How Much Does It Cost To Start A Credit Union

It is confidential and available only for you to view within Online. What do I need to join a credit union.

At least its not too high so long as theyre profitable long-term members Is It Worth It to Attract Just Anybody.

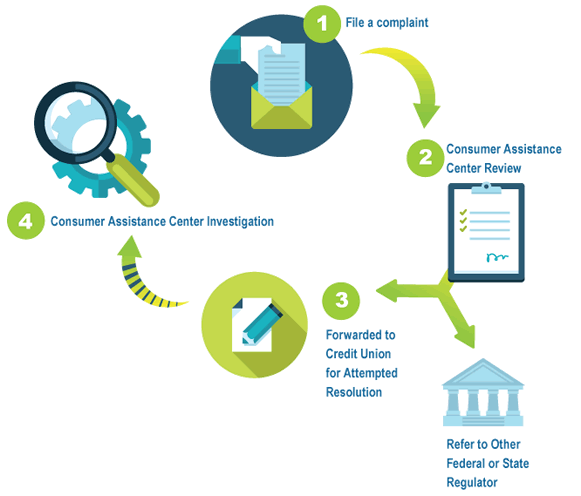

How much does it cost to start a credit union. Page on ncuagov 122K views. You can find it here. The NCUA does provide quite a few resources worth a read.

It does not cover every CUAnswers available service or product or out-of-pocket third party fees such as data lines equipment postage or required custom programming which will be determined on a case-by-case basis. Credit Union 1 works with a trusted third-party service provider SavvyMoney to deliver CreditSense to you through Online Banking. They have a very great PDF on what is required to start a credit union.

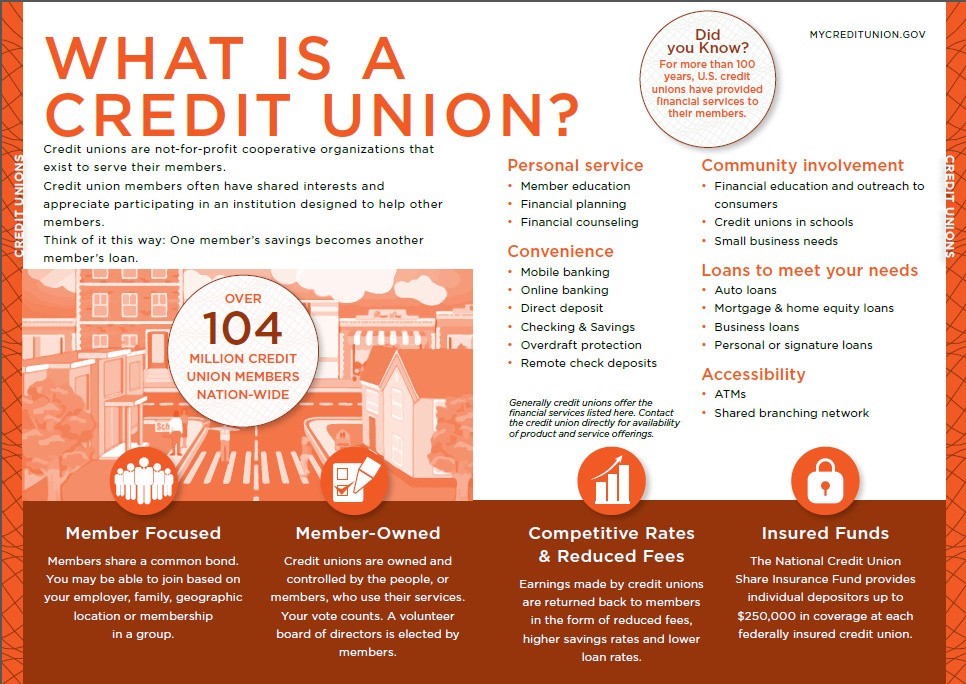

At some credit unions like the University of Wisconsins credit union you only need to have taken one class to become a member says Hanson. Depending on methodology and account type we see the average cost of acquiring a new member to sit somewhere between 400 and 700 Overall that doesnt seem too high. The only thing different from a bank and a credit union is that credit unions are not-for-profit organizations that operate to serve their members.

About 5 to 25 which is generally the cost of purchasing one par value share at a credit union in order to establish a membership account. It is a myth that a credit union is just a weak thing to manipulate and create profits. The most important paper work that you have to do to start a credit union is to get the Interpretive Ruling and Policy Statement 98-03.

Simply put the Starting a Credit Union Program is to cover core data processing services at no charge for a two-year period. A successful credit union needs healthy capital to cover the initial costs of getting a charter opening a location and employing workers not to mention selling financial products. The 250000 coverage applies to.

Next if you havent already you need to secure. Banks generate profit for their stockholders whereas credit unions give back those profits to their members. Box 11904 Tampa FL 33680 Member Care Center 1-800-999-5887 Routing Number 263 182 817 Your Savings Federally Insured to at least 250000 and backed by the full faith and credit of the United States Government National Credit Union Administration.

One-third of your members should at least show evidence that they will support the new credit union. TwinStar members earned a total of 265312 when partnering with our in-network agents to buy and sell their homes. The National Credit Union Share Insurance Fund NCUSIF protects accounts at federally insured credit unions up to 250000.

So at least 150K prior to accepting your first deposit. Pre-chartering costs are listed between 50-150K and after chartering 50-350K. The answer is no and maybe you have this misconception from not comprhending what a credit union really is.

The second step is for the start-up to secure funding. Starting a credit union requires start-up capital and a competent management team. It is the paper that remodels that NCUA Chartering and Field of.

Suncoast Credit Union PO. Its not that hard to get into a credit union. It depends on whether youre also looking for a basic or full service credit union.

The Paperworks in Starting a Credit Union. Some credit unions may also charge a nominal fee to process the account opening. A credit union is in reality a certified financial.

Before seeking a federal charter from the National Credit Union Administration NCUA a business plan should be devised showing a common bond for prospective customers economic feasibility and an estimation of costs. Despite being a non-profit organization credit unions do no rely on donations. The NCUA provides information on estimating start-up costs.

This is a complicated question however the NCUA - which charters Credit Unions - recommends 100000 per 1000000 of projected assets. Credit Union 1 does not receive this information from SavvyMoney therefore no Credit Union 1 employee can see your CreditSense credit score.