How To Register A Small Business With Sars

Click SARS Registered details on the side menu 5. If you are not yet an eFiler register at wwwsarsefilingcoza.

Https Cdn Ymaws Com Www Thesait Org Za Resource Resmgr Tax Talk Issues 2020 Tax Talk Issues2020ttp July Pdf

Higher incomes place businesses in higher tax brackets.

How to register a small business with sars. SOUTH AFRICAN REVENUE SERVICE. VAT is an indirect tax on the consumption of goods and services in the economy. Submit the registration form to your local SARS branch within 21 days from date of exceeding R1 million.

Complete the EMP101e Payroll taxes - Application for Registration taxes form. Tick the System Default box and click on Continue. Should you need to register for tax manually with SARS you should use Form IT77C.

Beware of scams pretending to be from SARS. How to register a business in South Africa. Dont click on any links please send it to email protected.

Select and complete the details of your business as shown below. Registration must be done within 60 days after starting operations by completing an IT77 form available at your local SARS office or from the SARS website. Tax Guide for Small Businesses 20192020 ii.

For the owners of private companies registering a new company through the CIPC website often leads to automatic SARS registration. 2 Activate your TCS service You only need to activate your Tax Compliance Status once and it will remain active. Not sole traders business registration online through the CIPC Companies and Intellectual Property Commission often leads to SARS registration as part of the process.

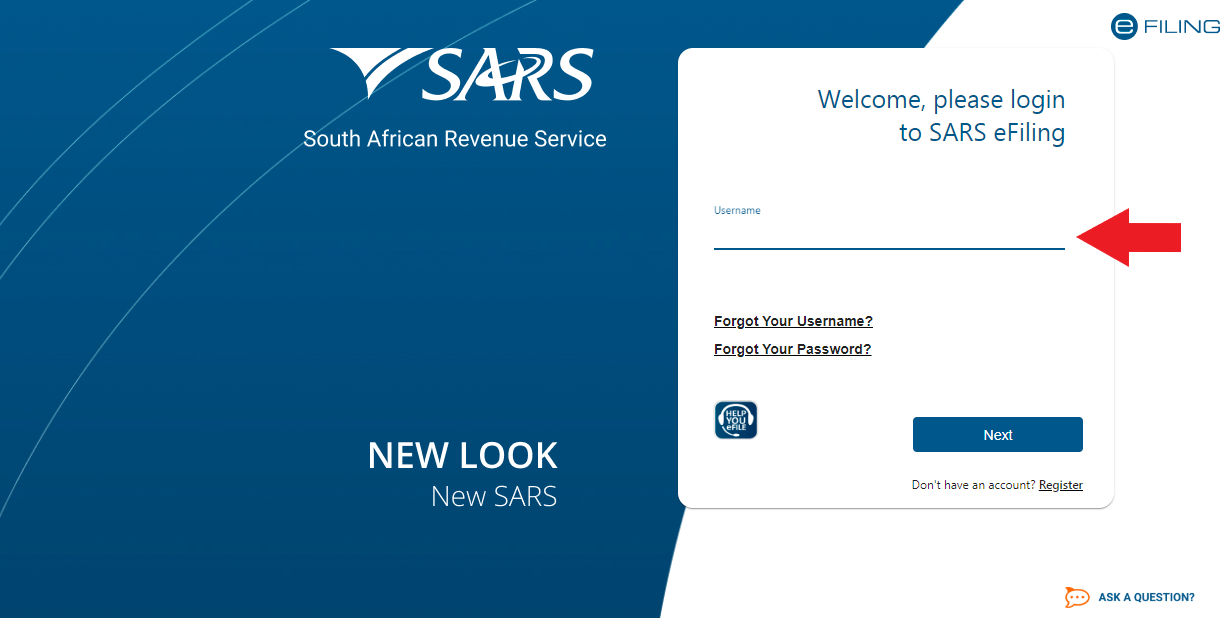

For new business owners with formal businesses ie. The easiest way to register with SARS is to visit the eFiling website. Date of 3rd issue.

Registration is now open on wwwsmmesagovza for small and medium-sized businesses that require help during the coronavirus crisis. Select Notice of Registration 6. To complete the registration process you will need at hand.

A business may also register voluntarily if the income earned in the past 12-month period exceeded R50 000. The department of small business development has promised a debt-relief fund for small businesses. For assistance in completing the form see the Guide for completion of Employer Registration application.

Your tax registration numbers. VAT vendors can also request and obtain a VAT Notice of Registration on eFiling. An individual if they are operating in their personal capacity.

Comments or suggestions on this guide may be emailed to. How to register for PAYE on eFiling. Follow these easy steps.

Small businesses with a turnover of up to R1 million per annum will now be able to pay certain taxes turnover tax VAT and employees tax twice instead of once a year making the process more efficient for qualifying small. Registering as an Employer. Standard small business tax brackets currently range from 7 to 28 in addition to a lump sum payable.

You can now register a business in South Africa for R175 heres what you need to know. Once completed click on Register. If youre considering turnover tax do your research.

According to SARS a small business that is registered as a micro business under the Sixth Schedule of the Income Tax Act may also register for VAT and may elect to submit returns and payments every four months ending on the last day of June October and February. Date of 4th issue. EFilers will register as Please select and click on the appropriate option below.

All you need is internet access. Date of 1st issue. See our latest list of scams here.

Once youre registered SARS will automatically issue you with a tax reference number. Leveraged Legal Products. SARS the Unemployment Insurance Fund UIF and the Compensation Fund CF he said.

Alternatively you can do this via MobiApp which can be downloaded on the Play Store or App Store. Visit the national COVID-19 Online Resource and News Portal at wwwsacoronaviruscoza or see SARS COVID-19 news items and tax relief measures here. In most cases an SME can be either a sole proprietorship or a partnership.

Tax How to Register as a Sole Trader with SARS. Go to the Organizations main menu 4. And then you should click on the Register New button on the left of the screen.

If one of your plans is registering a business in South Africa especially a small business in the form of a small-medium enterprise SME or a startup you will not have to register the entity like a company. You need to be registered for eFiling and have one tax type activated on your eFiling profile in order to activate the TCS service. This document asks for details.

Otherwise youll be liable to pay the standard small business tax rates as outlined by SARS at the beginning of each tax year. Login to SARS eFiling 3. Date of 2nd issue.

How to register with sars. If you register your company in this way you will shortly receive an email from SARS informing you of your new company tax number. Switch to QuickBooks Online.

Once youre on the site simply click Register Now to get started.

Lockdown Step By Step Guide To Registering Your Business As An Essential Service Fin24 Step Guide Business Essentials

Lockdown Step By Step Guide To Registering Your Business As An Essential Service Fin24 Step Guide Business Essentials

Sars Efiling How To Register As An Individual Individuality Registered Tutorial

Sars Efiling How To Register As An Individual Individuality Registered Tutorial

Tax Clearance Certificate New Compliance Pin With Sars Youtube

Tax Clearance Certificate New Compliance Pin With Sars Youtube

Sars Organisation Option How To Add Your Business On Efiling Youtube

Sars Organisation Option How To Add Your Business On Efiling Youtube

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

Sars Efiling How To Register As A Taxpayer And Get A Tax Number Youtube

Sars Efiling How To Register As A Taxpayer And Get A Tax Number Youtube

Get Our Image Of Sars Tax Invoice Template Invoice Template Templates Templates Free Design

Get Our Image Of Sars Tax Invoice Template Invoice Template Templates Templates Free Design

Updated How To Get A Tax Clearance Certificate Sars Efiling Tutorial Youtube

Updated How To Get A Tax Clearance Certificate Sars Efiling Tutorial Youtube

Proof Of Income Template Income Lottery Numbers Templates

Proof Of Income Template Income Lottery Numbers Templates

Fnb Online Banking In Namibia How To Register Online Banking Banking Electronic Banking

