How To Get Form 1099-g North Carolina

31 there is a chance your copy was lost in transit. You would enter it as Other Reportable Income in the Less Common Income topic.

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099-Gs for years from 2018 forward are available through your online account.

How to get form 1099-g north carolina. Contact the 1099-G issuer for a corrected form showing 0 benefits received. Call your local unemployment office to request a copy of your 1099-G by mail or fax. Ask for it from the Employment Security Commission of North Carolina which processes unemployment benefits.

Received a NC covid check for 335 - but no 1099-G from North Carolina - do I declare this. Once you login you will see the words View my 1099G in. Check your state department of revenue website to see if the state issued additional directions.

E-file Form 1099-NEC MISC INT DIV NC-3 directly to the North Carolina State agency. Claimants to Receive 1099-G Forms By Jan. Direct deposit is available for original refunds only.

The Department is required by the IRS to issue Forms 1099-G no later than January 31 of each year. Meet your North Carolina State reporting requirements with TaxBandits. It is unlikely you will get a form from NC on this payment.

Claimants may elect to have state andor federal taxes withheld from their benefit payments. You should receive Form 1099-G by mail if you have been granted unemployment compensation but you can also request it. 1099-G forms will be delivered by Jan.

Please fill out the following form to request a new 1099 form. Your local office will be able to send a replacement copy in the mail. If you are requesting your 1099G to be sent to another address than what we have on file you will be required to submit proof.

31 to claimants by mail or email as preferred by the claimant and will also be available to download through their DES online. You should receive Form 1099-G by mail if you have been granted unemployment compensation but you can also request it. However most state governments offer to access the form online on the unemployment benefits website.

If you are not sure exactly where just type 1099G then your state in google for example - you may find an option to retrieve 1099-g online. Ask for it from the Employment Security Commission of North Carolina which processes unemployment benefits. If you were receiving unemployment benefits in North Carolina you need to be watching for a seemingly vague notice in your email.

If you claimed itemized deductions on your federal return and received a state refund last year you will receive a Form 1099G. However it is taxable on the federal level. File your return reporting the income you actually received.

1099-G Form for state tax refunds credits or offsets. 1 of the current year since you may receive it automatically before that date. You must complete all fields to have your request processed.

It is not available to taxpayers filing a paper return. If you havent received your 1099-G copy in the mail by Jan. What should I do.

Allow two weeks to receive the form. To access your 1099-G which you will need when filing taxes login to your NC DES account first. I have checked my records and determined the amount reported on my Form 1099-G is incorrect.

Written requests for a hard copy of your 1099-G form from 2018 2019. Part III Column C should be blank or have the number 0 If you want to see if you qualify for a premium tax credit based on your final income you can complete Form 8962 to find out. It may take 10 business days to receive a copy of your Form 1099-G.

A 1099G is issued if you received 10 or more in gross unemployment insurance payments. To request a duplicate Form 1099-G contact the Department at 1-877-252-3052. You can also use the Check Claim Status tool to get your Form 1099-G.

View solution in original post 0. If the state issues you a refund credit or offset of state or local income that amount will be shown in Box 2 of your 1099-G form. If you dont qualify for a premium tax credit you dont have to include Form.

You may download a copy of your current IRS Form 1099-G through your online account at desncgov at no charge. Youll get a 1095-A too. If you prefer to have your Form 1099-G mailed you may request a copy from your Reemployment Call Center.

You may request the 1099-G Form only after Feb. The exact mailing date varies each year. Then you will be able to file a complete and accurate tax return.

The 1099-G form is a federal tax form used to report unemployment compensation paid by the state of North Carolina. I have misplaced my Form-1099-G. 31 All individuals who received unemployment benefits during 2020 should receive an IRS Form 1099-G from the Division of Employment Security.

