Business Income Tax Computation Format

BUSINESS SOURCE Gross income XX Less. NON ALLOWABLE EXPENSES Drawings COGS X Holidayleave passage X Bad Debt - specific NIL - general X Loan to directorsemployees X Entertainment on client X Depreciation X Provision of tax X Proposed dividend X Donation X Etc X LESS.

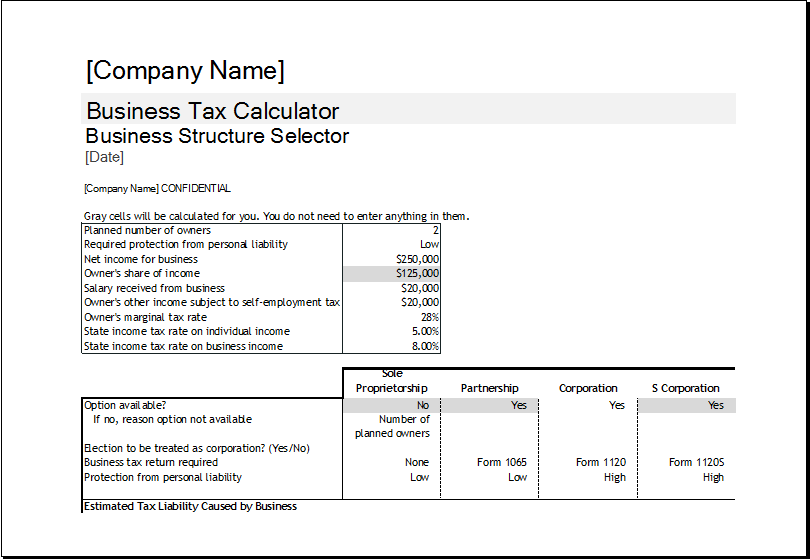

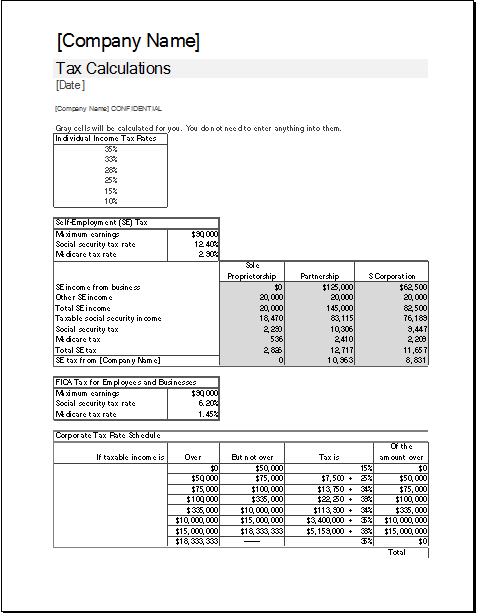

Corporate Tax Calculator Template For Excel Excel Templates

Corporate Tax Calculator Template For Excel Excel Templates

Tax paid in excess F2 - F1 F1 F2 F3 F4 Tax payable from E13 InstalmentsMonthly Tax Deductions Paid - SELF and HUSBAND WIFE if joint assessment F1 F3 F4 136 4 6 3 2 0 764 63 60000.

Business income tax computation format. Multiplied by income tax rate. Php 15000 x 12 months Php 180000. EXCEL BASED COMPUTATION CHART xlsx.

Income From Salary 1 XXXXX. Add up the income taxes due on compensation income and business income. Profit and gains of business and profession.

Php 180000 x 008 Php 14400. Deduction under section 24. Companies should prepare their tax computations annually before completing the Form C-S C.

Companies filing Form C should submit their tax computations and tax schedules together with Form C. Net Profit as per profit an d loss account. Unabsorbed loss bf XXX STATUTORY.

Multiply the gross income by 8 to compute the income tax due. Business Laws and Business Correspondence and Reporting. COMPANY TAX COMPUTATION - FORMAT ADD LESS RM RM NET PROFIT BEFORE TAX XX LESS.

Get the annual gross income. TDS Rate Related Provisions - FY 2021-22 AY 2022-23 Bank Audit Manual Formats - 2021. Xxxxx Income From House Property 2 XXXXX.

Income Tax Computation AY 2020-21 Download Preview. 2 TAX DUE ON BUSINESS INCOME. Adjusted net annual value.

Income Tax on Short -term Capital Gains from transfer of securities us 111A 11 Income Tax on Long-term Capital Gains us 112 us 111A 12 Income Tax on Long-term Capital Gains form equity shares units of equity-oriented mutual fund us 112A 13 Income Tax on Taxable Income plus Agricultural Income Less capital gains as above. Add- Income which are debited to profit and loss account but not allowable as deduction. Business Income Revenue Expense Business income is the amount of gain in monetary value or in kind earned from a sale of a service andor product after deducting all incidental expenses incurred by the business.

05 April 2021 Download. On the Credit side of Profit Loss Ac there are some Income which are tax free or not taxable under the head BusinessProfession. DEEMED PROFITS Chargeable to Tax as Business Income Under Profits and Gains of Business or Professions Section 41 Taxation of Undisclosed Business IncomeInvestments from Undisclosed Sources.

NON BUSINESS INCOME X Dividend received As per PL acc X Interest received As per PL acc X Interest on loan to employee X ADD. Tax Due on Business Income. Tax adjustments include non-deductible expenses non-taxable receipts further deductions and capital allowances.

The BTC is also used by companies to prepare their tax computations and tax schedules when filing their taxes. Income from house property. Computation of Business Profits.

Income Tax Computation Sheet Financial year 2018 19. Allowable expenses Double deduction XXX Special deduction XX Gross income from business XXX Add. Use tax preparation software to run a rough calculation of estimated taxes for the next year.

Self-generated Tax Invoice format for GST supply under RCM On. Computation of total income tax due. Computation of income tax due on business income Using the 8 tax rate.

PERSONAL INCOME TAX COMPUTATION RM RM SECTION 4a. You can use the estimated tax calculation worksheet provided by the IRS on Form 1040-ES or using the worksheets included in Publication 505. Capital allowance Unabsorbed capital allowance bf XXX Unabsorbed capital allowance current year XXX Balancing allowance XXX Adjusted income for business XXX Less.

Share Report Trending Downloads. Business Profit should be calculated through profit Loss AccountIn Profit Loss Account there are some expenses which are partly allowed or disallowed under Income Tax Act. Income Tax Computation Format For Companies Last updated at May 29 2018 by Teachoo It is prepared taking into account different cases of expense disallowed Learn more.

Companies filing Form C-S should prepare and retain their tax computations and tax schedules and submit them to IRAS only upon request. Balancing charge XXX XXX Less. Company tax computation format 1.

A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax. Form BE Form B TOTAL INCOME - SELF Form BE Form B Form BE Form B or or or C34 C35 C36 C16 C17 C18 Part C Balance of tax payable F1 - F2 LESS. TCS collection on receipt from customer us 206C1H On.

Generally business income is computed as follows. Corporations usually use Form 1120-W to calculate their estimated tax. Deduction in respect of Expenditure incurred on setting up of a Specified Business.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Total Income Tax Due Compensation and Business P20000000. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Corporate Tax Calculator Template For Excel Excel Templates

Corporate Tax Calculator Template For Excel Excel Templates

Chat Showing Computation Of Income From Business Or Professions Gross Total Income

Company Tax Computation Format 1

Company Tax Computation Format 1

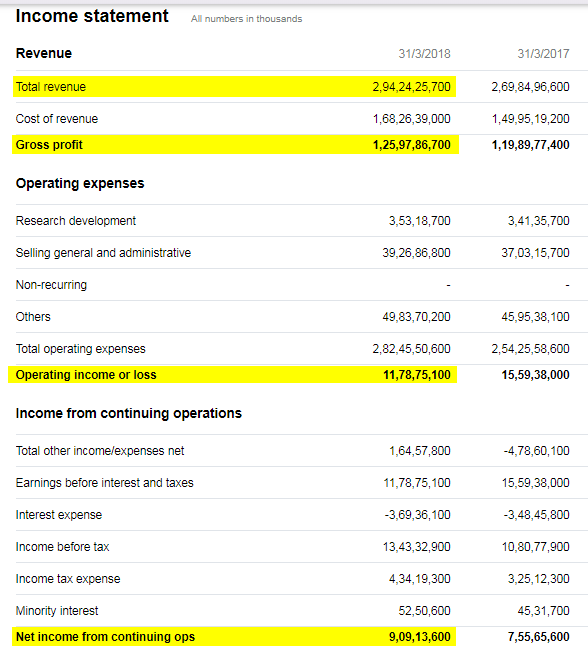

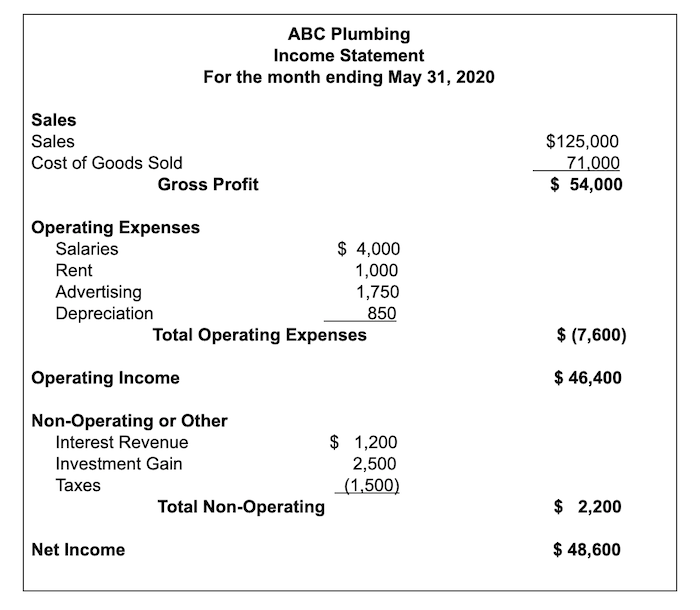

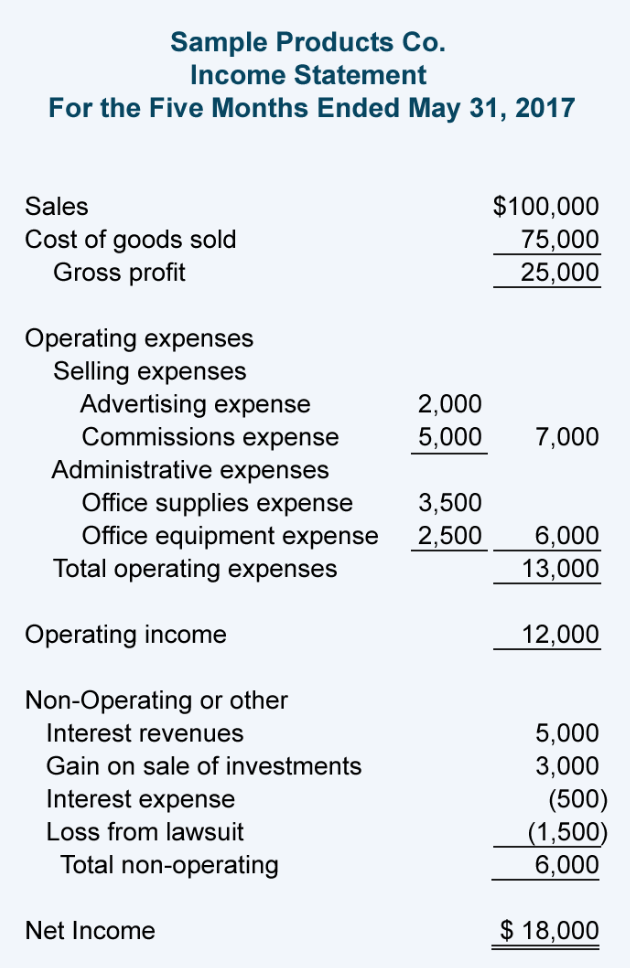

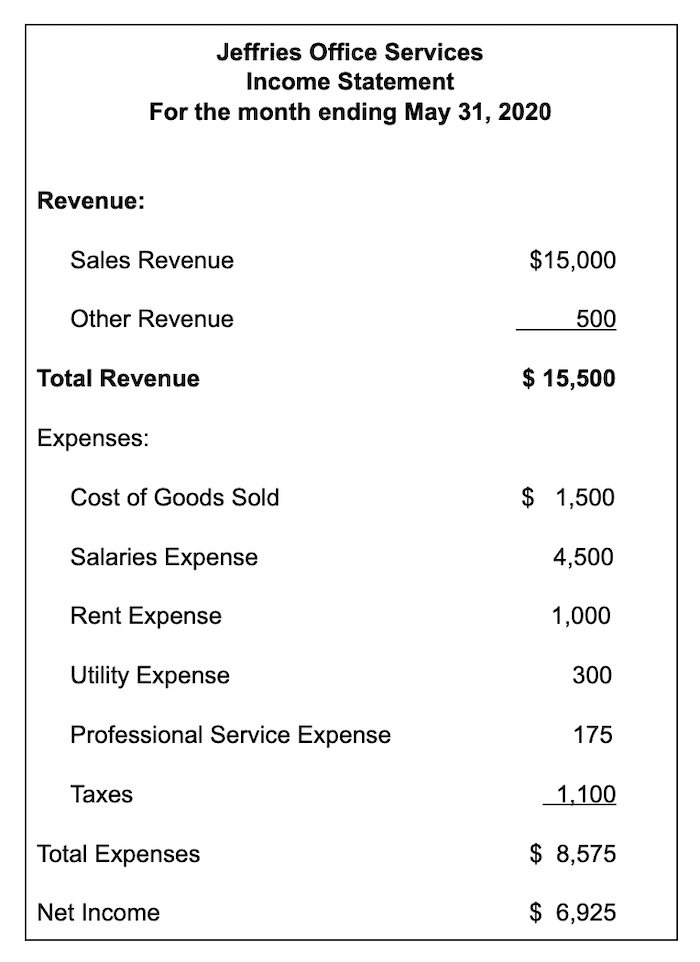

Income Statement Formula Calculate Income Statement Excel Template

Income Statement Formula Calculate Income Statement Excel Template

A Beginner S Guide To The Multi Step Income Statement The Blueprint

A Beginner S Guide To The Multi Step Income Statement The Blueprint

Multi Step Income Statement An In Depth Financial Reporting Guide Freshbooks Resource Hub

Multi Step Income Statement An In Depth Financial Reporting Guide Freshbooks Resource Hub

Company Tax Computation Format 1

Company Tax Computation Format 1

3 11 16 Corporate Income Tax Returns Internal Revenue Service

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Chat Showing Computation Of Income From Business Or Professions Gross Total Income

How To Prepare An Income Statement A Simple 10 Step Business Guide

How To Prepare An Income Statement A Simple 10 Step Business Guide

3 11 16 Corporate Income Tax Returns Internal Revenue Service

3 11 16 Corporate Income Tax Returns Internal Revenue Service

A Small Business Guide To The Income Statement The Blueprint

A Small Business Guide To The Income Statement The Blueprint

3 11 16 Corporate Income Tax Returns Internal Revenue Service

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Chat Showing Computation Of Income From Business Or Professions Gross Total Income

The Formula For Calculating Ebitda With Examples

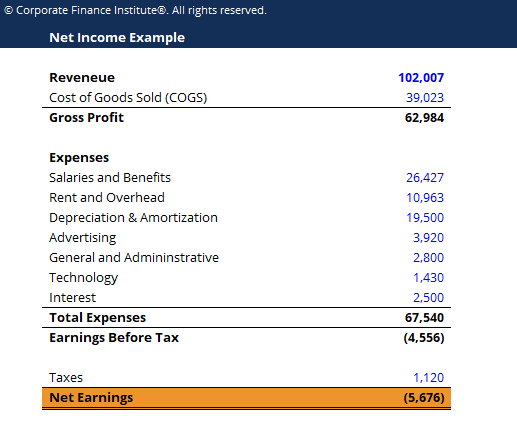

Net Income Template Download Free Excel Template

Net Income Template Download Free Excel Template

Pdf Income Tax Computation Format Pdf Download Instapdf

Pdf Income Tax Computation Format Pdf Download Instapdf