Fnb Online Banking In Namibia How To Register Online Banking Banking Electronic Banking

How To Register Central Supplier Database Application Self Registration Registration Accounting Information

How To Register Central Supplier Database Application Self Registration Registration Accounting Information

Register On Sars Efiling Business Tax Types Youtube

Register On Sars Efiling Business Tax Types Youtube

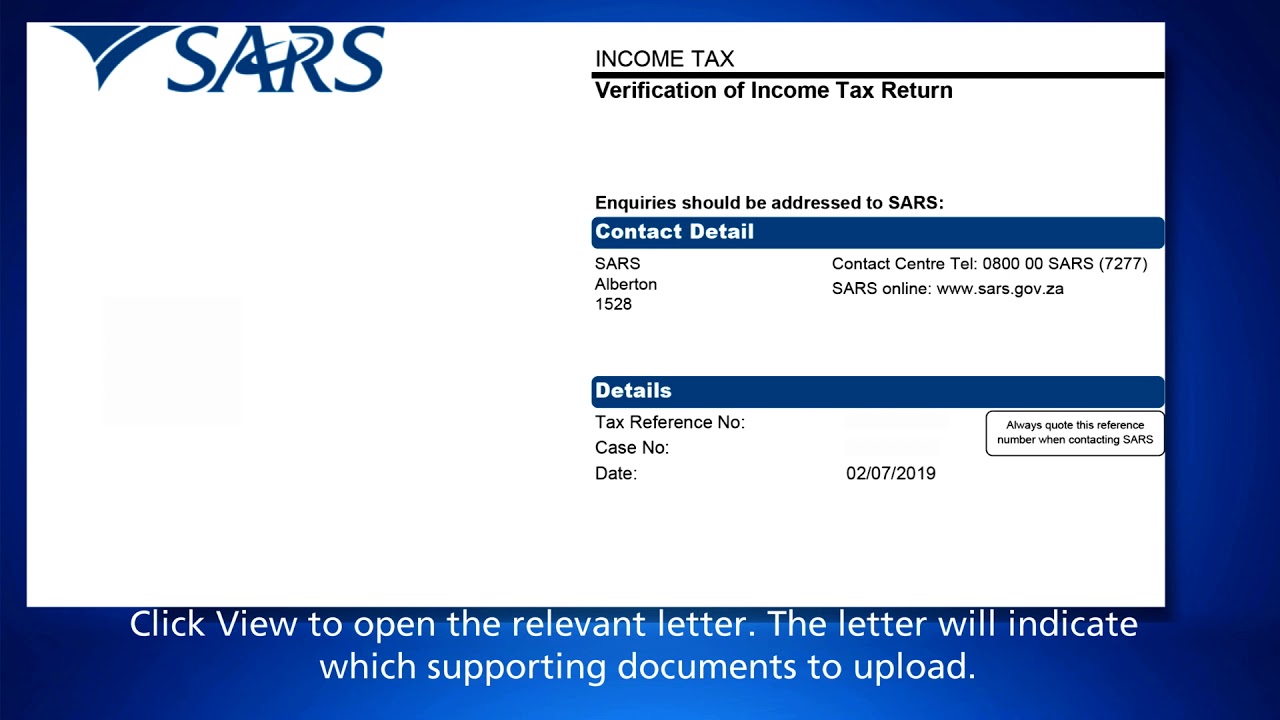

Sars Efiling How To Submit Documents Youtube

Sars Efiling How To Submit Documents Youtube

How To Register For Sars Efiling Youtube

How To Register For Sars Efiling Youtube

Sars Efiling How To Register Youtube

Sars Efiling How To Register Youtube

How To Manage Your Profile On Sars Efiling Youtube

How To Manage Your Profile On Sars Efiling Youtube

Sars Efiling How To Submit Your Itr12 Youtube

Sars Efiling How To Submit Your Itr12 Youtube