the instructions for Form 1099-R.

1099 form box 7 codes. 30 rows Box 7 Code. 2 Early distribution exception applies under age 59½. 7 is the code for Normal Distribution which means it was distributed to taxpayer after age 595.

The following codes identify the distribution received. Code 8 According to the 2020 Instructions for Forms 1099-R and 5498 Code 8 Excess contributions plus earningsexcess deferrals andor earnings taxable in 2020 signifies that excess contributions were deposited and returned in the same year regardless of the year for which the excess was attributed. Report on Form 1099-R not Form W-2 income tax withholding and.

If you filed 1099-MISC with only Box 7 in the past you should most likely choose Box 1 - Nonemployee Compensation on the 1099-NEC. Enter the appropriate codes in box 7. 29 rows 2020 1099-R Box 7 Distribution Codes.

Do not combine with any other codes. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. If a 1099-R has than one distribution code in Box 7 you will need to determine which code should be applied to give the correct tax treatment and then only enter that code.

The 1099 code D box 7 is correct in that there is 700000 of investment income which may or may not be subject to the 38 tax on investment income TTB 6-1 and 6-6 depending on whether the taxpayer meets other income thresholds. Box 7 is used to report income to you. Line 7 of the 1040 to be included in wages line 15 of the 1040 to be included in IRA distributions if the IRASEPSIMPLE box is marked on the 1099 screen.

1 Early distribution no known exception in most cases under age 59 ½. The 1099-MISC box 7 was also used to report fees commissions prizes awards and other forms of compensation for services. 1 Early distribution no known exception in most.

Depending on the agreement this form was also used to report golden parachute payments. D - net investment income. The taxable amount of the distribution should still be indicated in Box 2a based on the differing rules.

Code 7 may be used in combination with codes A B D K L or M. 2 - premature distributions with an exception. Here are the various codes listed in box 7 of Form 1099-R.

In Drake17 and prior if the 1099-R reports a code of 8 in box 7 Distribution Code and is typed in that field on the 1099 screen the amount will flow to. It is not necessary to check the box for a distribution from a Roth IRA or for an IRA recharacterization. See Corrective Distributions and IRA.

Also see instructions for Forms 5329 and 8606. The different codes within box 7 tell what the tax treatment of any distribution amounts should be. You will not be able to enter both codes in the Distribution code field.

F - charitable gift annuity. Crop insurance proceeds are reported in box 9. Payer made direct sales of 5000 or more checkbox in box 7.

Some applicable codes include but are not limited to. Code 1-Early Distribution Use Code 1 only if the solo 401k participant was not age 59 12 or older at time of the distribution AND codes 23 and 4 do not apply. Codes for Box 7 of the 1099-R tax form include number or a letter in the alphabet states the Prudential website.

1 - premature distributions without an exception. 2020 Form 1099-R Codes Box 7. Beginning in 2020 box 7 will be used to indicate the payer made direct sales of 5000 or more of consumer products to a buyer.

D is the new nonqualified annuity distribution code. Changes in the reporting of income and the forms box numbers are listed below. Governmental section 457b plans.

This is the most common situation and the only box most businesses will need to select for payment types. Distribution Codes Enter an X in the IRASEPSIMPLE checkbox if the distribution is from a traditional IRA SEP IRA or SIMPLE IRA. Due to the creation of Form 1099-NEC we have revised Form 1099-MISC and rearranged box numbers for reporting certain income.

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

:max_bytes(150000):strip_icc()/1099c-5606545f559b4f28883a0de35905889b.jpg) Form 1099 C Cancellation Of Debt Definition

Form 1099 C Cancellation Of Debt Definition

Major Changes To File Form 1099 Misc Box 7 In 2020

Major Changes To File Form 1099 Misc Box 7 In 2020

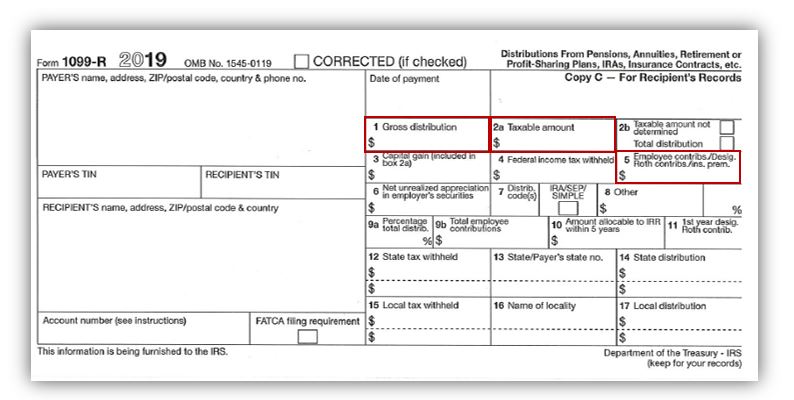

Understanding Your 1099 R Form Kcpsrs

Understanding Your 1099 R Form Kcpsrs

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Change To 1099 Form For Reporting Non Employee Compensation Ds B