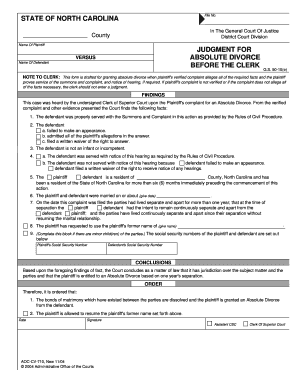

Divorce In Nc Fill Out And Sign Printable Pdf Template Signnow

Divorce In Nc Fill Out And Sign Printable Pdf Template Signnow

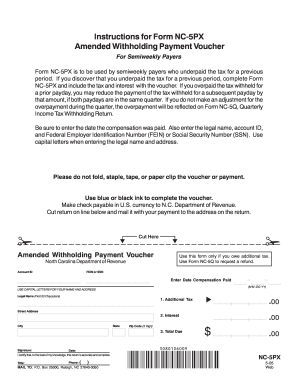

Nc 5px Form Fill Out And Sign Printable Pdf Template Signnow

Nc 5px Form Fill Out And Sign Printable Pdf Template Signnow

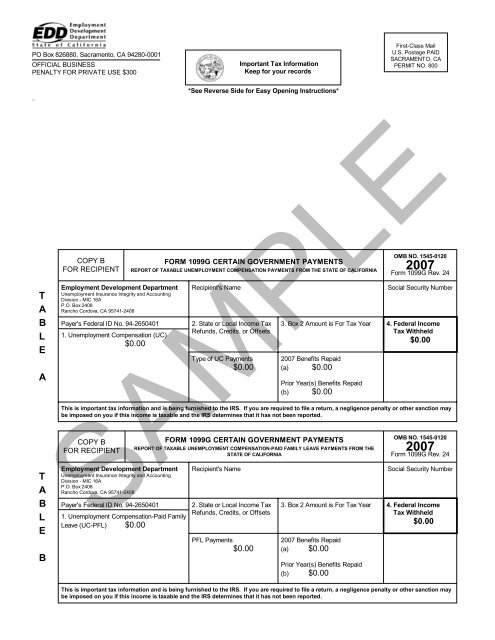

Irs Form 1099g Employment Development Department State Of

Irs Form 1099g Employment Development Department State Of

Irs Form 941 X Complete Print 941x For 2021

Irs Form 941 X Complete Print 941x For 2021

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Https Files Nc Gov Ncdor Documents Files Nc 30 Book Web 1 16 19 V4 Final Pdf

T Addendum Fill Out And Sign Printable Pdf Template Signnow

T Addendum Fill Out And Sign Printable Pdf Template Signnow

Https Files Nc Gov Ncdor Documents Files Final Vita Manual 2018 Pdf

2019 2021 Form Nc Dor Nc 478g Fill Online Printable Fillable Blank Pdffiller

2019 2021 Form Nc Dor Nc 478g Fill Online Printable Fillable Blank Pdffiller

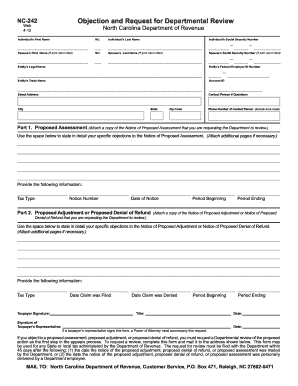

2020 Form Nc Dor Nc 242 Fill Online Printable Fillable Blank Pdffiller

2020 Form Nc Dor Nc 242 Fill Online Printable Fillable Blank Pdffiller

Bill Of Sale Form North Carolina Liability Release Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Bill Of Sale Form North Carolina Liability Release Form Templates Fillable Printable Samples For Pdf Word Pdffiller

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

What Is A 1099 Form 1099 Form 1099 Form Know How

What Is A 1099 Form 1099 Form 1099 Form Know How

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Https Www Sog Unc Edu Sites Www Sog Unc Edu Files Course Materials Electronic 20materials 20jdc 202018 0 Pdf

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Https Files Nc Gov Ncdor Documents Files Final Vita Manual 2018 Pdf

2020 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

2020 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov